Open interest in Ethereum futures reached a new high of $1.46 bln, according to derivatives data provider Bybt.

The new ATH comes just days after Bitcoin futures achieved a similar feat. On Aug. 1, its OI surged to $5.58 bln, the highest point since mid-February, right before the cryptocurrency market endured a significant correction.

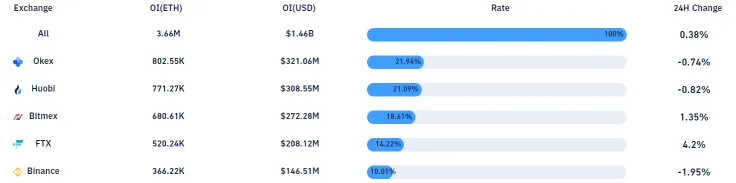

OKEx takes first spot

Malta-based cryptocurrency exchange OKEx is in the lead, with $321.06 mln worth of outstanding contracts.

OKEX’s Singaporean competitor Huobi is in a very close second place. Its OI for Ethereum contracts is currently standing at $308.55 mln, trailing OKEx by a razor-thin 0.8 percent margin.

Together with BitMEX, OKEX and Huobi are responsible for 61.64 percent of all the market activity for Ethereum futures.

FTX and Binance come in fourth and fourth places, respectively.

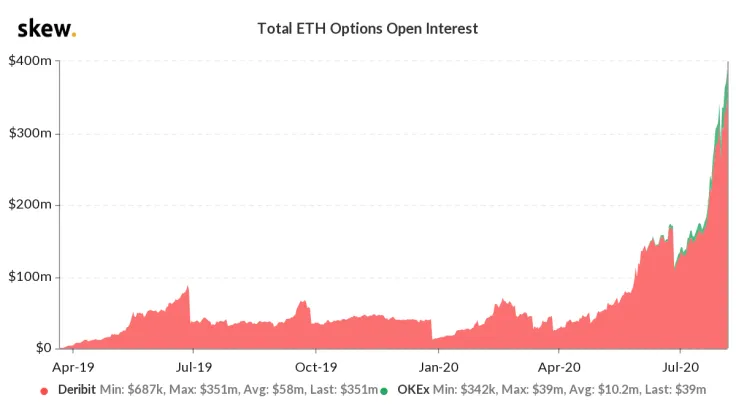

In the options department, ETH’s OI also saw a six-fold increase over the past three months, with unregulated Dutch exchange Deribit accounting for 90 percent of all positions.

Regulated Ether futures are coming

As reported by U.Today, regulated Bitcoin futures offered by Chicago-based CME Group snagged third place in terms of the number of open positions, setting yet another new high.

As the cryptocurrency space continues to mature, CME Group’s Tim McCourt claims that more investors will flock to "trustworthy venues":

As the next wave of more sophisticated participants enters the crypto space, volume will inevitably shift towards safer, more trustworthy venues.

Back in November 2019, CFTC chairman Heath Tarbert said that Ether futures could be launched in the following six months, before doubling down on his claim in his Jan. 30 interview with Bloomberg.

New York-based ErisX launched physically-delivered Ether futures back in March, but CME Group is yet to dip its toes into the second-largest cryptocurrency.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin