A cryptocurrency market is an attractive place for professional traders. But ordinary members of the crypto community are looking for ways to make money with Bitcoin and other cryptocurrencies. Most often, the problem lies in the starting capital. To invest in a crypto, you need a lot of money, otherwise, the profit from trading will be scant. And what if there is another way, and even a few hundred dollars is enough to start?

What is CFD high-risk trading

The Contract for Difference of Price (CFD) is a form of agreement between the seller and the buyer on the transfer of the difference in the asset’s price at the time of its conclusion (most often it’s opening a position) and at the agreement’s end (closing). CFD is a type of margin trading. That is such a trade in which the merchant does not own the funds but receives them on bail (margin).

In principle, there are only 2 results of this type of trading crypto:

- If the transaction was successful, the buyer returns the seller’s cryptocurrency plus the commission for its use, and the difference remains — this is his profit.

- If the transaction is unsuccessful, the buyer is obliged to repay the expenses from his own pocket and return the full amount he borrowed from the seller plus a commission for using the funds.

Thus, the use of CFDs in the cryptocurrency market is high-risk trading. On the one hand, you can make money quickly, but on the other hand, you can completely or partially lose your investments.

CFD is especially effective when using short trading strategies because a longer order means more commission to pay. In addition, it’s necessary to take into account the gap that is formed after the exchange’s close. An obligatory feature of the Contract for Difference is to conduct a reverse transaction. After all, the merchant is obliged to close his loan and return the borrowed amount.

How CFDs work

The popularity of CFDs is due to the fact that the buyer doesn’t need to own the asset. That is, the trader contributes a margin (the amount of bail) and receives funds with leverage. For example, the trader has 1 BTC and can get 4 BTC more, in which case the leverage will be 1:4. At its disposal, the trader will have 5 Bitcoins. After closing the deal, he is obliged to return 4 Bitcoins plus credit and a certain commission. His Bitcoin can turn into 1.5 or 0.5 BTC — it depends on how well it trades. Often, margin requirements are displayed as a percentage, for example, to get 100%, you need a margin of 1%, leverage of 1:100. In many cases, the maximum loan amount is regulated by the exchange. A particular client can be provided with maximum leverage in accordance with his previous trading history and deposit amount.

Calculating profits or expenses is also quite simple. Imagine that having 1 Bitcoin, a trader wants to use a leverage of 1:4, in which case he will have 5 BTC in circulation. The closing of the trade brought a profit of 10%, in our case, it’s 0.5 Bitcoin. The total amount has risen to 5.5 BTC. Of these, we must give the seller 4 Bitcoins + commission percentage (say, 0.1 BTC). As a result, we will have 1.4 Bitcoin, of which the net profit is 0.4. The same with losses, only 1 Bitcoin will decrease, down to zero.

There is such a thing as a margin call. It refers to cases where a trader incurs losses that can exceed the size of the margin. That is, if there’s a danger of losing credit funds, a margin call is triggered, the crypto is sold on the market and the CFD provider receives his money back.

Given the high volatility of the cryptocurrency market, a margin-call can be triggered often, in such cases the trader will have to replenish his account if he expects the price to increase further.

Advantages/disadvantages of high-risk trading

It’s always necessary to remember that CFD trading is a huge risk and you need to trade cryptocurrency using this strategy only when you have the proper experience and cool head. If you’re still unsure whether the game is worth the candle, the right thing to look at the advantages and disadvantages of CFDs. Let's start with the advantages:

- Margin allows you to trade with large leverage. Therefore, for a good income on trade, you can have up to 10% of the total amount you need. If you trade correctly, profits can increase many times over.

- There’s no need to buy a cryptocurrency, which allows brokers to avoid extra overpayments.

- Cryptocurrency trading using CFDs is quite simple, as is the case with stocks.

- There‘s no difference in the use of long and short trades, both options are easy to use. All because of the absence of an additional brokerage commission, which was charged for conducting short orders before the appearance of the CFD.

- There’s no time frame, you can trade even after hours, and contracts don’t have a specific expiration date.

- Easy to place stop loss and conditional orders.

Good advantages over classical methods, but there is always the flip side of the coin. Disadvantages of CFDs:

- More leverage carries the risk of large losses.

- With the reverse movement of the market, losses can go beyond the original margin. There is a need to replenish the account in order to avoid margin calls. Losses can be huge.

- Lack of influence on the asset and voting rights, due to lack of ownership.

- The lack of flexibility of leverage makes it necessary to create a strategy for a specific CFD, which requires additional time and attention.

- Changing the margin size in the course of trading by the decision of the provider. As a result, the trader is obliged to make additional funds.

- The nature of cryptocurrency economics still known very poor. There is a common opportunity to lose your money as a result of ‘black swan’ influence on the market.

- The risk of over-trading due to low input threshold.

Both lists can be supplemented more, but we believe that these points are enough to make an informed decision.

How to choose a reliable broker?

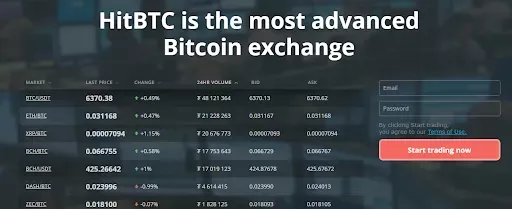

Now there is a large number of brokers around the Internet, but not everyone is worth entrusting your money to. Therefore, we decided to help with this issue and conducted our comprehensive analysis of popular brokers of various types. It turns out popular does not mean reliable. That's the experience we had.

eToro

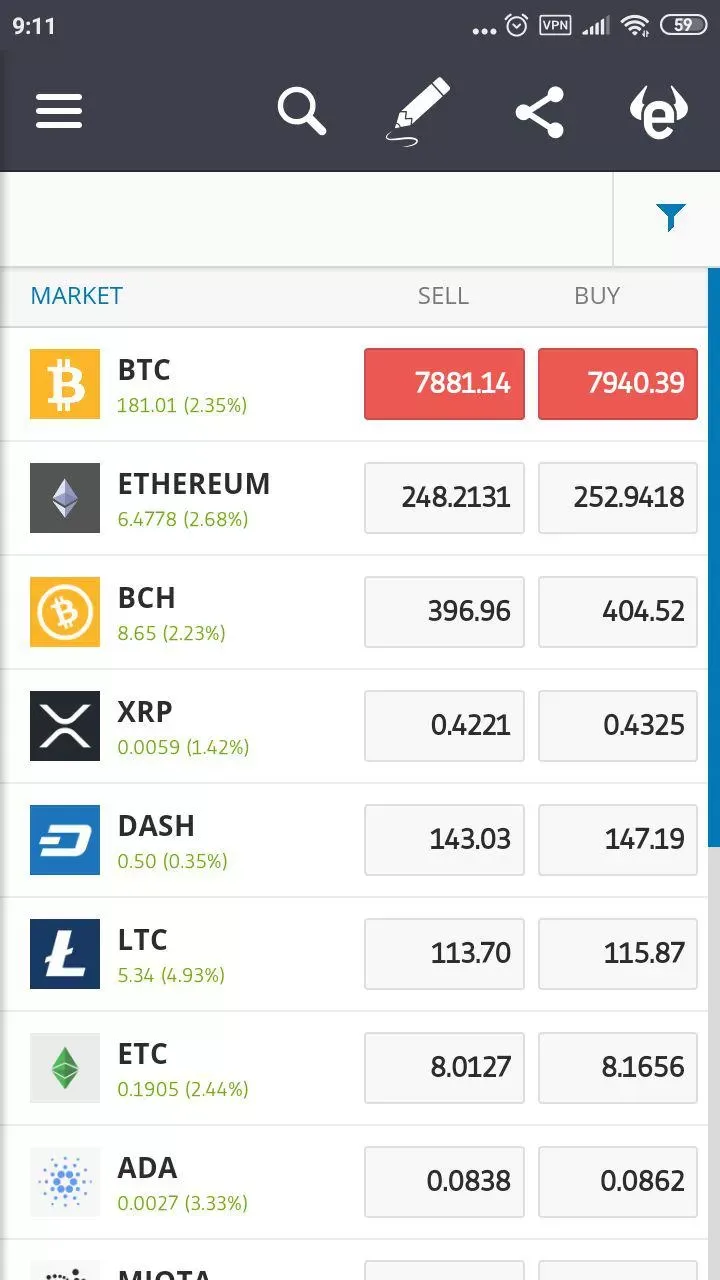

The company was founded in 2007, and in the last few years, it has begun to actively implement cryptocurrency. We managed to count the 12 most popular cryptocurrencies available for trading, including Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Ripple, EOS and others.

For each of the cryptocurrencies, you can find detailed information: a chart, a previous close price, a price range.

A convenient feature is the ability to copy trades of popular traders. That is, your account will automatically repeat the actions of the selected trader. This feature allows you to make a profit without even having extensive knowledge of crypto trading. By the way, beware that great traders’ strategies are also subject to mistakes.

The platform is actively developing in the crypto direction by expanding the list of cryptocurrencies. Also, at the end of 2018, eToro presented their own cryptocurrency wallet and are planning to launch their own stablecoin this year. For the convenience of users, there are mobile applications.

Plus500

Plus500 is one of the most reputable forex brokers. It was founded in 2008. Today, the list of cryptocurrencies includes 10 items:

- Bitcoin

- Ethereum

- Bitcoin Cash

- ABC

- Litecoin

- Ripple

- NEO

- Stellar

- Cardano

- Monero

- Tron

The broker has its own mobile applications that allow you to trade constantly. Leverage for crypto reaches a ratio of 1:30, and margin — 5-10%. The minimum deposit is $100. In the majority of reviews, people are not very positive. Many question the stability of the site and the displayed data. There may be problems with money withdrawal.

IG

Strange, but with the popularity of IG, the first thing we met was a pile of negative reviews. Perhaps this is the antics of competitors, or maybe not. All people complained about problems with withdrawals, some had a malfunction on the platform. Nevertheless, the broker has been working for more than 40 years, the date it was founded was 1974. Eight popular coins are available for trading crypto: Bitcoin, Litecoin, EOS, NEO, Bitcoin Cash, Stellar, Ethereum and Ripple.

Cryptocurrency leverage reaches a value of 1:5. Of course, a company with such a long history has its own applications for Android and iOS. User reviews are pretty positive.

XTB

This Forex broker has been working since 2002. The minimum deposit is $250. Leverage for crypto and other assets is 1:30. The most popular cryptocurrencies on the list are Bitcoin, Ethereum, Ripple and others.

Users praise the fairness of the broker, but there are questions about the functionality. Therefore, the reviews are somewhere between good and normal.

High-Risk trading in the United States

Residents of the United States are less fortunate and all listed brokers are restricted in the country. However, there is a way out of this situation. An alternative to cryptocurrency brokers can be trading on Coinbase.

The platform also provides an opportunity for margin trading. But there is a small problem: if you want to trade this way, it’s available only to customers who have invested at least $5 million in the exchange.

Conclusion

Trading Contracts for Difference can be both profitable and unprofitable, but always risky. This is a great way to gain access to a large amount of crypto, but also a great way to be left with nothing. We recommend trading CFDs only to experienced traders or to study the topic if there is such a desire. And remember that no matter what cryptocurrency you choose to trade, it must be with money that you are ready to lose.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov