During his latest appearance on CNBC's "Squawk Box," Galaxy Digital CEO Mike Novogratz voiced his bullish Bitcoin sentiment, stating that he still loves cryptocurrencies as a hard asset despite a recent pause in the market rally.

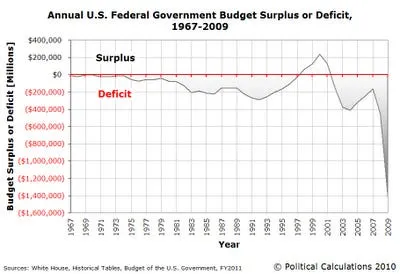

The former hedge fund manager also says that he has a "big gold position" while offering a bearish outlook on the U.S. dollar due to the surging U.S. budget deficit:

I don't see our deficits miraculously collapsing.

The U.S. deficit reaches $3 tln

The United States Department of the Treasury announced that the country's deficit surpassed $3 tln for the first time in history last Friday. It is predicted to hit $3.3 tln by the end of this budget year.

The government was forced to aggressively ramp up spending in order to stimulate the economy amid another recession.

The last time the U.S. recorded a budget surplus—when the government's tax revenue exceeds its spending—was in distant 2000.

In fact, there have only been five years in which the government logged budget surpluses since 1969.

Bitcoin's archrival

As reported by U.Today, Altana Digital Currency Fund CIO Alistair Milne said that the biggest threat any government could pose to Bitcoin is to choose to run a budget surplus, thus undermining one of the main value propositions of the world's biggest cryptocurrency.

When, in Novogratz's words, money starts growing on trees, investors of the likes of Paul Tudor Jones start turning to the scarce cryptocurrency to hedge against inflation.

Bitcoin's rally in August was partially attributed to the weakening U.S. Dollar Index (DXY), while the most recent pause also coincided with the greenback's temporary revival.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin