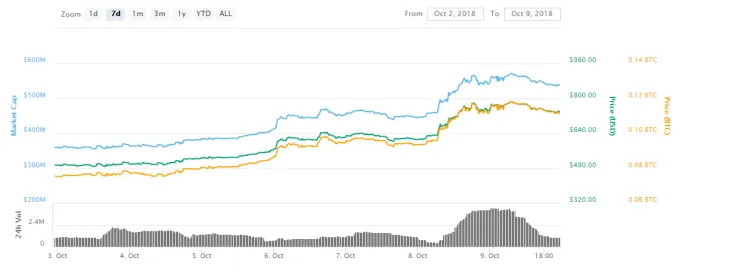

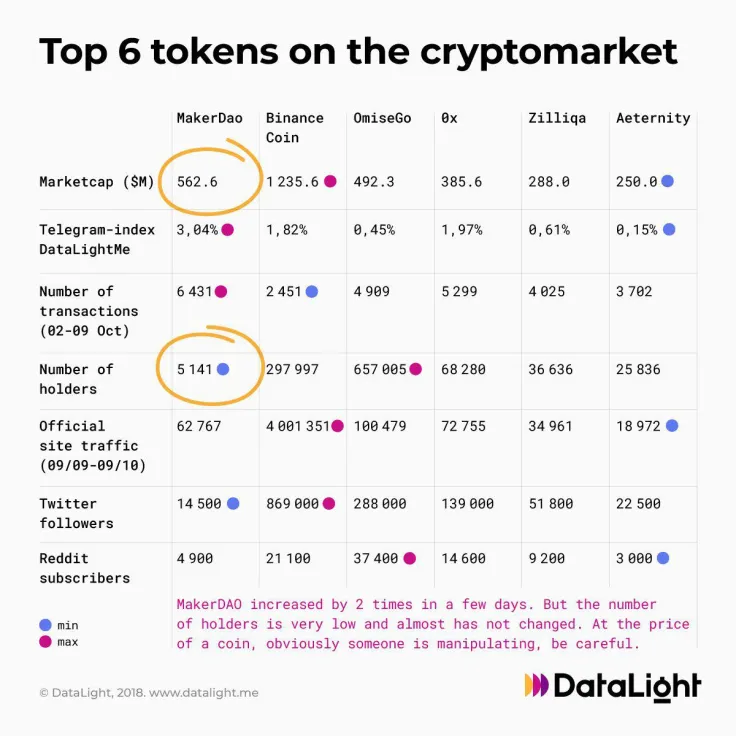

MakerDao (MKR), the 22nd biggest cryptocurrency on the market, has recently witnessed a huge spike in price, nearly doubling its price in just a couple of days. A newly published report by DataLight shows that there is very little to be excited about since this might be a textbook example of price manipulation.

Advertisement

Advertisement

Unlike Dai (DAI), MKR is not a stablecoin, so certain price volatility is natural. However, the study points out that despite the recent price uptick the number of holders remains the same. Moreover, nearly half of all the MKR tokens are controlled by only three holders.

Advertisement

Back in September, Andreessen Horowitz bought six percent of the total MKR supply.