Interesting things often occur not only in the cryptocurrency market. The US stock market has started 2019 with strong gains for all major US indices, almost covering the losses it experienced in 2018.

Can this uptrend continue, as many analysts are skeptical about it, being already in the tenth year of a bullish market? We will comment on one key driver that can lead to higher stock market price levels in 2019, as well as discuss the state of the labor market and provide some insights.

This is the year-to-date performance of major US indices in 2019:

|

Index |

Close price as of Friday, Feb. 1, 2019 |

Performance year-to-date Advertisement

|

|

Dow Jones Industrial Average |

25,063.89 |

+7.57% |

|

Nasdaq Composite |

7,263.87 |

+9.47% |

|

S&P 500 |

2,706.53 |

+8.13% |

|

Russell 2000 |

1,502.05 |

+11.45% |

|

S&P Midcap 400 |

1.841,52 |

+10.83% |

In 2018, the performance of the Russell 2000 was -12.18%. The performance for the Dow Jones, S&P 500, and Nasdaq was -5.63%, -6.24% and -3.88% respectively.

The Russell 2000 underperformed in 2018 and for the first month of 2019 it outperformed the three major US indices. This trend may continue in 2019 as there could be a rotation and portfolio rebalancing from large cap stocks to small cap stocks, seeking excess risk-adjusted returns.

What does the recent US labor market data tell us about the state of the economy?

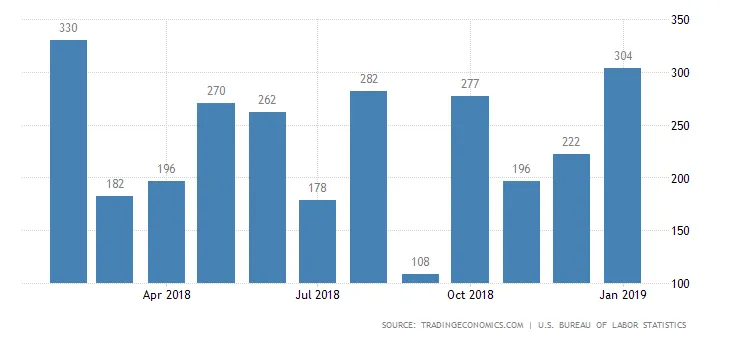

According to Trading Economics, “Nonfarm payrolls in the US increased by 304 thousand in January of 2019, following a downwardly revised 222 thousand rise in December and easily beating market expectations of 165 thousand. Employment grew in several industries, including leisure and hospitality, construction, health care, and transportation and warehousing.”

“There were no discernible impacts of the partial federal government shutdown on the estimates of employment, hours, and earnings from the establishment survey. Instead, the impact of the shutdown contributed to the uptick in the unemployment rate to 4 percent from 3.9 percent as it included furloughed federal employees who were classified as unemployed on temporary layoff under the definitions used in the household survey.”

It was the second consecutive month that US Non-farm payrolls beat estimates by a large number. The expectations on Jan. 4, 2019 and Feb. 1, 2019 were 177K and 165K respectively. The actual numbers for January and February were 312K and 304K respectively. The US economy added the most jobs in 11 months, and the impact of the partial US government shutdown was minimal to the unemployment rate, which moved higher to 4.0% from 3.9%.

On Friday, Feb. 1, 2019, the US stock market did not react much to the strong labor market numbers. The S&P 500 closed at 2,706.53 points (+0.09%), the Dow 30 closed at 25,063.89 points (+0.26%) and Nasdaq closed at 7,263.87 points, (-0.25%). A strong labor market is one of the most important key drivers for higher economic growth measured by GDP number in 2019. More jobs equal to higher consumer spending, higher demand for goods and services and higher level of economic activity and growth.

This strong uptrend for the US labor market may not last all year long, though. Chances are that most probably it will not as it is prone to cyclicality and as seen from the chart there is a lot of volatility about the actual numbers. But for now, it is encouraging that we can note a very strong trend that has already formed for the US labor market.

Economic factors that could pause the recent uptrend of the US stock market

Some economic factors that are monitored as potential catalysts for the performance of the US stock market in 2019 are:

-

Developments in trade talks between the US and China. Agreements to end the trade wars and levy tariffs should be positive for the US stock market.

- The path of interest rate hikes. The Fed at its latest monetary policy decision changed the language used, mentioning that it will pause the future interest rate hikes for now, monitoring closely the economic and market conditions. Two interest rate hikes were expected in 2019 before this announcement, and now these two hikes are questionable. A less tightening monetary policy by the Fed is supportive for the stock market.

- Corporate earnings. Lately several companies have reported better than expected quarterly earnings. To name only two, Apple Inc. (AAPL) and Facebook Inc. (FB). While several analysts warn about a recession in the US economy in 2019, the chances are very slim, almost zero.

A strong US labor market cannot predict higher stock market returns in 2019. But it shows that economic conditions are strong, and acts as a high level of confidence that in a strong economy, the stock market could probably also have very high odds of being strong as well.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin