Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

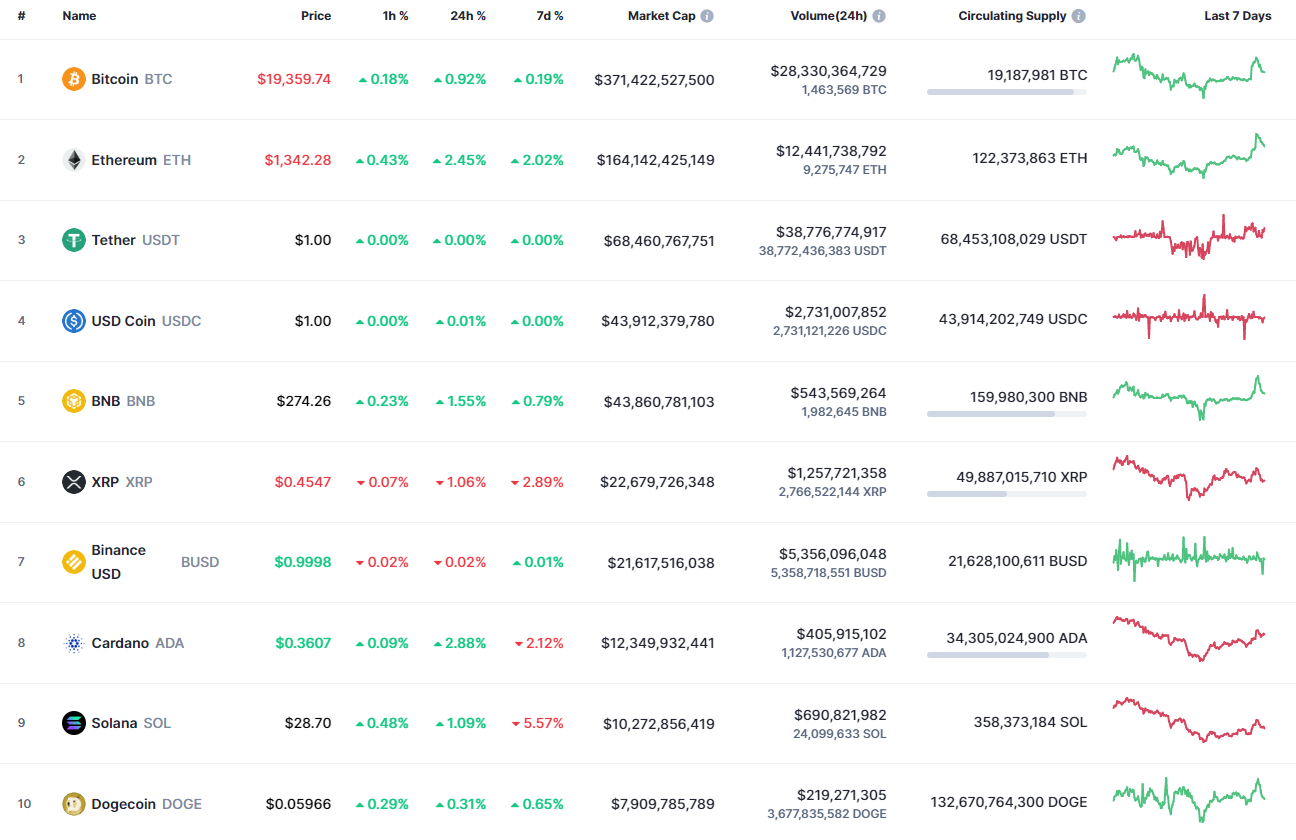

Bulls have almost restored the lost positions as the majority of the coins are back in the green zone.

ETH/USD

Ethereum (ETH) is one of the biggest gainers today, going up by 2.49%.

Despite today's rise, Ethereum (ETH) keeps trading in a wide range, accumulating power for a further sharp move. This is also confirmed by the low volume, which means that none of the sides is ready yet. The midterm bull run might happen only if the rate reaches the $1,400 mark and fixes above it with no or small wicks.

Ethereum is trading at $1,345 at press time.

SOL/USD

Solana (SOL) is less of a gainer than Ethereum (ETH) with growth of 1.78%.

Even though yesterday's candle was bullish, it is still early to consider a reversal, as not enough energy has accumulated for that. Until the price is below the psychological $30 mark, bears remain more powerful than bulls. However, if the bar closes above $30, a further rise may last for a few weeks.

Solana is trading at $28.89 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov