Jim McDonald of Attestant staking service provider, attempted to foresee the costs to bear the future validators for the Ethereum (ETH) 2.0.

Ethereum (ETH) 2.0. Validation Expenses

Mr. McDonald mentioned three main types of validators’ costs: expenses for setup, infrastructure and operation.

The first type of costs includes those for selecting the hardware, the operating system and software implementation. The last one seems to be the most difficult as six implementations of Ethereum (ETH) network are available now.

The infrastructure costs include depreciation expenses for the hardware, electricity and network costs. It’s better to calculate depreciation period for the period of 36 months, suggests Mr. McDonald.

The operation costs include those spent on Maintaining the hardware, software upgrades and re-evaluation of implementations.

Expensive Evolution

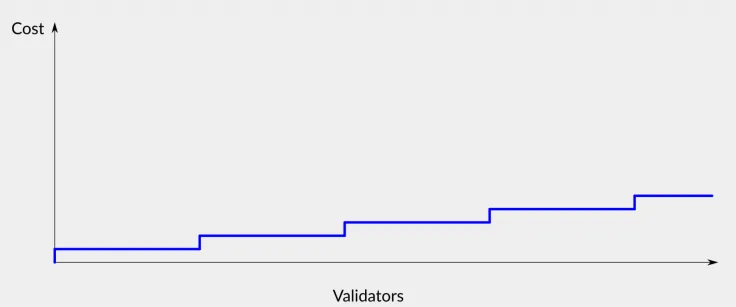

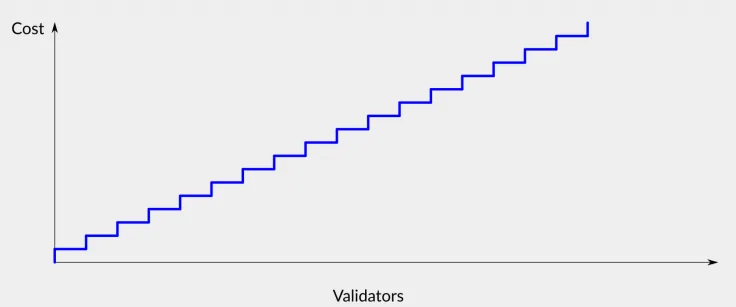

But the most interesting suggestion that Mr. McDonald has made is the fact that the expenses reviewed will drastically rise with the progress of Ethereum (ETH) 2.0. network phases. The analyst demonstrated this increase in schemes for the Phase 1 and Phase 2:

Unfortunately, Mr. McDonald failed to demonstrate the approximate costs in absolute numbers. By the way, in accordance with the last estimations, a minimum required stake in Ethereum (ETH) 2.0 will be 32 ETH with 4-5% of expected annual yield.

Do you plan to validate Ethereum (ETH) 2.0 transactions? Share your plans with us in Comments section below!

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin