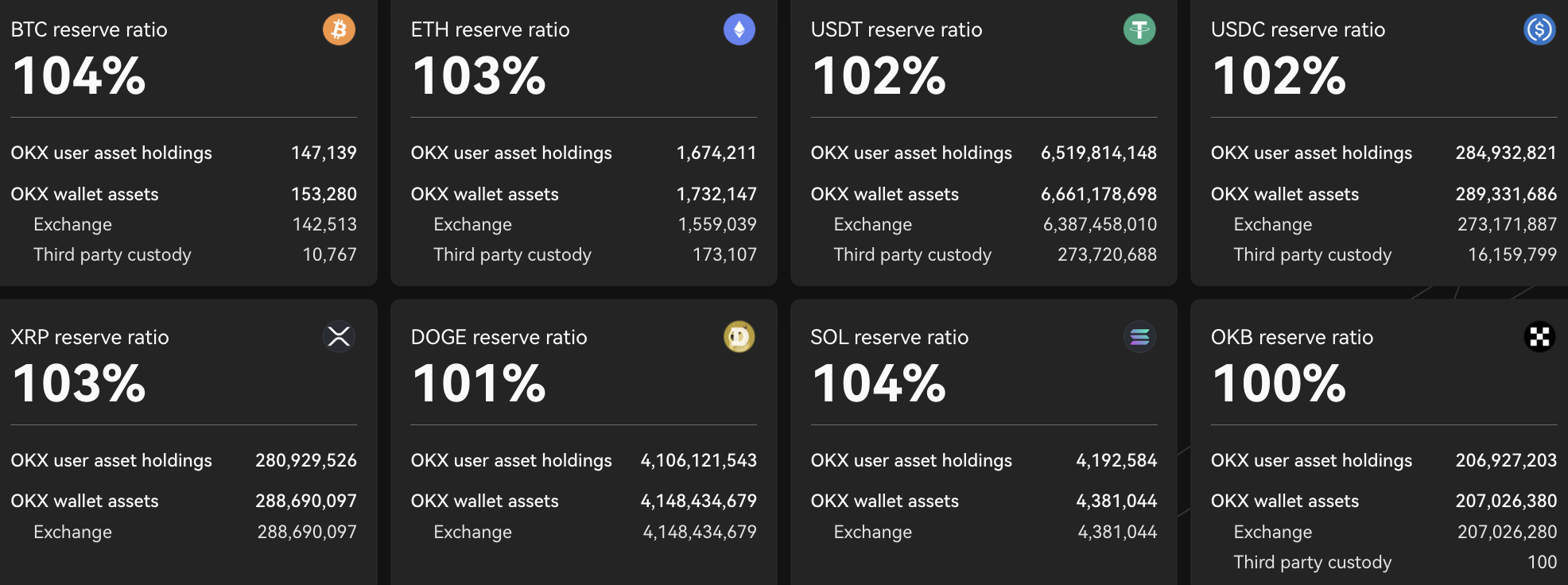

One of the largest crypto exchanges in the world, OKX, has presented its monthly proof-of-reserves report, which shows the state of user funds, exchange reserves and coverage ratio. According to the latest data, OKX has over $22.5 billion in funds and crypto assets on its platform.

Of particular interest, however, was the fact that user assets in the popular XRP cryptocurrency fell by 40.6 million tokens to the level of 280.93 million XRP. This volume of funds is in turn backed by 288.69 million XRP, which provides a coverage ratio of 102%.

It is important that the volume of user funds in XRP on OKX is falling for the second month in a row, and during this period fell by 14%.

What's going on?

However, according to the same data, users' funds in XRP may not be going anywhere, but on the contrary, they are overflowing into other assets.

For example, while reserves in XRP on OKX were falling, they have grown by 5% in USDT since the end of March. With Ethereum as the main altcoin, the exchange's reserves grew by 2.14% during the period under review. In another popular stablecoin, Circle's USDC exchange reserves rose to 289.33 million from 223.69 million in March. These volumes still cover the number of user funds on the exchange in full, with some leftover.

XRP is not the only cryptocurrency on OKX that shows such dynamics. A similar trend is seen with Bitcoin (BTC) and Solana (SOL), for example.

It is possible that holders are actually withdrawing their assets from the centralized exchange, which causes such a "slimming." Or, it is possible that there is an overflow of funds, and crypto investors fix a portion of their positions in assets and go to the "crypto cache."

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin