Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

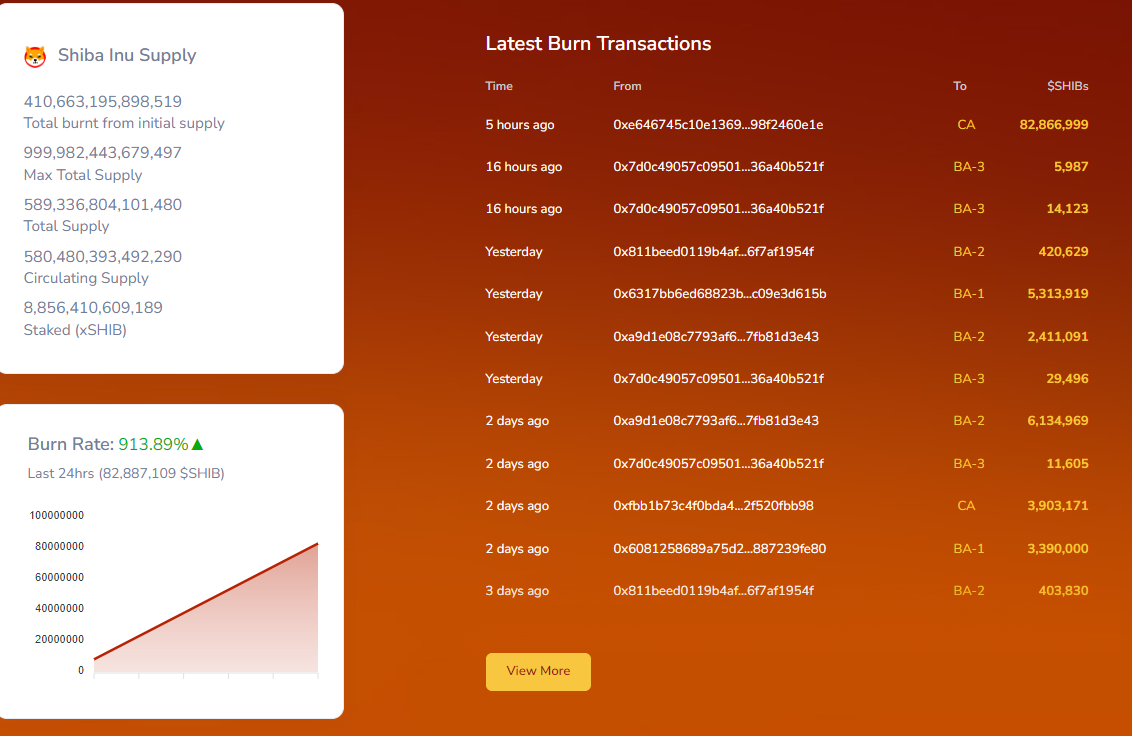

Shiba Inu (SHIB) has witnessed a significant milestone as the burn rate for the token has surged by an astonishing 1,000%, and the token's supply keeps on shrinking. Unfortunately, it might not be enough.

Analyzing the recent price chart of SHIB, the currency demonstrates a notable response to the burn. Despite the broader market's movements, SHIB has managed to carve its own path. Post-burn, a slight uptick in the price showcases the immediate impact of reducing the circulating supply. This is viewed positively by holders who anticipate that a decrease in supply with steady or increasing demand could lead to a price increase.

The price chart illustrates SHIB navigating through a consolidation phase, with a recent breach below a critical ascending trendline. This breach was quickly followed by a recapturing of the trendline, indicating that the burn news may have spurred investor confidence, leading to buying pressure that helped SHIB regain its footing above this technical support level.

In the grand scheme of things, the overall cryptocurrency market, as depicted by the Bitcoin (BTC) chart, shows a healthy consolidation pattern, with Bitcoin maintaining a steady position near its recent highs. Bitcoin's price action often sets the tone for the altcoin market, and its current strength provides a stable backdrop for coins like SHIB to capitalize on individual catalysts, such as the burn event.

The fact that SHIB's price has shown resilience and an immediate reaction to the burn event, even when Bitcoin's price is experiencing a consolidation phase, highlights the relative independence of meme tokens from Bitcoin's performance. However, investors should keep in mind that assets like Shiba Inu tend to follow bigger meme coins or altcoins like Ethereum, which in their turn are heavily affected by Bitcoin's movements.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov