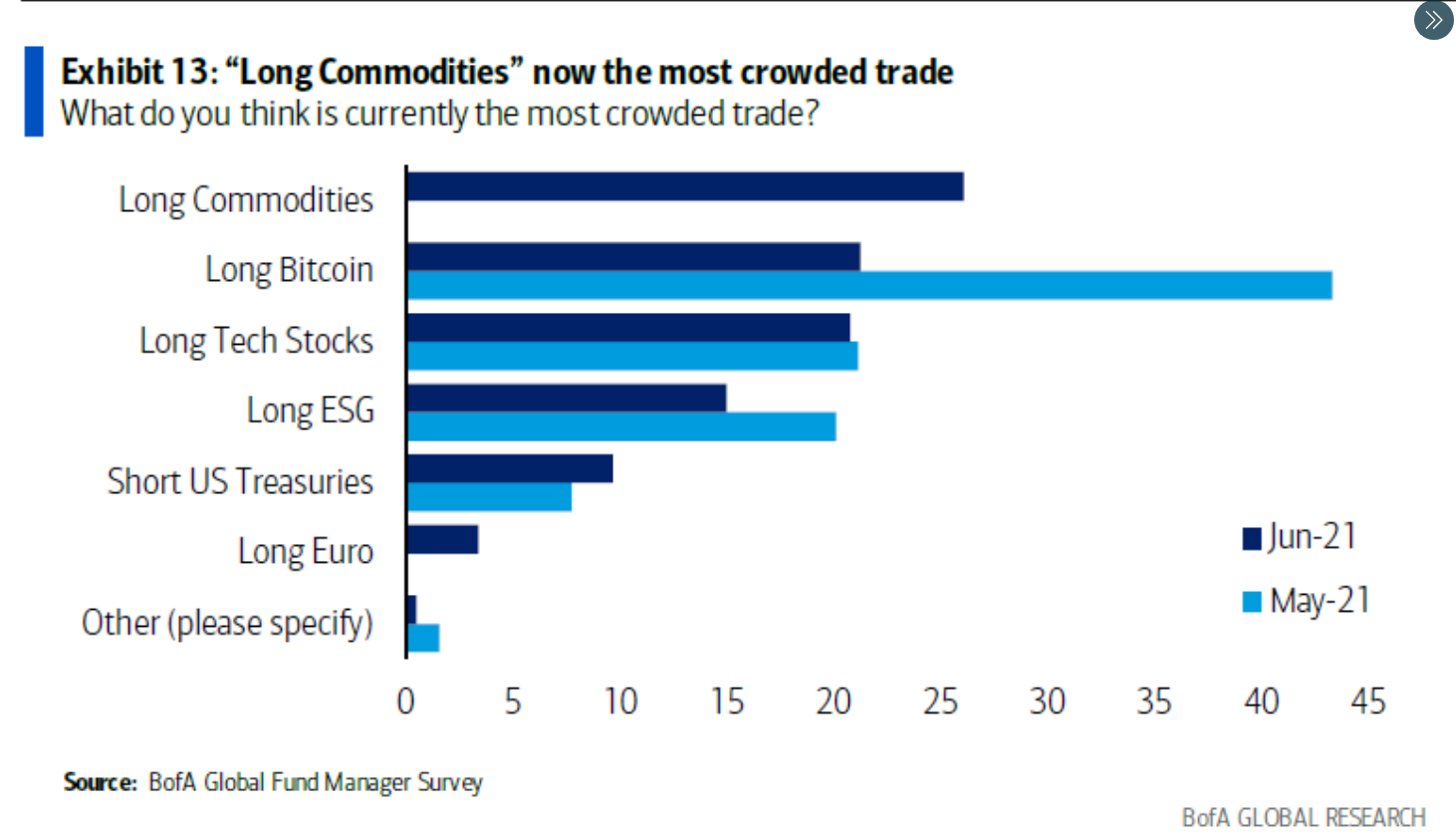

“Long commodities” has become the most crowded trade in the world, according to a monthly survey of fund managers conducted by Bank of America.

Commodities, such as copper, gold, and oil, have been rallying hard because of strong demand after a major pandemic-driven recession. The fact that commodity prices are soaring against the backdrop of massive government spending is also widely seen as a harbinger of future inflation.

“Long Bitcoin” now comes in second place after topping the list last month. The previous poll was conveniently unveiled right on the cusp of a massive sell-off that took place on May 19.

Fund managers also expect tech stocks and ESG stocks to beat the market while shorting U.S. Treasuries.

While it was the case last month, becoming the most crowded trade doesn’t necessarily signal the market top. For instance, Bitcoin also came on top of the January BofA survey, but it went on to soar higher in the following months.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin