Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

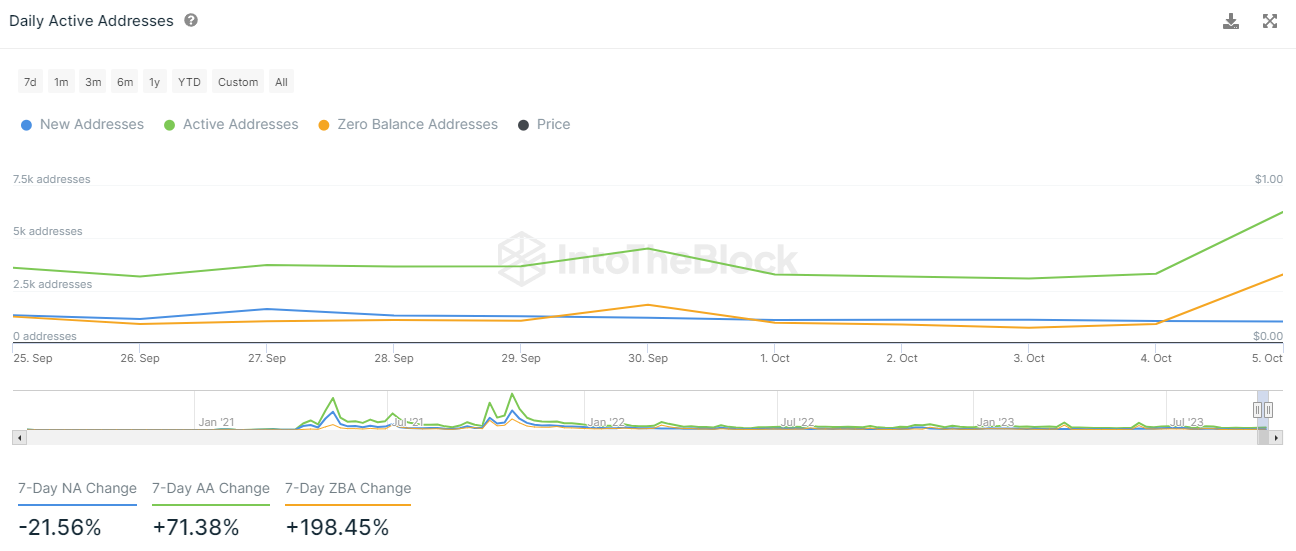

Shiba Inu (SHIB) has finally shown some signs of recovery, especially after its recent surge in network activity. According to on-chain data, the number of daily active addresses for Shiba Inu has seen an immense 198% increase in the last week. The most significant part of this growth occurred just yesterday, suggesting that this could be one of the first signs of an impending price recovery for SHIB.

As of the latest data, the price of SHIB is currently at $0.00000718. While the asset has been struggling to maintain a strong position on the market, this recent uptick in network activity could be a game-changer.

The price of Shiba Inu has been relatively stagnant over the past few weeks, but the recent surge in daily active addresses could be a precursor to a price rally. While it is too early to make definitive conclusions, the asset's price has shown some resilience in the face of a generally bearish market.

One of the key factors contributing to this surge could be Shiba Inu's increasing prominence in the DeFi space. As more users engage with Shiba Inu's ecosystem, the asset could potentially see more liquidity and trading volume, which in turn could drive up its price.

Interestingly, while Ethereum's Total Value Locked (TVL) is in decline, Shiba Inu's TVL has been steady, without showing any serious plunges recently. Although this is not substantial when compared to Ethereum, it is a positive sign for Shiba Inu, especially if Ethereum continues to lose ground.

It is crucial to note that the surge in daily active addresses could lead to increased volatility. Investors should be cautious and not solely rely on this metric for investment decisions. Other on-chain metrics like transactional activity on large wallets are equally important.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov