As the cryptocurrency industry recovers from a prolonged recession, the demand for reliable trading platforms is surging at an increased pace. BTSE (short for "Buy, Trade, Sell, Earn") offers an all-in-one crypto ecosystem for traders, stakers and even blockchain developers.

Its revamped >35% referral commission program, futures copy trading platform, and grid bot trading feature are designed to cater to the next generation of crypto traders. Additionally, its EUR-based debit card solution, "BTSE Card," is expected to launch soon, to enable users to spend their crypto earnings in real-life scenarios.

BTSE caters to newbies and pro traders alike

Since its launch in 2018, the BTSE crypto exchange has combined user-friendliness and high trading performance, with the ethos of operating as a boutique crypto trading platform. BTSE’s simple, clean mobile app offers one of the most intuitive experiences for traders on the go. Meanwhile, BTSE’s trading engine and desktop platform, built by seasoned programmers and traders from the world’s leading investment banks, offer an unparalleled experience for more advanced users.

Notable features at BTSE include:

- BTSE is a Tier-1 cryptocurrency futures trading platform, ranking 7th for futures on CoinGecko;

- BTSE currently offers more than 70 futures contracts encompassing a wide range of cryptocurrencies including BTC, ETH, MATIC and MASK, among others ;

- BTSE offers up to 100x leverage for futures contracts;

- BTSE offers advanced trading tools that include TWAP, OCO, algorithmic index orders, hidden orders, margin calls, etc;

- All instruments on BTSE are available in more than 20 languages;

- The BTSE mobile app, which offers trading on the go, is available on both the App Store and Google Play Store and offers convenient login options such as Google Login and QR code scanning;

- BTSE does not only operate a crypto exchange, but also runs a B2B white label solutions arm, BTSE Enterprise Solutions, which enables entrepreneurs to build their own cryptocurrency exchanges by leveraging BTSE’s award-winning trading technology and infrastructure;

- The platform's easy-to-use staking solutions offer APYs of up to 9% for U.S. Dollar Tether (USDT) deposits, a welcome boon for buy-and-hold investors;

- The exchange will soon release BTSE Card, a EUR-based debit card that can be topped up using cryptocurrencies.

In addition to the above, BTSE is constantly increasing the range of assets available for trading, while adding support for new blockchains and tokens. The platform employs cutting-edge security measures, most of which were developed in-house, to ensure the complete security of customers' funds. The platform has observed zero downtime since its launch.

Introducing BTSE, a next-gen futures exchange for mainstream audiences

BTSE combines the benefits of a user-friendly trading platform with disruptive technology. This combination has enabled BTSE to evolve into a go-to crypto futures trading platform for millions of users from all over the globe.

BTSE: The Basics

Launched in 2018, BTSE is a cryptocurrency futures trading platform. It facilitates the secure and anonymous exchange of Bitcoin (BTC), U.S. Dollar Tether (USDT) and over 130+ cryptocurrencies.. Originally founded by an elite team of Wall Street traders and programmers, the company champions a "technology first" approach. Today, under the leadership of CEO Henry Liu and COO Jeff Mei, BTSE is being steered towards new horizons.

Image by BTSE

Apart from operating as a trading platform for end users, BTSE operates a B2B arm, BTSE Enterprise Solutions, that offers white label blockchain solutions for companies seeking to roll out their own crypto exchanges.

The platform's innovative nature has not gone unnoticed: the exchange received the prestigious 2022 Best Crypto Trading Technology award by Entrepreneur.com.

BTSE is available as a web interface and also via mobile app for iOS and Android-based smartphone devices.

BTSE: Advanced futures trading for everyone

BTSE's feature-rich and high-performance futures trading platform is a core element in the BTSE ecosystem. Thanks to its cutting-edge tech and infrastructure, the platform supports up to one million trades per second. Because all of its systems are developed and hosted in house, BTSE boasts a solid track record of zero downtime since its founding. BTSE was the first mainstream trading platform to offer its customers an all-in-one multi-currency order book, meaning that liquidity for different trading pairs for a particular base currency is combined, i.e. orders for BTC/USD and BTC/JPY are combined into one book. As a result, BTSE offers far deeper liquidity when compared to exchanges which use order books based solely on one currency.

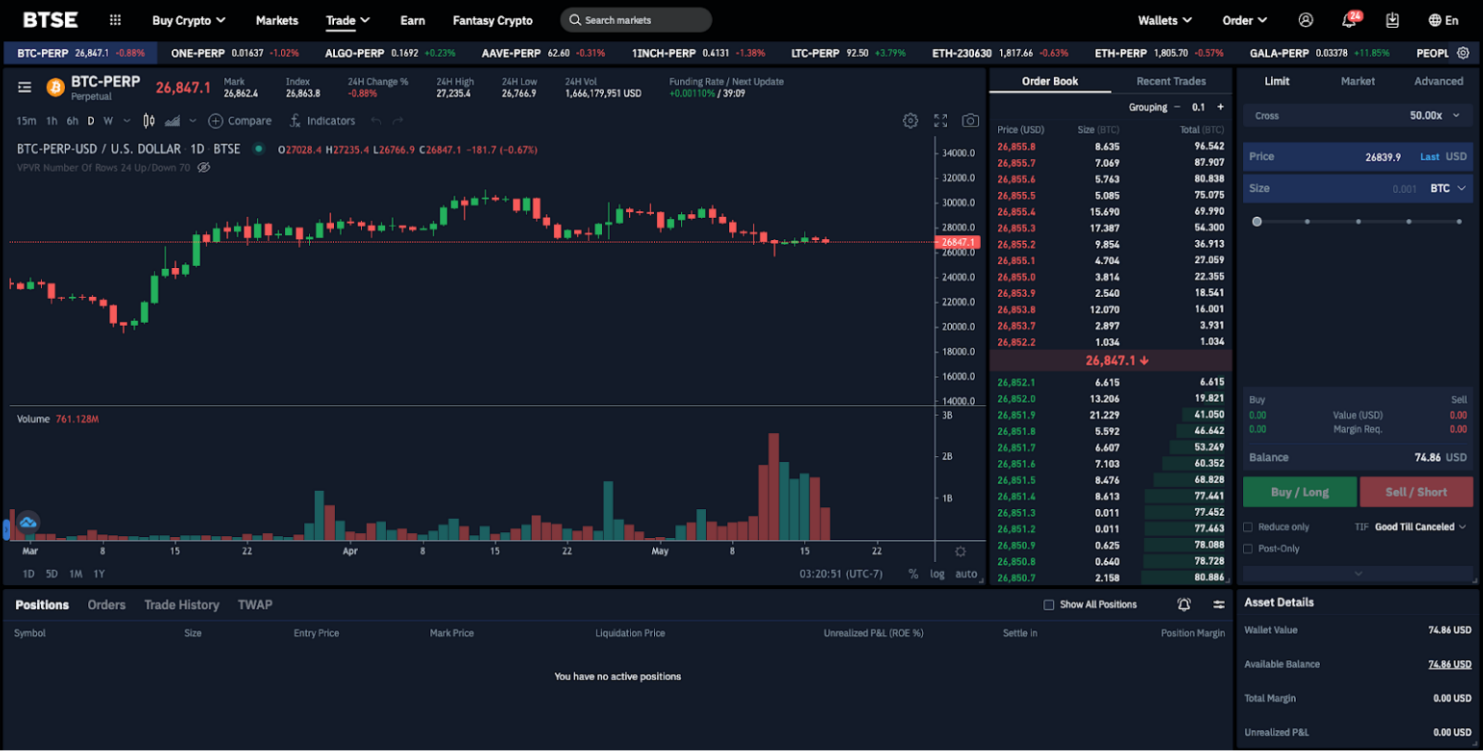

Image by BTSE

The platform offers advanced charting tools for seasoned traders and sophisticated order types: time-weighted average price (TWAP) orders, one-cancels-the-other (OCO) orders, algorithmic index orders, hidden orders etc. To make futures trading predictable and frictionless, BTSE implemented automated and customizable margin call notifications. Customizable alerts are designed to mitigate the liquidations for BTSE traders. Also, the exchange pioneered multi-asset collateral and settlement, making for a more fluid trading experience.

To enhance flexibility and risk control, BTSE offers a maximum 100x leverage for futures trades.

BTSE: Newbie-friendly staking solutions with up to 9% APY on stablecoins

Cryptocurrency staking has gained traction as one of the most reliable and newbie-friendly ways for earning passive income in crypto. With staking, the user just locks his or her tokens and obtains periodic rewards proportional to the amount of funds locked.

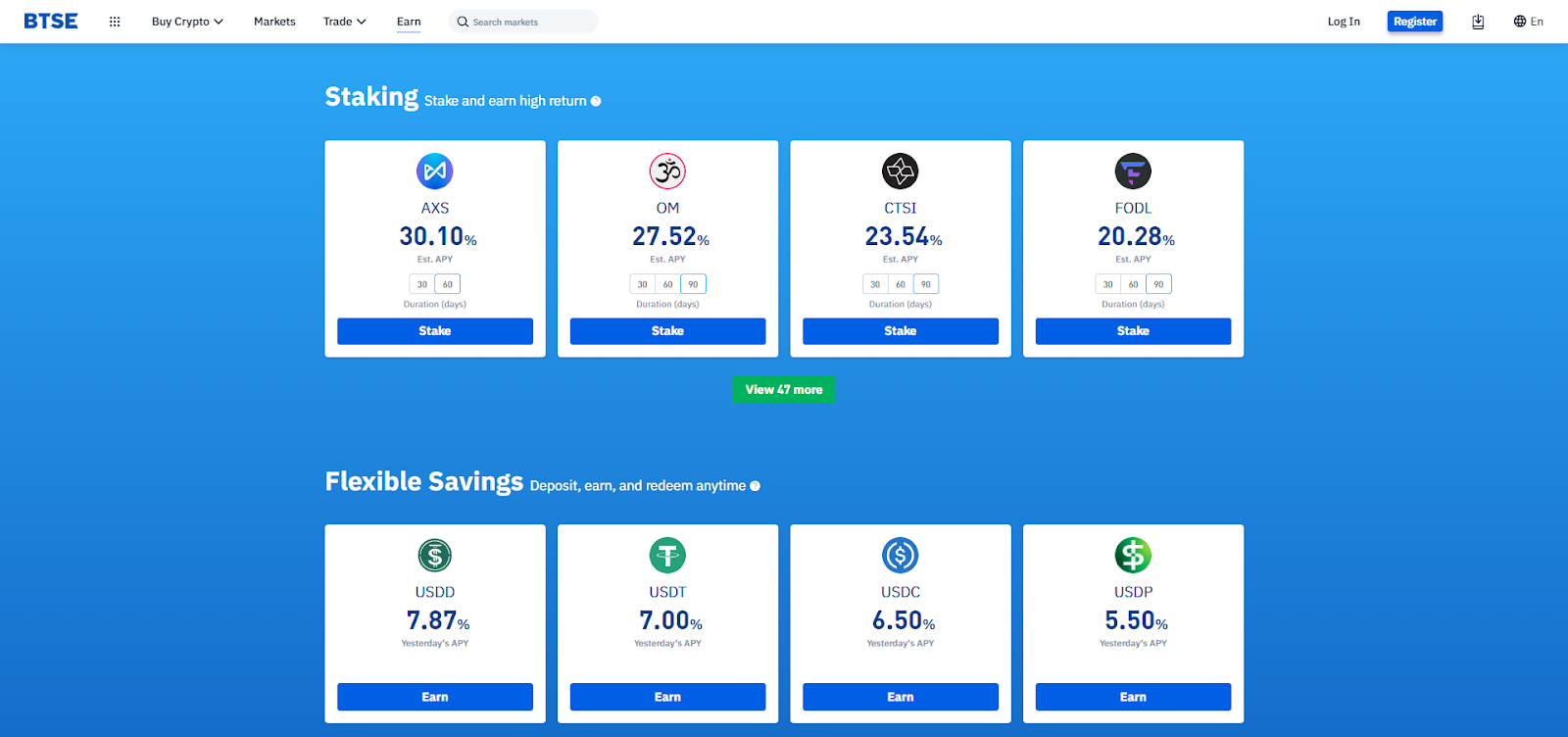

With BTSE Earn, an easy-to-use cryptocurrency staking dashboard, users can inject their liquidity into fixed and flexible staking programs. In the fixed savings module, users are invited to lock USDT with 9% APY, and Bitcoin (BTC) with 2.75% APY; staking altcoins on BTSE offers yields of up to 37%. Seven (7-), 14-, 30-, 60- and 90-day staking programs are available for BTSE users.

Image by BTSE

Also, in a flexible savings program, users can stake USDT at an APY of 7% with the opportunity to redeem their stakes at any moment without losing rewards, as interest is awarded and compounded daily. Last but not least, in BTSE’s Lending module, users can earn interest by lending fiat-pegged assets (wHKD, wUSD, wEUR and so on) to the BTSE capital pool.

BTSE: Compliance and fiat card plans

Since the early days of its operations, BTSE has been focused on regulatory compliance to protect user funds. As of Q2, 2023, the platform is licensed in Lithuania and Liechtenstein, both European countries that are among the key global fintech hubs. A number of license applications are pending for BTSE in Europe and Asia.

In the coming months, the exchange is set to release the BTSE Card. This will be a full-fledged debit card with support for deposits in Euro (EUR) With this strategic offering, BTSE will be able to offer its users a convenient and reliable channel for crypto-to-fiat conversion.

BTSE: Tech solution for white label services

Besides its impressive toolkit for end users (both corporate and retail traders), BTSE runs a B2B unit named BTSE Enterprise Solutions, which is focused on building white label solutions for crypto entrepreneurs.

With BTSE’s white label solutions, developers do not need to build their cryptocurrency exchanges from scratch. They can instead take BTSE’s battle-tested technology and customize it to the needs of their respective business strategies to launch their offerings more quickly.

With this offering, BTSE can streamline the development process for novel crypto services to optimize resource efficiency. BTSE Enterprise Solutions also supports its customers in areas where technical and marketing expertise are required.

Closing thoughts

Boutique cryptocurrency exchange BTSE guarantees low-fees, secure and fast futures trading for traders across various trading literacy levels. Its staking, lending and saving programs allow crypto users to benefit from their deposits, offering APYs of up to 9% on stablecoins, 2.85% on Bitcoin (BTC) and 37% on altcoins.

It will be interesting to see what else this tech-focused boutique crypto exchange rolls out in the near future. Crypto enthusiasts can check out BTSE website, follow the platform in Telegram and Twitter, join the discussions in Discord and track its content on YouTube.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov