Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Launched in 2022, Tezro application has already established itself as a low-cost and newbie friendly crypto wallet and payments processor with seamless fiat support.

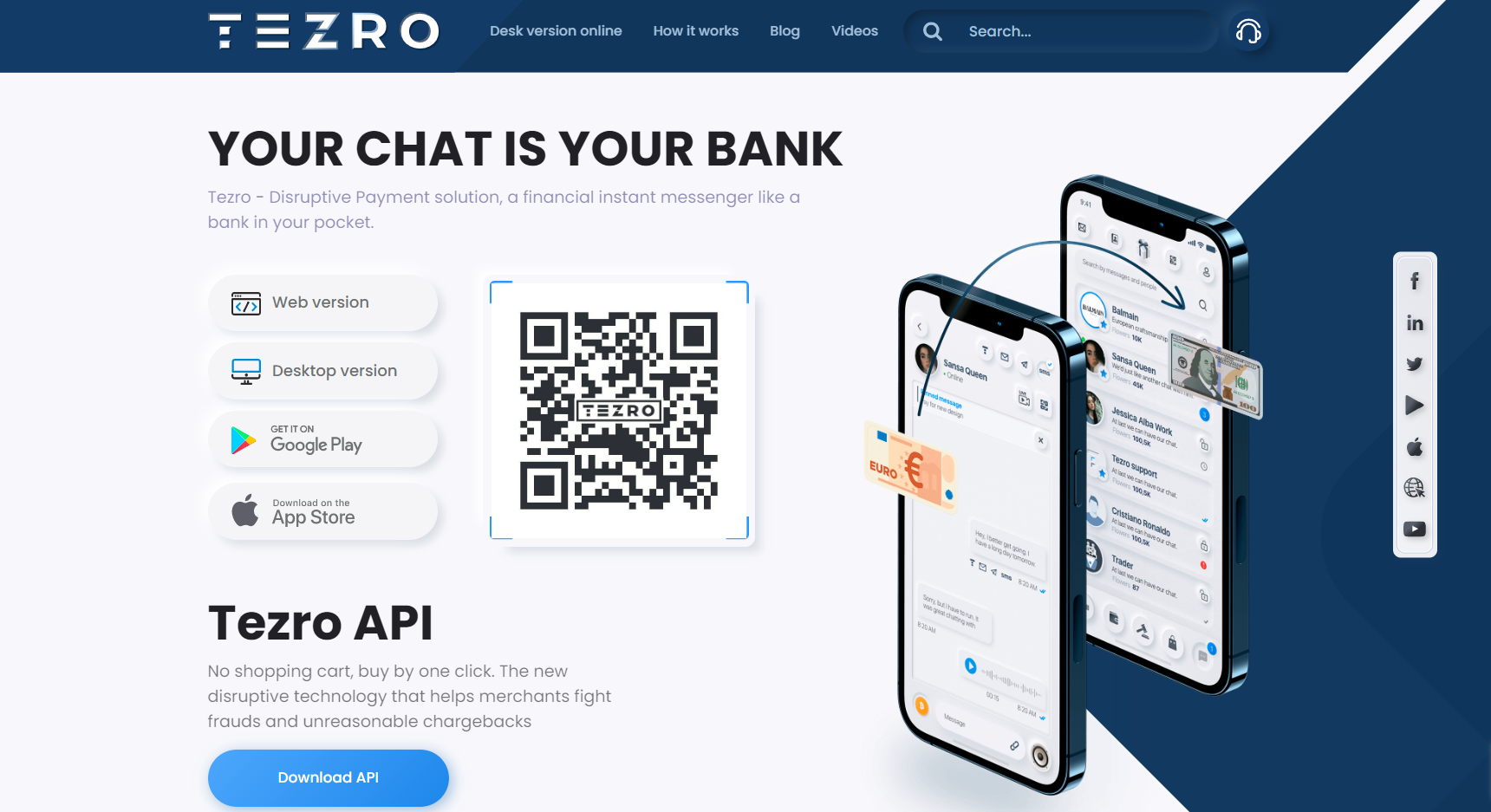

Multi-currency fiat and crypto payments service: What is Tezro?

EU-regulated payments service Tezro is designed to introduce a viable and resource-efficient alternative to SWIFT, a cross-border system of messaging between banks and wire transfers. Tezro leverages blockchain-based instruments for seamless asset transfer without borders and limitations.

Besides transfers, Tezro clients are able to convert cryptocurrencies among each other and exchange them for fiat assets. Both transfers and cross-asset swaps are confirmed in milliseconds: this brings Tezro to the top of the fastest crypto-to-fiat protocols.

Its peak throughput is about 15,000 transactions per second, while leading card systems Visa and MasterCard only process 2,500 transactions per second. Not unlike PayPal, Venmo, CashApp and so on, Tezro supports payments requests. With its request module, users can share bills or just send money to their friends, counterparts, clients, contractors, etc.

Existing releases of Tezro support operations with Bitcoin (BTC), major altcoins Ethereum (ETH) and Eos (EOS), the largest USD-pegged stablecoin U.S. Dollar Tether (USDT) and so on. Also, Tezro supports integration with fiat card services and major gift coupons providers in Europe..

Introducing DeFi module by Tezro, AI-fueled investing tool for newbies

With Tezro, users can not only transfer value but also benefit from the volatility of cryptocurrency prices. In particular, Tezro allows investing in trending native assets of red-hot decentralized finance (DeFi) protocols.

To ensure sustainable and profitable investing in the long run, Tezro employs trading bots based on artificial intelligence (AI) technologies. They allow us to generate profits in an automated manner with no human interference needed. Automated services work in accordance with the “buy low, sell high” strategy in predetermined channels to effectively manage traders’ risks and minimize losses.

Tezro DeFi investing module introduces the sphere of investing in digital assets to cryptocurrency newbies even without previous experience in blockchain, trading or investing. Similar AI-powered tools are used by Tezro as market-making instruments on its built-in crypto exchange.

Tezro Stream Service advances crypto processing for merchants

Besides its feature-rich toolkit for retail users, Tezro offers an ecosystem of instruments for crypto-friendly entrepreneurs. First of all, it includes an opportunity to issue invoices: with these instruments, organizations can transfer money to each other just like retail clients.

Then, an escrow service protects counterparties from being scammed. With escrow services integrated, both parties can refund assets in the event of misbehavior on the part of the invoice issuer (recipient of money).

Tezro can be integrated by e-commerce stores: their goods can be displayed in the application so that potential clients can buy goods and services without leaving the application. Integration of Tezro advances its brand visibility all over the globe and guarantees an inflow of clients from the Web3 community.

Tezro’s price tag instrument allows customers to easily create tags linked to their Instagram posts and products. As such, Tezro streamlines all e-commerce processes for both large businesses and SMEs.

Tezro Stream Service is designed to allow app users to demonstrate their online offerings in offline channels, merging the benefits of both segments. To describe the USPs of goods and services, sellers can release stories and tell a wide audience about the features of their products.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov