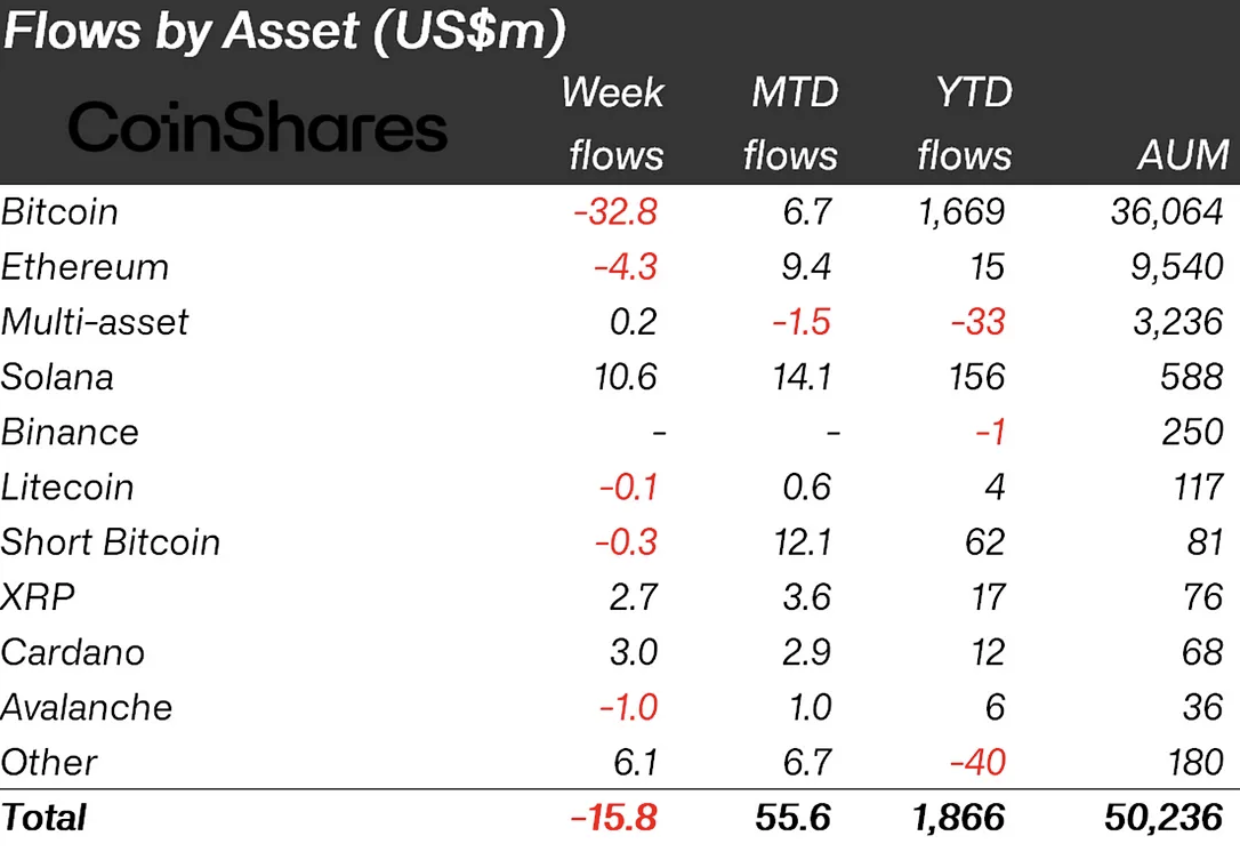

In a whirlwind week for the crypto market, CoinShares' latest report unveils a staggering 338% surge in weekly fund inflows for XRP-oriented investment products.

The data reveals a remarkable increase, with inflows skyrocketing from $800,000 to an impressive $2.7 million in just one week.

This surge has propelled the net flows in XRP ETPs to $3.6 million since the start of December, outpacing even Ethereum (ETH) by $2 million. However, XRP still falls short in comparison to Solana (SOL), the altcoin that takes the lead in this figure with $156 million.

Rotation

Last week's performance marked a milestone for XRP, with an extraordinary gain of 338%. The digital asset investment products landscape, however, tells a contrasting tale. Overall, there were minor outflows totaling $16 million, ending an 11-week streak of inflows.

Bitcoin bore the brunt of this trend, witnessing $32.8 million in outflows, while Short Bitcoin ETPs also experienced minor outflows amounting to $300,000.

In a noteworthy twist, altcoins, spearheaded by XRP, Solana (SOL) and Cardano (ADA), emerged as the backbone of the crypto market, reinforcing a trend witnessed in recent weeks. The data suggests that investors might not be abandoning these instruments altogether but are instead engaging in a strategic rotation of funds from Bitcoin to altcoins.

What is funny, though, is that the main altcoin, ETH, did not escape the market dynamics unscathed, witnessing outflows of $4.3 million in the past week.

This shift in investment patterns raises questions about the evolving preferences of cryptocurrency investors and the potential impact on the broader market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov