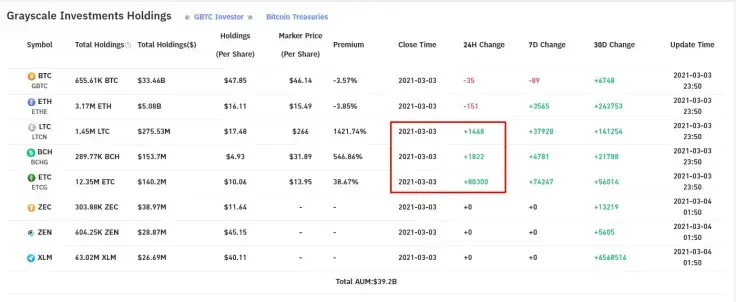

Data provided by analytics service Bybt indicates that, on March 3, Grayscale Investments added large amounts of LTC, BCH and ETH to its crypto portfolio.

The aggregate amount of digital assets managed by the company has now added up to $40 billion.

Grayscale keeps stocking up on Litecoin

Data from Bybt has it that, on March 3, the Barry Silbert-affiliated company added 1,468 Litecoins to its portfolio—the equivalent of $277,833.

Over the past week, Grayscale has bought 37,928 LTC and, in the past 30 days, its LTC holdings have increased overall by 141,254 coins from this Bitcoin fork.

As reported by U.Today earlier, by March 1, Grayscale had acquired around 80 percent of all LTC produced by miners in February. They had cumulatively mined 201,600 LTC coins.

More BCH and ETH added to Grayscale's AUM

Apart from the "digital silver" (LTC), on March 3, the largest crypto hedge fund purchased 1,822 BCH ($955,165) and 80,300 ETC ($895,949).

The weekly purchase of BCH has totaled 4,781 coins ($2,504,856).

Earlier this week, Grayscale also added 35,855,625 XLM to its Stellar Trust.

Overall, the biggest crypto-purchasing hedge fund is holding a staggering $39.2 billion of digital assets under management as of March 3.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov