In a recent twist, the U.S. Supreme Court declined to hear Battle Born Investments' lawsuit against the government over 69,370 BTC seized in the Silk Road darknet marketplace case, paving the way for authorities to sell all seized crypto assets. This amount of BTC can currently be valued at $4.3 billion.

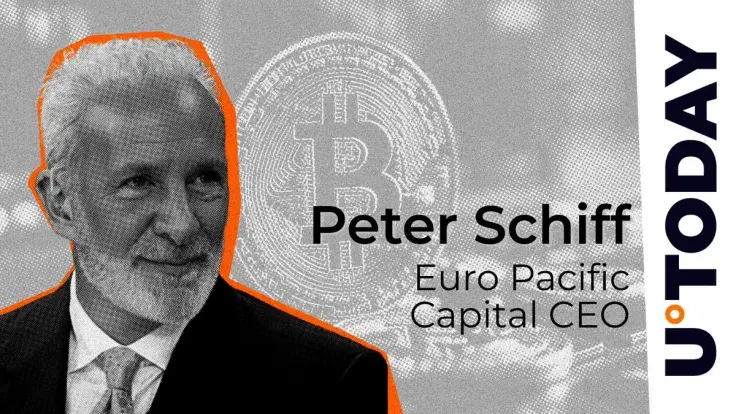

Apart from paving the way for the U.S. government to sell Bitcoin, the news also opened a wide spectrum of opportunities for several financial experts to express their opinions on the matter. One of them was Peter Schiff, known as a fierce cryptocurrency skeptic who cannot stop arguing that there is no real value in the new class of digital assets.

As such, he suggested that the U.S. government's decision to sell such a large amount of Bitcoin could be a rare smart move, implying that a significant sell-off could negatively impact the price.

Schiff also highlighted the opportunity for MicroStrategy, led by Michael Saylor, to potentially acquire this Bitcoin through additional borrowing, suggesting a bold move for the company. The company has recently been active on the debt market, with multiple bond offerings totaling billions in 2024.

FUD or fact?

Schiff's warning of a possible sell-off has people talking. Some say it is just more fear, uncertainty and doubt (FUD) surrounding Bitcoin, while others think it could be a real cause for concern given the potential flood of BTC onto the market and its subsequent effect on supply dynamics.

Whether this is just another bogey for the crypto or a repeat of last summer, when Germany sold off its Bitcoin, remains to be seen.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin