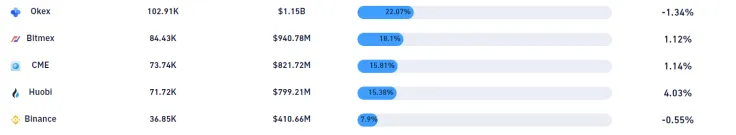

Chicago-based CME Group is now in third place when it comes to open interest (OI) in Bitcoin futures, according to London-based derivatives data provider Skew.

Only two unregulated exchanges, BitMEX and OKEx, are above CME, as the exchange has already surpassed $821 mln worth of all outstanding contracts.

CME Group keeps setting new highs

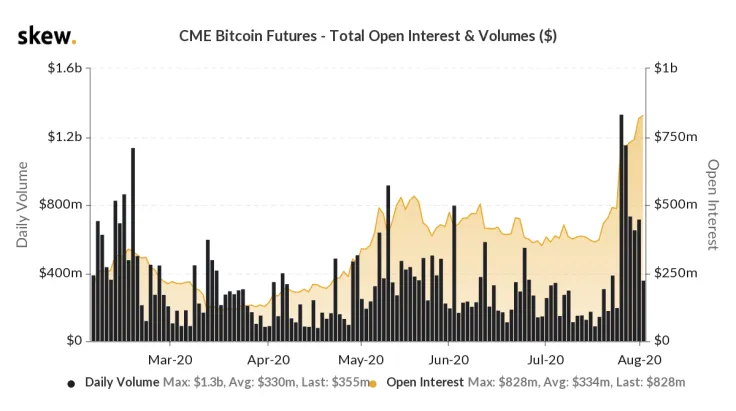

As reported by U.Today, OI surged to more than $450 mln as of July 22 when the exchange started seeing more demand for Bitcoin trading.

The main catalyst for this surge was the Bitcoin rally that took the flagship cryptocurrency from $9,100 to a local high of $12,100 in just 12 days (a 31.74 percent increase).

Now, Bitcoin futures offered by CME Group keep obtaining new highs, inching closer toward the much-coveted $1 bln mark.

Since the institutionally-oriented futures exchange was closed over the weekend, it was not affected by Bitcoin’s seismic drop from the aforementioned high to $10,559 in practically no time.

Shrugging off March

OI collapsed by 16 percent on Aug. 2 on unregulated exchanges due to the massive crash.

Overall, it is currently standing at $5.2 bln after reaching a new all-time high of $5.6 bln on the verge of the crash, according to data provided by futures trading information platform Bybt.

OKEx comes in first place with $1.15 bln worth of contracts, followed by BitMEX which is $60 mln shy of the ten-figure mark with $940 mln.

Huobi and Binance occupy the fourth and fifth spots, respectively, with $799 mln and $410 mln contracts.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin