Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

- Introducing Asia Exchange, a multi-purpose crypto ecosystem with ASIA utility token

- Asia Exchange Basics: What are crypto exchange, staking, OTC and IEOs?

- Asia Exchange for spot trading: user-friendly, fast, secure platform for 79 tokens

- Novel crypto concepts on Asia Exchange (ASIA): Staking and IEO

- Native assets of Asia Exchange: Asia Token (ASIA) and Asian Dollar (AUSD)

- Referral program

- Closing thoughts

Asia Exchange (also AsiaX, ASIA) is an intuitive one-stop solution for cryptocurrency trading, staking, “over-the-counter” exchange, initial exchange offering and so on. Here’s how Asia attempts to empower its users with a holistic crypto experience.

Introducing Asia Exchange, a multi-purpose crypto ecosystem with ASIA utility token

Launched by veteran cryptocurrency enthusiasts, Asia Exchange brings military-grade security to the segment of centralized cryptocurrency conversion of cryptocurrencies.

In this over-saturated segment, how does Asia Exchange differ?

- Intuitive interface: no previous experience in crypto or trading is required

- Military-grade security: multi-level protection of clients’ funds and data

- Holistic cryptocurrency ecosystem: staking, trading, OTC deals and one-click crypto purchasing in one interface

- Novel tokenomic design that includes ASIA core native token and Asian Dollar (AUSD) stablecoin

- Built-in IEO dashboard for early-stage projects

- Lucrative multi-level referral program, “ASIA Agents”

Asia Exchange Basics: What are crypto exchange, staking, OTC and IEOs?

Asia Exchange (ASIA) released a combination of nearly all cutting-edge instruments that are available in the crypto segment. Which ones?

Crypto exchange

A crypto exchange should be considered a class of platforms (software applications or web interfaces) that allow the exchange of one digital asset to another. Crypto exchanges provide their users with opportunities to benefit from price movements in either direction.

There are centralized and decentralized exchanges: while the first type utilizes centralized instruments to store users' funds, decentralized exchanges (or DEXs) perform all operations on-chain.

Staking

On some blockchains (Cardano, Eos, Tezos), the integrity of blockchain operations is ensured by the stakes - the portions of cryptocurrency locked by their users in special environments. Stakers receive shares from the transactional fees of this or that blockchain.

At the same time, if the staker (or the actor he/she staked his/her coins in favor of) fails to validate transactions in the correct manner, he/she loses the stake or staking rewards.

OTC

Over-the-counter deals (OTC) in crypto is a process of peer-to-peer buying/selling cryptocurrencies with no third party at a predetermined rate. There are no orderbooks in OTC trading; the parties discuss conditions between each other.

IEO

The initial exchange offering refers to the design of the initial tokensale when the process is executed through an exchange. It is much safer than ICO: the funds are not raised directly by a project team that significantly reduces the possibilities for an exit scam.

Asia Exchange for spot trading: user-friendly, fast, secure platform for 79 tokens

First and foremost, Asia Exchange (ASIA) was launched as a centralized spot instrument for token exchange designed for both newbies and sophisticated traders.

Trading

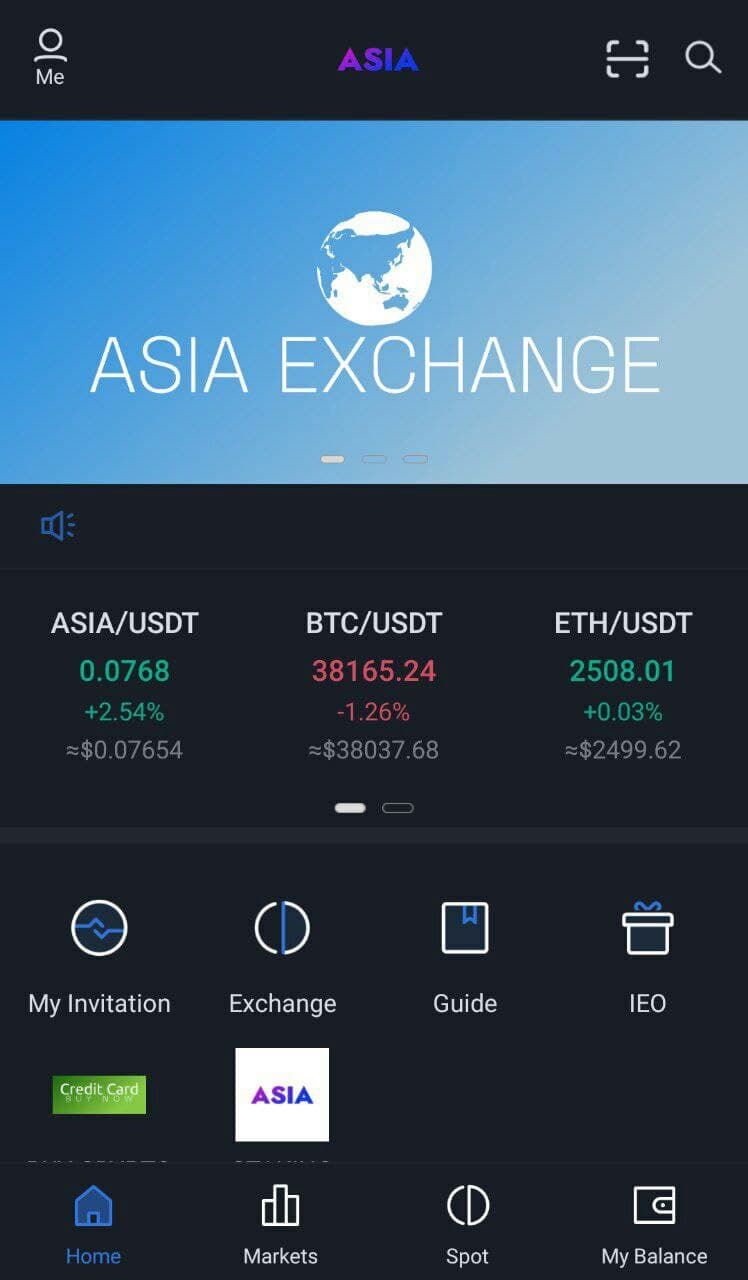

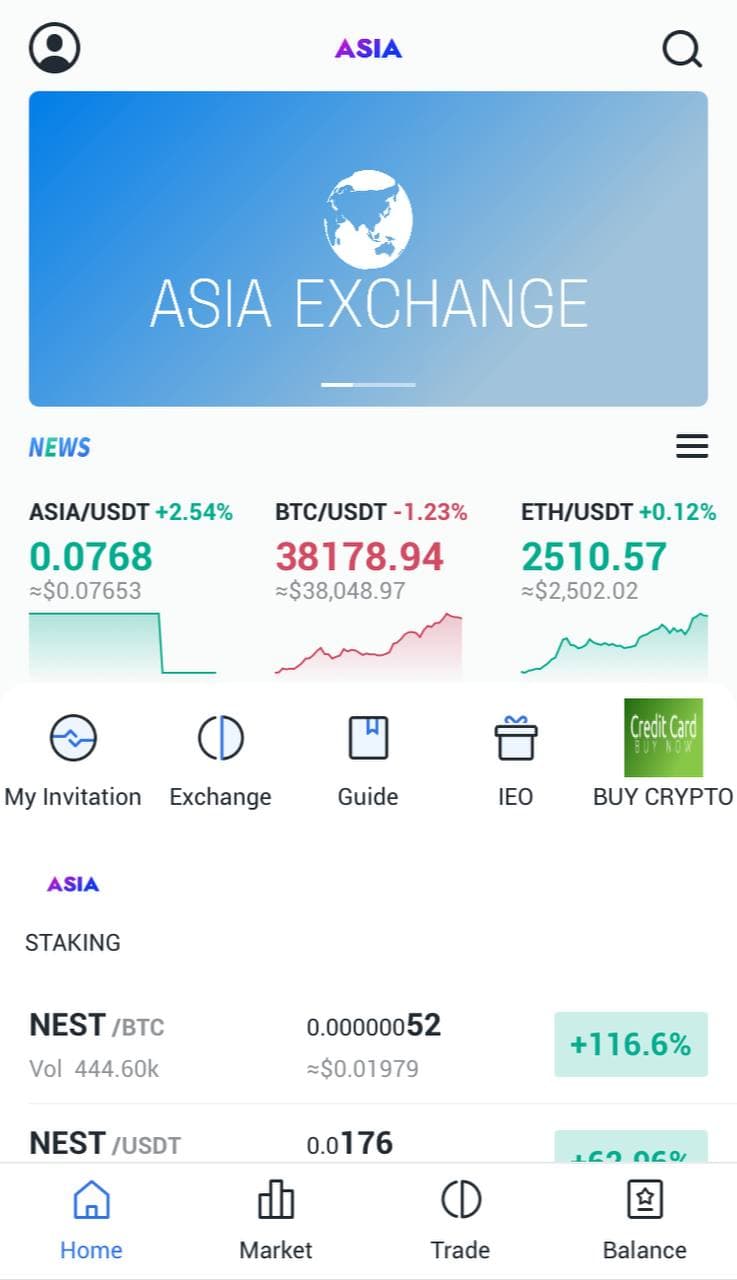

With Asia Exchange (ASIA), the trading interface is available via the “Trade” button on the upper left side of its main page. By default, assets are listed against the U.S. Dollar Tether (USDT) stablecoin.

Also, the selected assets are available for trading against cryptocurrency majors Bitcoin (BTC) and Ethereum (ETH). USDT is also listed against the exchange’s native coin, ASIA.

The interface of Asia Exchange (ASIA) looks classy: it includes a crypto price chart powered by TradingView, orderbooks, the history of the “Buy” and “Sell” market, limit and stop-limit orders. By clicking on the “USD” button, a user can see the rates of all assets denominated in U.S. currency while, by default, they are demonstrated in USDT equivalent.

Tokens

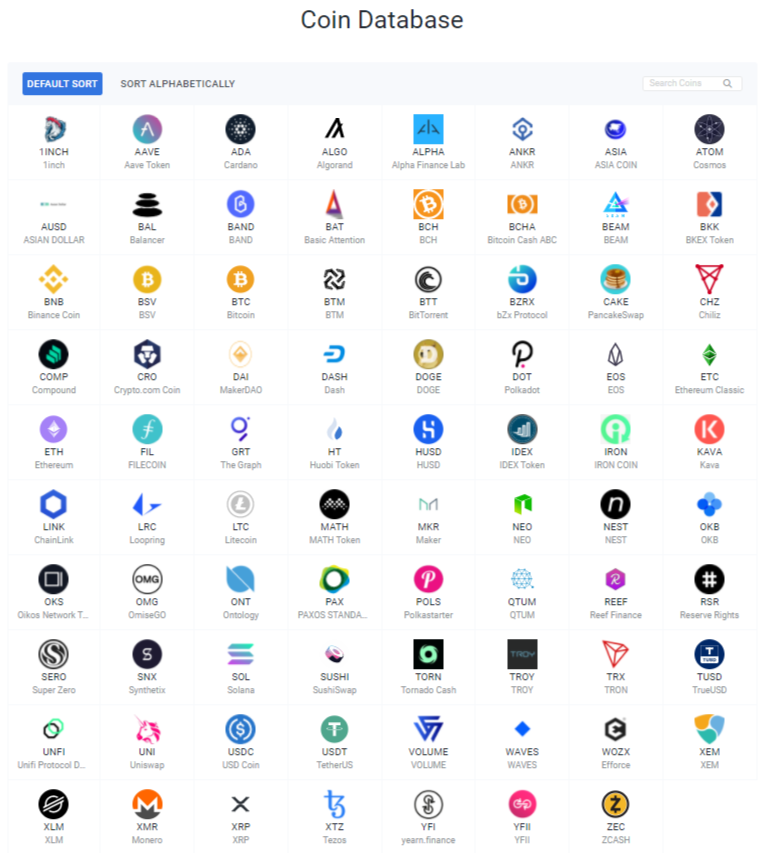

As of Q3, 2021, 79 cryptocurrencies are available on Asia Exchange (ASIA). Detailed information on every token listed on the exchange is available in a “Coin Info” module on the upper left side of its main page.

Asia Exchange (ASIA) boasts tokens of various categories. It listed crypto heavyweights (Bitcoin, Bitcoin Cash, Dogecoin, Dash), top-notch smart contracts environments (Ethereum, Solana, Ethereum Classic, Tron, Tezos), native assets of DeFi protocols (Yearn.Finance, DFI.Finance), stablecoins (U.S. Dollar Tether, USD Coin, True USD, Huobi USD, DAI, Paxos Standard), utility assets of centralized exchanges (OKCoin, Binance Coin) and decentralized exchanges (PancakeSwap, Uniswap, IDEX).

In addition, the ASIA token of Asia Exchange is available against U.S. Dollar Tether (USDT) on the platform’s trading suite.

Security

The implementation of unmatched security is a “killer feature” of the Asia Exchange (ASIA). Four separate methods of privacy and security protection are being implemented right now. Combined, they prevent malefactors from interacting with exchanges and accessing users’ funds.

On Asia Exchange, users’ funds are protected by two-factor validation and email encryption. To authorize transactions, users should confirm their activity via both mobile phone and email.

The interaction between users’ browsers and Asia Exchange’s trading engine is protected by SSL-encryption, a top-tier mainstream security protocol. Finally, Asia Exchange is super serious about IP-change verification: its users are strictly prohibited from accessing the exchange with maliciously modified IP addresses.

OTC

Over-the counter deals (OTC) have never been easier than with Asia Exchange. Clicking on the “OTC” button in the upper left of Asia Exchange’s main page redirects users to a dialogue with Telegram bot AsiaX (@Type2a). Thus, in one click, the user is redirected to a peer-to-peer dialogue designed to discuss the conditions of the OTC deal.

In its dialogue, users can discuss the currency, amount, conversion rate and the type of order (“Buy” or “Sell”) he/she prefers to place on Asia Exchange’s OTC desk. Then, the parties begin discussing the mutually profitable conditions of trade.

Novel crypto concepts on Asia Exchange (ASIA): Staking and IEO

Asia Exchange boasts two interesting concepts that allow crypto entrepreneurs and average users to benefit from being involved in the digital assets segment.

Staking on Asia Exchange

During the last few years, staking evolved into the most user-friendly practice for obtaining passive income on idle cryptocurrency. With Asia Exchange’s staking dashboard, even crypto newcomers can lock assets for periodic rewards.

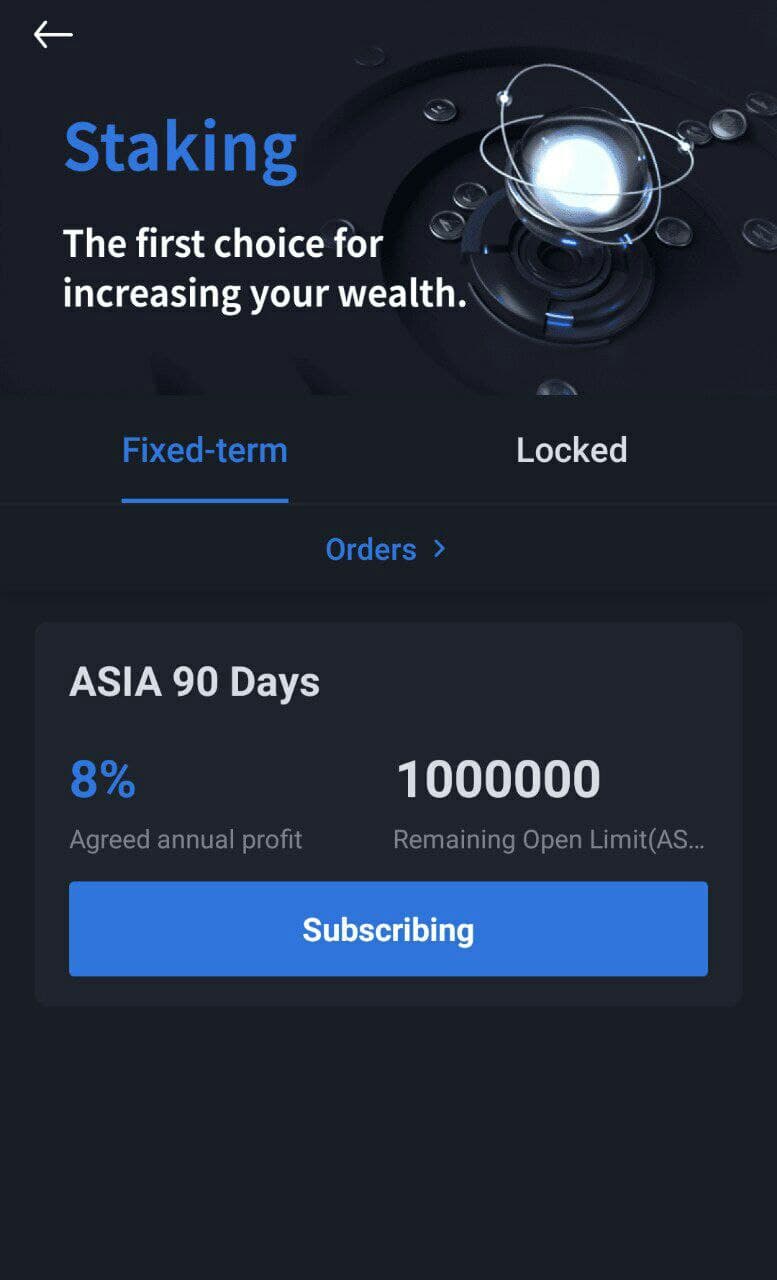

Three coins are available for staking on Asia Exchange: ASIA, IRON (native token of Iron Finance DeFi ecosystem) and Asian Dollar (AUSD) stablecoin.

As the only asset with a stable price, AUSD is available for staking with 3 percent in annualized percentage yield (APY). ASIA and IRON are available for staking within various programs with an APY between 6.3 percent and 8 percent. Most lucrative rates are introduced for longer terms and greater sums locked.

As of early August 2021, the program “ASIA 90 days” is open for new participants. The net amount of funds that can be staked within the program is limited by one million ASIA tokens (about $70,000). The program starts on Aug. 14, 2021, and closes on Nov. 22, 2021. The subscription is open until Aug. 13.

IEOs on Asia Exchange

Asia Exchange welcomes all cryptocurrency projects to organize an initial exchange offering on its platform. The robustness and viability of Asia Exchange’s IEO module have been demonstrated by a recent overhyped ASIA tokensale.

It took place in Q2, 2021 in the “IEO” module of Asia Exchange. ASIA IEO included four stages. Right now, ASIA can be purchased in an ordinary manner with Bitcoins (BTC).

Native assets of Asia Exchange: Asia Token (ASIA) and Asian Dollar (AUSD)

Asia Exchange introduces a bi-token economical model. It includes two ERC-20 (Ethereum-like) tokens, ASIA coin and Asian Dollar (AUSD) stablecoin.

Asia Token (ASIA)

Asia Token is a core native asset of Asia Exchange. It is issued on the top of Ethereum (ETH) blockchain, so its liquidity can be easily deposited to all noncustodial Ether-based platforms (exchanges).

Asia Token (ASIA) has no pre-mine: its supply is capped at 100 million tokens. Ideologically, ASIA token shares the concept of the most overhyped “exchange coins,” like Binance Coin (BNB), OK Coin (OKB), Huobi Token (HT) and so on.

Just like tokens of fintech unicorns, ASIA token guarantees its users multiple benefits while using Asia Exchange instruments.

ASIA tokens were distributed between early enthusiasts of the project via IEO. Right now, ASIA can be purchased with Bitcoins (BTC) in the “IEO” module of Asia Exchange or in the “Trading” module with U.S. Dollar Tether (USDT) stablecoins.

Asian Dollar (AUSD)

Native stablecoins are an exclusive instrument for top-tier cryptocurrency exchanges. For instance, world-leading exchange Binance has its Binance USD (BUSD) stablecoin issued by Paxos Global, while Huobi utilizes Huobi USD (HUSD) by Stable Universal.

The Asian Dollar (AUSD) represents a USD-pegged reliable stablecoin by Asia Exchange. It significantly washes operations on Asia Exchange and can be used as a hedge against crypto volatility.

Referral program

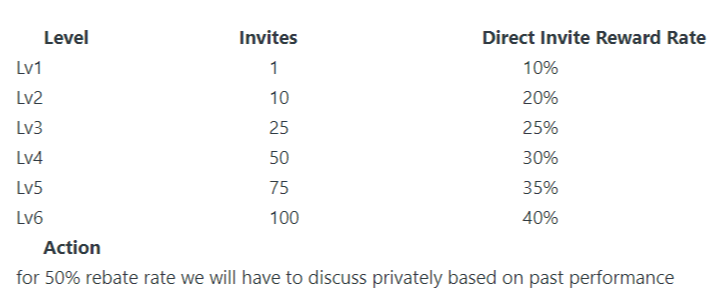

To allow Asia Exchange users to monetize their influence in the crypto world, the exchange started a multi-level referral program.

Within the framework of this referral program, “Asia Agents,” an owner of a referral link can obtain up to 50 percent of trading fees collected from his/her invited users.

The more users that are invited by this or that referral, the greater his/her commission becomes.

Closing thoughts

Long story short, Asia Exchange has delivered a go-to ecosystem for storing, exchanging, staking and OTC trading of multiple crypto tokens. Its security is protected by cutting-edge mechanisms. Asia Exchange trading engine is available on both the web interface and mobile applications for iOS and Android.

The bi-token economic system with Asia Coin (ASIA) and Asian Dollar (AUSD) ensures sustainable and comfortable trading on Asia Exchange.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin