Ryan Berckmans, Ethereum (ETH) investor and active contributor to Ethereum-based products, explains the core benefits of scalability solution StarkNet.

StarkNet or Solana?

According to the tweetstorm by Mr. Berckmans, Ethereum's Layer 2 scalability solution, StarkNet by Starkware Industries, has a number advantages over much-anticipated "Ethereum killer," Solana.

1/ StarkNet vs. Solana

As crypto grows, there's a need for scaling solutions that can grow to global ubiquity. On ethereum, only some zk-rollups, like StarkNet, meet this criterion, but happily, they do it very well.

Here are three benefits of StarkNet vs. Solana

?— Ryan Berckmans (@RyanBerckmans) September 17, 2021

First, StarkNet's fees remain low as its network scales, while Solana (SOL) fees will rise in case of congestion.

Then, StarkNet's "property rights" are actually those of Ethereum, so all interactions are protected by the entire L1 hashrate. At the same time, StarkNet is more decentralized.

While Ethereum (ETH) has four independent clients developed by different teams, Solana (SOL) has only one, and this status quo will most likely remain untouched.

All Ethereum L2s are skyrocketing

Finally, ownership of Solana's native token, SOL, looks far more whale-dominated than that of Ether's supply. Mr. Berckmans recalls that 40% of SOL is considered non-circulating supply.

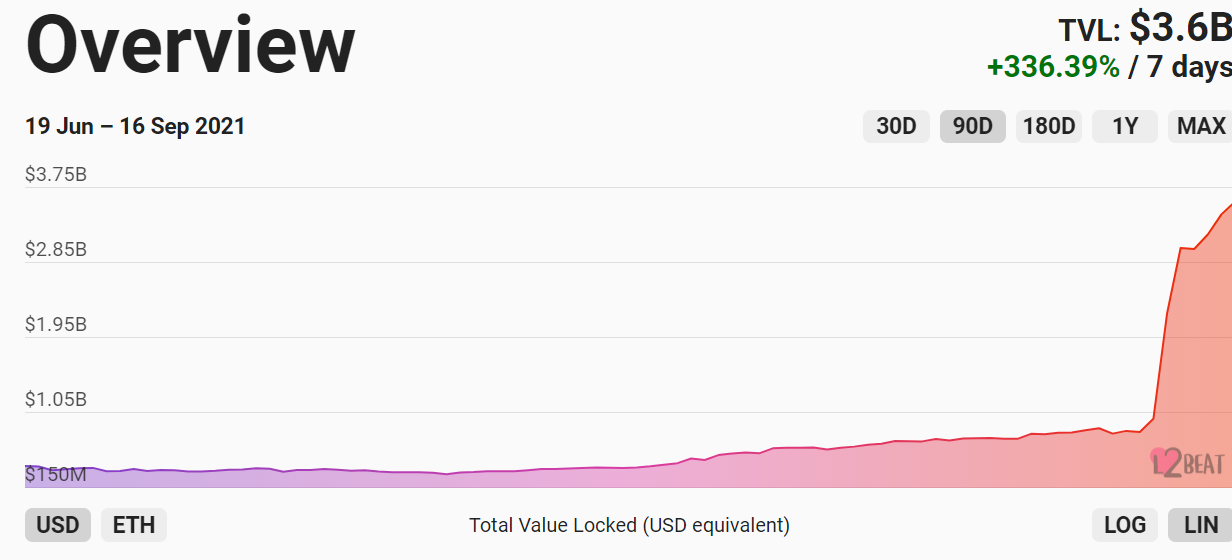

As covered by U.Today previously, second-layer scalability solutions for Ethereum (ETH) are witnessing unparalleled upsurge in terms of user activity and total value locked.

As displayed by leading L2 tracking dashboard L2Beat, the TVL of Ethereum's Layer 2 ecosystem more than quadrupled in seven days.

At press time, its total sits over $3.6 million for all mainstream platforms.

Dan Burgin

Dan Burgin U.Today Editorial Team

U.Today Editorial Team