Nansen, a top-tier on-chain analytical team, has noticed an interesting "flippening" on the Ethereum (ETH) network. Does it mean that the bear market has not arrived yet?

OpenSea consumes more gas than Uniswap: Nansen

Mr. Alex Svanevik, CEO and founder of Nansen, has taken to Twitter to share that OpenSea, the largest marketplace for non-fungible tokens, is now the #1 gas consumer of the entire Ethereum (ETH) network.

.@opensea has flipped @Uniswap as #1 most used product on Ethereum. pic.twitter.com/BhhnU3VDEk

— Alex Svanevik (@ASvanevik) January 31, 2022

Uniswap (UNI), the most popular decentralized cryptocurrencies exchange on Ethereum (ETH), is now dethroned by an NFT heavyweight.

Mr. Svanevik added that this is not the first time a flippening has taken place. According to Nansen's State of the Crypto Industry Report 2021, OpenSea consumed more gas than Uniswap in September-October 2021.

Also, Axie Infinity play-to-earn ecosystem was the top consumer of Ethereum's gas before switching to Axie's own sidechain, dubbed Ronin.

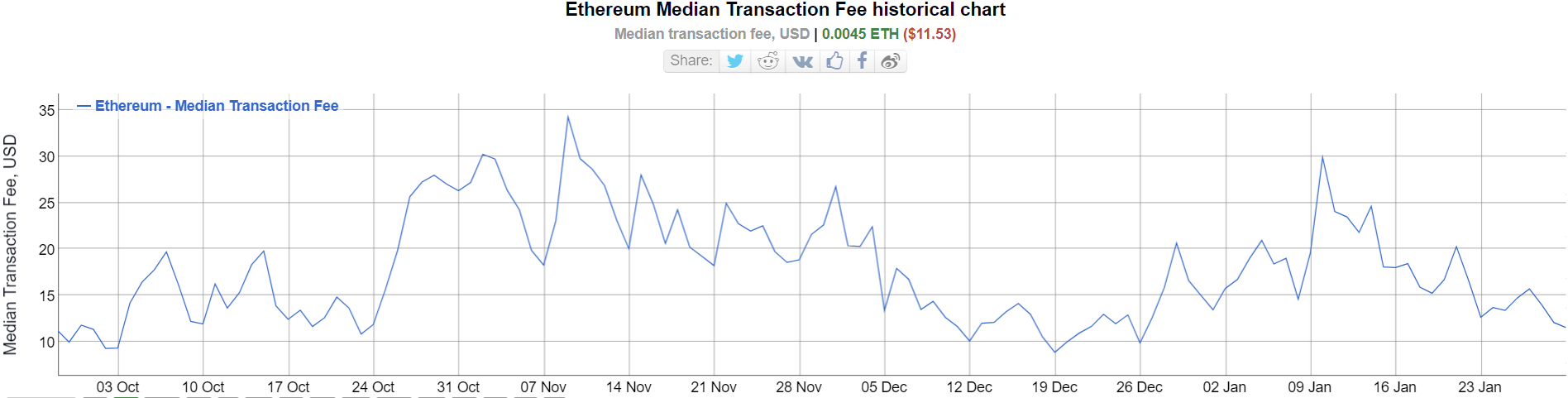

Ethereum median transaction fees at five-week lows

This "flippening" most likely means that crypto markets have just entered the next wave of NFT euphoria despite a prolonged dropdown of crypto capitalization.

As the Ethereum (ETH) price attempts to stay above the $2,500 level, median and average gas fees on flagship smart contracts platforms target monthly lows.

According to Bitinfocharts explorer, Ethereum (ETH) fees are three times lower than three weeks ago.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov