The last few days in the crypto market have been wild to say the least. With only two alternative cryptocurrencies pumping, Bitcoin (BTC) trading at the key $104,500 level flirting with an all-time high breakout, and every other asset dumping two days in a row by double-digit percentages, wild is the softest anyone can call this unprecedented chain of events.

Interesting, then, what the mightiest think of all this. For one of the key figures in the cryptocurrency market, former CEO of the world's largest exchange Binance, Changpeng Zhao, nothing ends here and the fear of missing out is just beginning.

What's interesting is that just four days ago, Zhao also published a post dedicated to this very feeling on the edge of greed and fear. At the time, CZ said that it's okay to feel this way, but the real difference is to act responsibly.

Just greed, nothing extreme

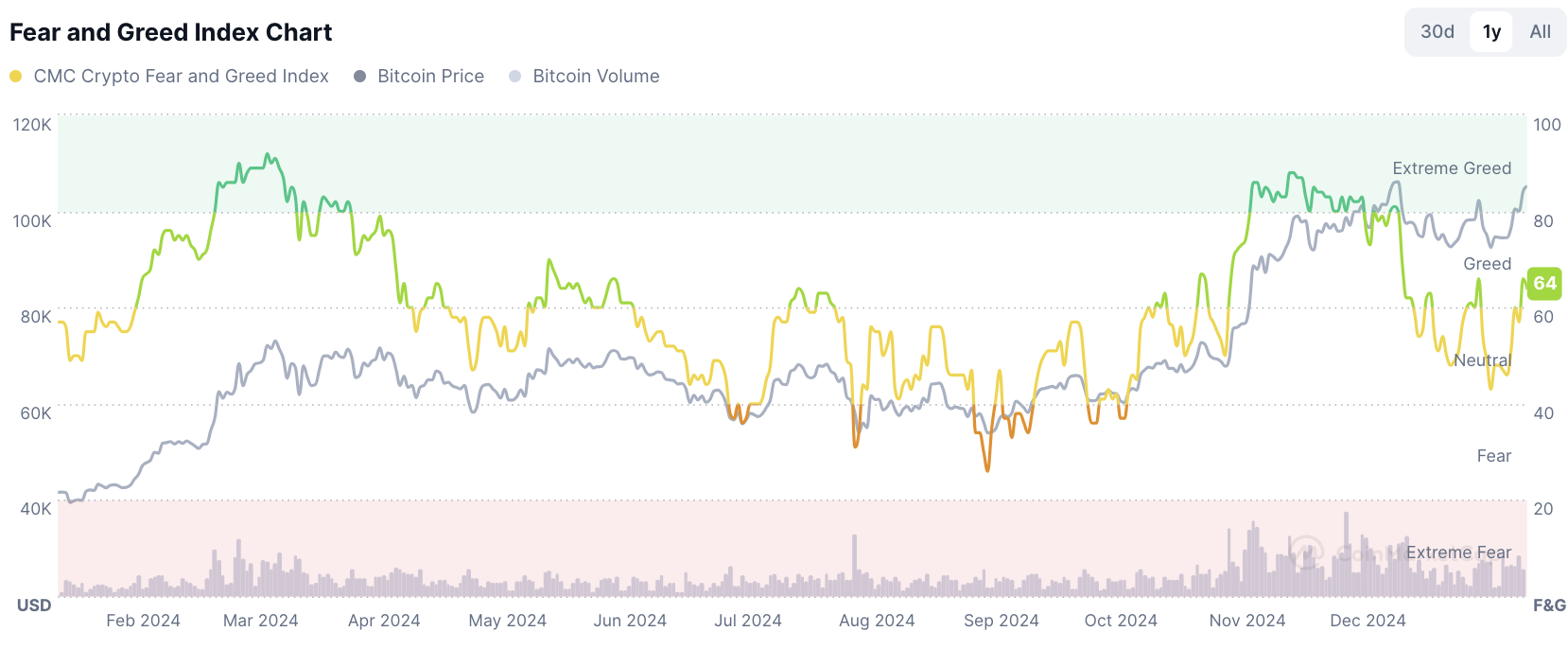

If one were to try to measure FOMO as an indicator, perhaps the best way would be a Fear and Greed Index. This index ranges from 0 to 100, with lower values indicating extreme fear and higher values indicating extreme greed.

The one from CoinMarketCap shows that the market is currently in greed mode, but at 64 out of 100 it is not extreme yet.

And it's not that extreme greed is rare, we have seen the market tilt toward it many times in recent weeks and months. The last such mania was in early December, for example, and after that the market went into a month-long correction, with Bitcoin trading below six figures all the time.

It seems that the market is fairly balanced at the moment, although many may be experiencing FOMO looking at the performance of some of the "new shiny coins."

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin