Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Shiba Inu (SHIB) finds itself at a crossroads as it faces headwinds from the broader market correction and declining network activity. Until recently, the token had benefited from a high burn rate and a surge in network activity, which contributed to its improved market performance. However, as these factors start to wane, the future trajectory of Shiba Inu hangs in the balance.

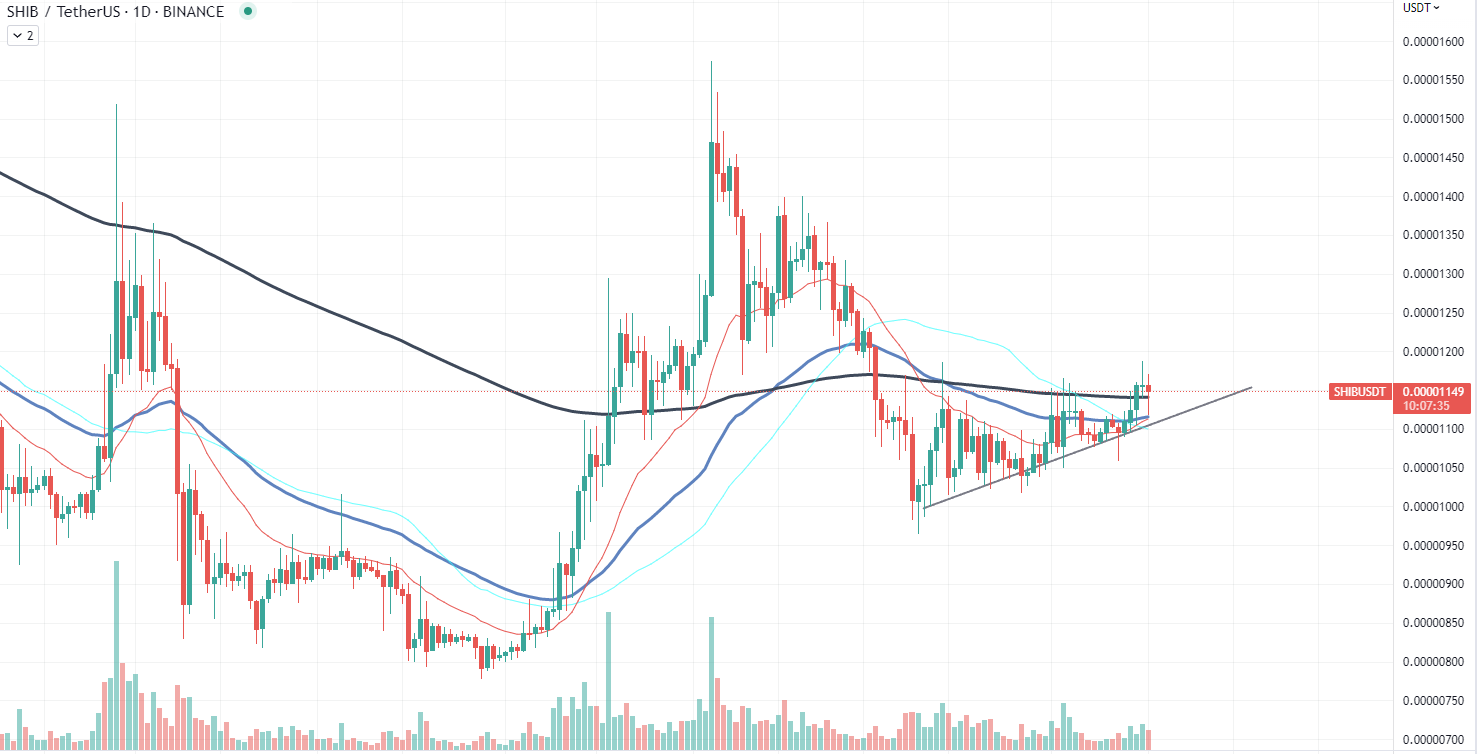

The token's inability to finalize a breakthrough above the 200-day exponential moving average (EMA) has left investors uncertain about its next move. Shiba Inu now stands at a crucial juncture, where it could either establish support above this critical resistance level or succumb to downward pressure, potentially ending its monthlong local uptrend.

The high burn rate and robust network activity previously played a significant role in bolstering Shiba Inu's performance on the market. As more tokens were removed from circulation, the supply and demand dynamics shifted in favor of the cryptocurrency, leading to price appreciation. However, with the recent dip in network activity, the token's burn rate has also been negatively affected, consequently impacting its market position.

Despite these challenges, it is essential to note that Shiba Inu has demonstrated remarkable resilience and adaptability in the past. The community-driven project has expanded its scope beyond being a mere meme token, delving into the realms of decentralized finance (DeFi) and non-fungible tokens (NFTs).

Ethereum's first post-Shanghai correction

Ethereum recently encountered strong resistance around the $2,000 price level after entering the much-anticipated Shanghai era. Despite significant advancements brought by the network update, the price of Ether (ETH) may experience a reversal in the near term. Investors should not be alarmed by this potential downturn, as the digital asset has enjoyed a massive rally over the past 40 days, appreciating nearly 50% in value. A market correction at this stage is to be expected.

Shanghai is a crucial milestone for Ethereum as a network and a project as it allows users to take full control of staked ETH. While it might create pressure on the asset in the short term, the long-term benefit heavily outweighs temporary market-related issues.

As more ETH becomes available on the market, selling pressure may increase, leading to a temporary decline in the asset's price. It is essential to recognize that such corrections are normal in a volatile cryptocurrency market and can present opportunities for long-term investors to enter or accumulate at more attractive price points.

Cardano hits $200 million

Cardano, a popular smart contract platform, has recently experienced a reversal in its price rally despite reaching a new all-time high in Total Value Locked (TVL) on the network. Surpassing the $200 million mark, Cardano's TVL milestone reflects the strong fundamental growth of the network. However, this has not translated to sustained price appreciation, as the digital asset has shed approximately 4.4% of its value in recent trading sessions.

The price pullback could be attributed to a regular market correction, as Cardano has been on a consistent upward trajectory for over a week. It is not uncommon for markets to experience periodic cool-off phases, allowing investors to reevaluate their positions and potentially lock in profits.

Moreover, the correlation between a project's fundamentals and its price action is often inconsistent on the cryptocurrency market. While the TVL milestone is an important indicator of Cardano's growing positions in DeFi, it is not a guaranteed catalyst for continuous price gains. Market sentiment could be a more substantial factor.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov