Grayscale has filed with the SEC to launch Litecoin and Solana ETFs, alongside other crypto-related products.

Several firms, including Grayscale, VanEck, 21Shares, Bitwise and Canary Capital, are also pursuing spot Solana ETFs, with the SEC's preliminary decisions anticipated by late January 2025.

Nate Geraci, president of the ETF Store, shares optimism about the timeline, reflecting broader market sentiment.

Many in the industry speculate that potential shifts in the U.S. administration and SEC leadership could foster a more favorable regulatory climate for crypto ETFs.

Polymarkets currently estimate a 77% likelihood of Solana ETF approval in 2025, sparking enthusiasm among investors. Approval is expected to act as a major price catalyst, with some arguing the impact is not yet fully reflected in Solana's market valuation.

Possible Solana price breakout

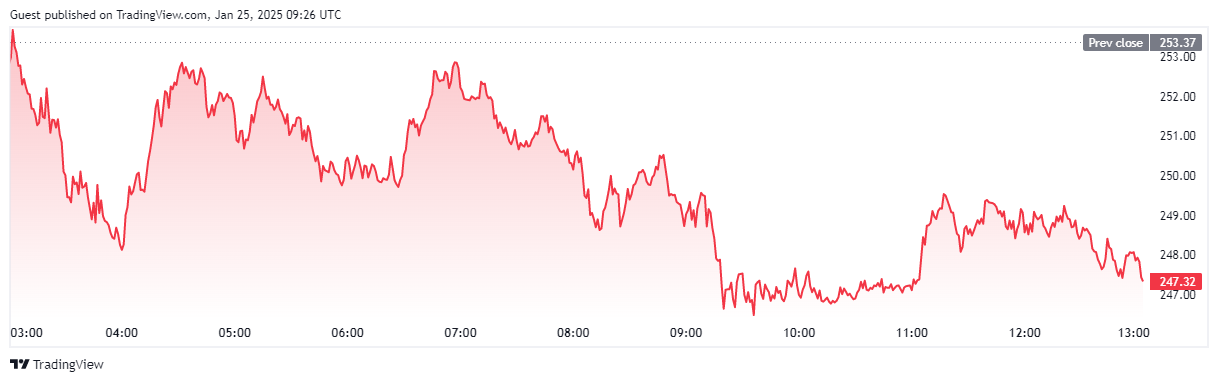

Solana (SOL) has regained bullish momentum after approaching the $230 support level. Currently trading at $240.60, SOL has experienced a 6.11% decline in the past 24 hours, with market volume dropping by 35.4% to $13.48 billion.

Despite recent declines, analysts remain optimistic about Solana's recovery. Continued interest and growing confidence in the coin could potentially drive prices upward, mirroring its resilience over recent days.

Tomiwabold Olajide

Tomiwabold Olajide Godfrey Benjamin

Godfrey Benjamin Caroline Amosun

Caroline Amosun Arman Shirinyan

Arman Shirinyan