Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

From November 21 to 24, within three days, the price of XRP increased by over 136%. It rose from $0.32929 to as high as $0.78 on Binance, during a strong uptrend. A quantitative trader attributed the massive volatility to relatively low liquidity and a large surge in open interest.

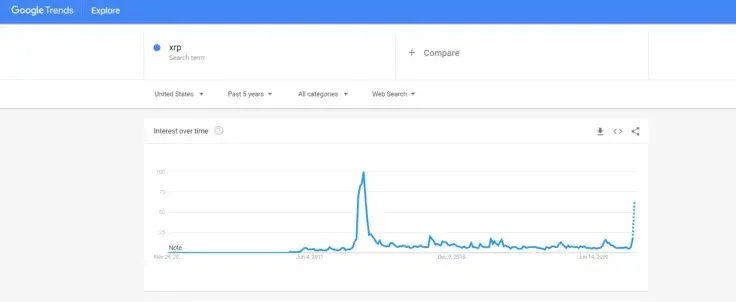

In 2017, the price of XRP peaked at over $3.2. At the time, Google Trends’ popularity of the keyword “XRP” hit 100 points out of 100. During the recent rally, it rose to 63 points. The highest level it saw was in September 2018, when the Google Trends popularity reached 20.

In comparison, in early November, the popularity of the keyword was hovering at around 5 to 7 points. This shows that the interest in the cryptocurrency spiked significantly as the rally began.

Why Did XRP Surge so High and Why Did Interest Spike?

The primary catalyst behind XRP’s steep rally was like the frenzy around the cryptocurrency on social media.

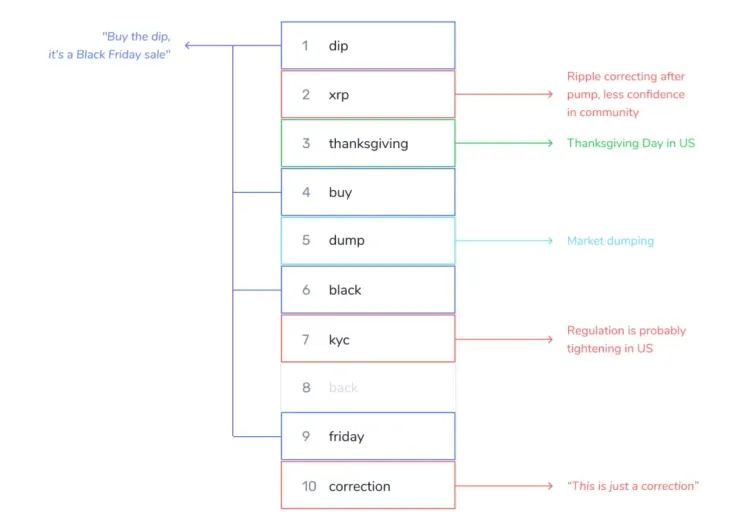

On-chain analysis firms, including Santiment, reported that XRP remained a polarizing keyword even with popular keywords like Black Friday.

Albeit the popularity of XRP on social media declined after it crashed on Coinbase from $0.8, Analysts at Santiment said:

“This Thanksgiving follows the largest dip day in two and a half months, and #crypto social media is trending with subjects like #buythedip and #blackfridaysale. $XRP is still polarizing like it has been all week, as confidence is wavering slightly.”

Alternative cryptocurrencies (altcoins), like XRP, saw a more intense price movement generally due to lower liquidity. The trend of altcoins surging rapidly following a Bitcoin uptrend is also reminiscent of previous cycles.

In December 2017, as an example, the price of Bitcoin neared $20,000 across major exchanges, including Coinbase and Binance. A month later, in January 2018, an altcoin mania picked up. This was the period where XRP surpassed $3.2 and Ethereum hit $1,400.

Sam Trabucco, a quant trader at Alameda Research, which trades over $600 million a day, explained:

“And altcoins? Same move except, typically, WAY more intense. As we expect! Liquidity is lower and OIs are up a lot more vs. typical liquidity, so liquidations are just always gonna impact them more here. XRP was again super extreme -- that's a 20% crash!”

What Happens Next?

For now, after Bitcoin rapidly declined from $19,400 to $16,200, altcoins are consolidating. Bitcoin has remained above $16,200 since, recovering above $17,000 on the day.

Altcoins fell steeply as BTC dropped, but cryptocurrencies like XRP have started to rebound in tandem with BTC.

Altcoins have been moving simultaneously with Bitcoin, mimicking its price movement but with higher volatility. This would mean that if BTC increases, the probability of a stronger uptrend for altcoins remains high if it follows the ongoing trend.

Denys Serhiichuk

Denys Serhiichuk Gamza Khanzadaev

Gamza Khanzadaev Alex Dovbnya

Alex Dovbnya