Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

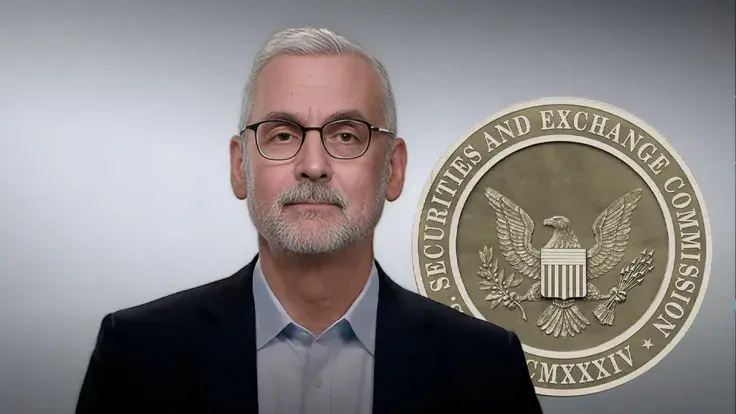

Ripple's top lawyer Stuart Alderoty has blunt remarks for the United States Securities and Exchange Commission (SEC) and its chair, Gary Gensler.

In a tweet, Alderoty claims the SEC is losing its legal battles and is also being criticized by judges.

Most recently, the Ripple general counsel pointed out the SEC's loss in the Govil case. This development, which he defined as "no harm, no foul," could have broader consequences for Ripple's continuing legal battle with the SEC.

In August, asset manager Grayscale won a significant legal victory against the SEC, with a federal judge slamming the SEC for being "arbitrary and capricious" and stating that it was wrong to reject Grayscale's application to launch a Bitcoin ETF.

Ripple earned a significant victory in July when a judge decided that XRP was not a security in and of itself. Following that, the SEC's request for an interlocutory appeal was denied. The SEC then withdrew its charges against Ripple executives Brad Garlinghouse and Chris Larsen in October.

The SEC filed a lawsuit against Ripple and two of its executives in December 2020, alleging that they raised more than $1.3 billion through an unregistered digital asset securities offering.

The complaint alleged that Ripple raised funds, beginning in 2013, by selling XRP in an unregistered securities offering to investors in the U.S. and worldwide.

In this regard, CryptoLaw founder John Deaton believes Ripple will essentially trim fines, citing the Supreme Court's Morrison ruling, which specifically excludes sales outside the U.S.

As previously noted, the next phase in the Ripple case is a remedies' discovery process, for which Judge Torres has already set a schedule.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov