Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

XRP is signaling bullish moves. The coin is witnessing a price rally that could see it close the month of March on a positive note. Notably, XRP has recorded its fourth-best price performance in March since 2014.

XRP’s March rally and historical trends

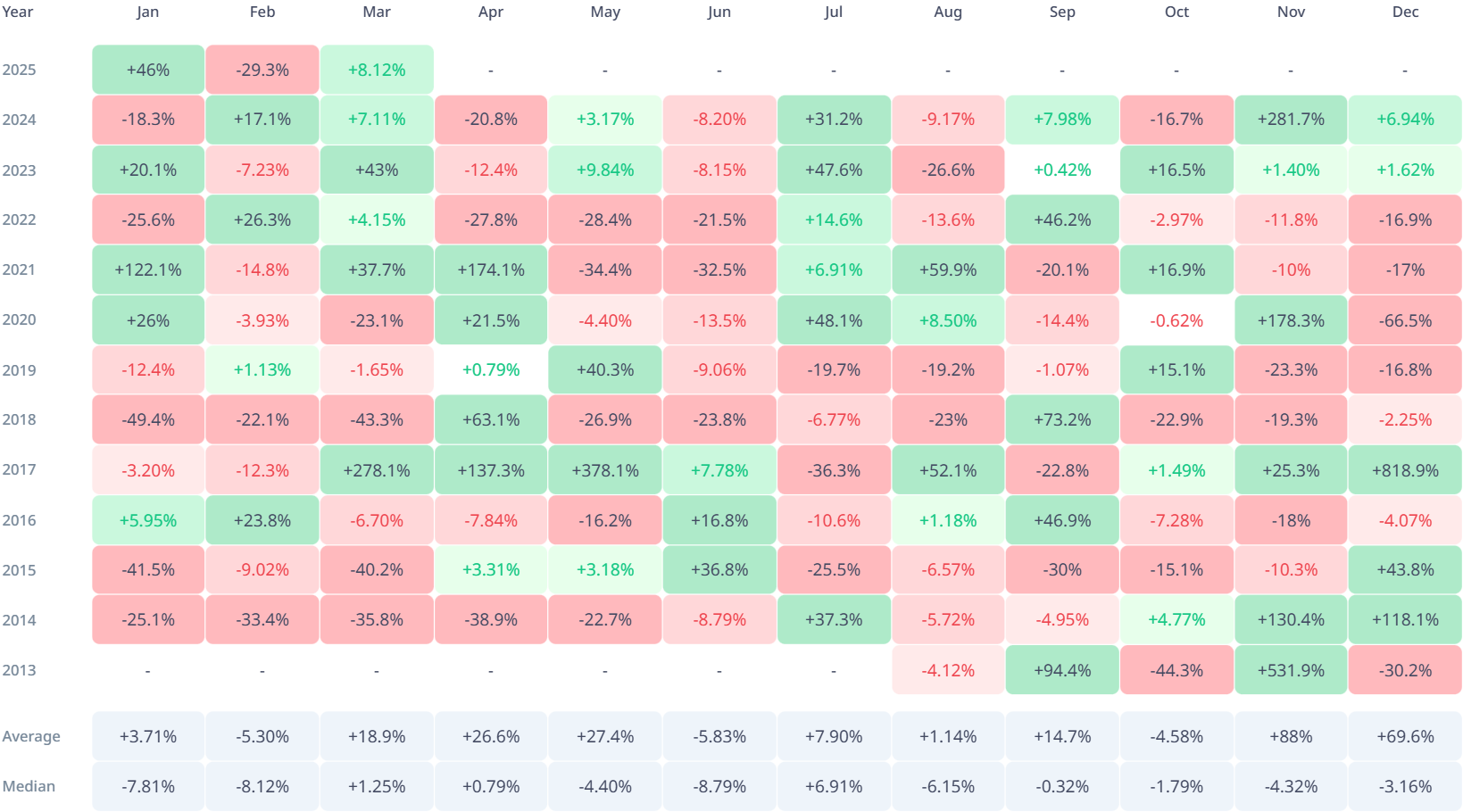

Cryptorank data shows that XRP's average monthly price growth has been 18% for the past 11 years. Given its trajectory so far, analysts predict a likely repeat performance for the coin.

Despite experiencing volatility on the market, XRP has rebounded well, lifting off from key support levels. For instance, XRP dropped as low as $1.93 within the last seven days as the general market witnessed bearish pressure.

However, the coin has recovered sharply and returned to the $2 zone. As of this writing, XRP's price changed hands at $2.32, representing a 2.88% uptick in the last 24 hours, per CoinMarketCap data.

Within the same time frame, trading volume increased slightly by 0.14% to $5.61 billion. The recovery has attracted the interest of investors who are ready to engage and actively take advantage of the possible price rally.

Factors influencing XRP’s trajectory

Based on historical precedence, market observers note that XRP price growth commences in March and proceeds upward.

XRP has historically recorded an average increase of 26.6% and 27.7% in April and May. Therefore, the rebound move seen by XRP at the moment might signal a pending rally for the coming months.

Meanwhile, developments like the Securities and Exchange Commission's (SEC) pending decision on filed applications could swing things for XRP.

Notably, Nate Geraci, president of the ETF Store, has predicted that BlackRock could join the race for an XRP exchange-traded fund (ETF). So far, several asset managers have filed for an XRP ETF, although the SEC has shifted from deciding on Grayscale's application to May 21, 2025.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov