Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

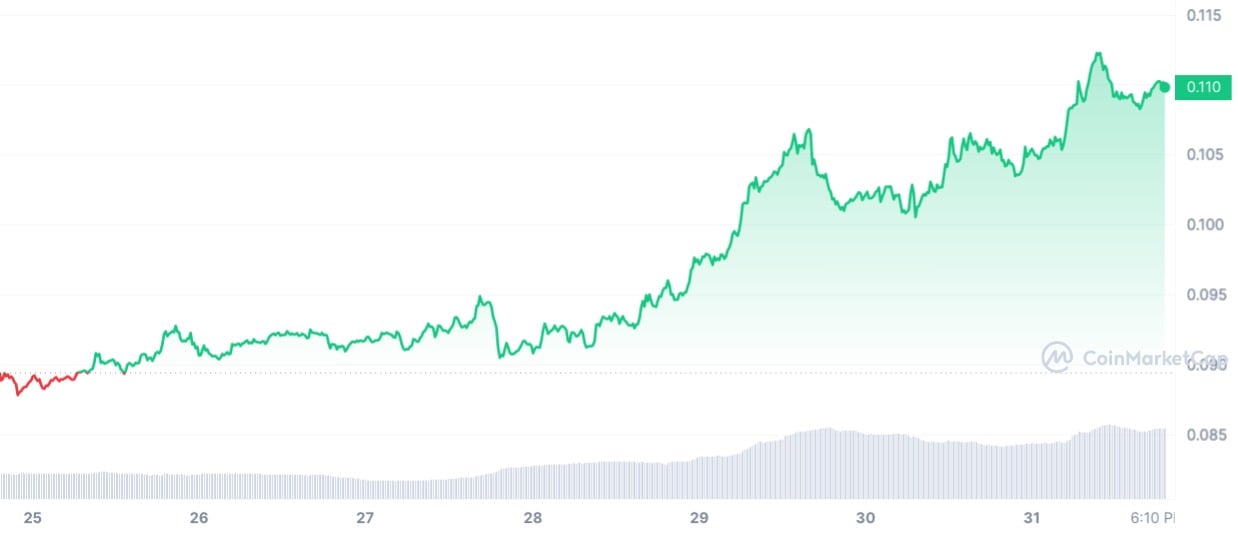

XRP's price action in recent days has significantly improved the wellbeing of not only its holders, but also that of its main competitor in the form of XLM. Since Monday, for example, the Stellar token has risen by 20%, breaking all key resistance levels in its path and reaching multi-month highs. XLM now trades at $0.11 per token, where it was last quoted back in November 2022 before the FTX crash.

Amusingly, the performance of the XLM price is accompanied by the same phenomena as XRP. In particular, it concerns abnormal volumes on South Korean exchanges. For example, on the largest of them, Upbit, XLM turnover has tripled in the last two weeks.

From XRP to XLM

The logic behind XLM's price action following XRP is quite simple and obvious. Conceived by Ripple co-founder Jed McCaleb as a decentralized counterpart to his original creation, the Stellar ecosystem and its XLM token are in the context of the crypto market what Shiba Inu (SHIB) is to Dogecoin (DOGE).

When the price of one of them kicks in, the other's follows after a while. This is because investors want to jump on the departing train and look at similar assets in search of these opportunities. This is how capital flows across the market.

However, it is worth being cautious, as this could very likely signal the end of the rally in the primary asset, i.e., XRP, or among these tokens altogether.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov