As cryptocurrencies are gaining a mainstream profile, merger and acquisition deals are now actively taking off.

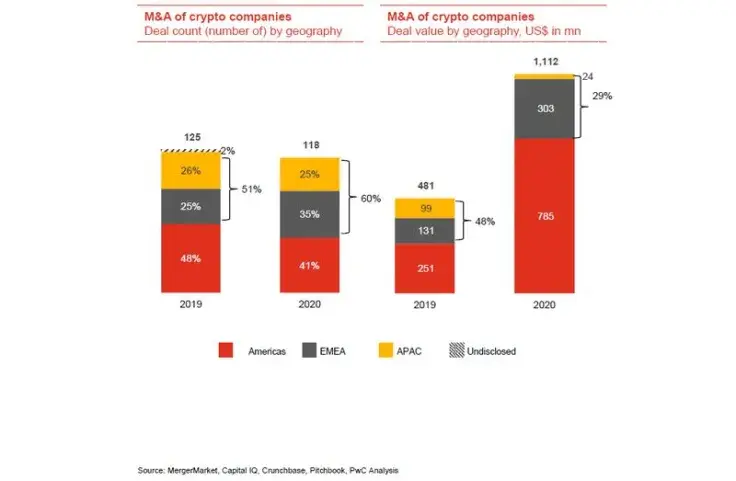

According to a new report released by PricewaterhouseCoopers (PwC), the cryptocurrency M&A sector grew to $1.1 billion last year.

Unsurprisingly, the U.S. is responsible for the lion’s share of that figure, with local deals generating $785 million. The EMEA region comes in a distant second place with $303 million. The gap between the two regions has widened compared to 2019 due to rapid institutional adoption in the U.S.

As reported by U.Today, the value of M&A deals collapsed 76 percent in 2019 after a brutal bear market.

However, 2021 is already on track to surpass 2020, according to PwC‘s Henri Arslanian.

Bitcoin is routinely making new all-time highs this year, recently surpassing the $60,000 level.

The biggest M&A deals of 2020

When it comes to the biggest M&A deals of 2020, Binance certainly takes the cake with its staggering $400 million acquisition of cryptocurrency data provider CoinMarketCap, which also happens to be the most-visited industry website in the world.

Last year, rivaling cryptocurrency exchange FTX also acquired portfolio-tracking app Blockfolio for $150 million.

Coinbase, the largest U.S. exchange, purchased cryptocurrency brokerage firm Tagomi for up to $100 million last May for expanding its institutional services.

PayPal was also in talks to buy crypto trust company BitGo in 2020, but the deal didn’t work out.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin