Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Q4 of 2024 is shaping up to be a significant quarter for the crypto options market as crypto takes on a prominent position in political discourse, particularly in the U.S. As such, investors are turning to options to position around events and express views on volatility rather than just direction. However, the growing demand for crypto options requires a better derivatives trading experience for options and futures.

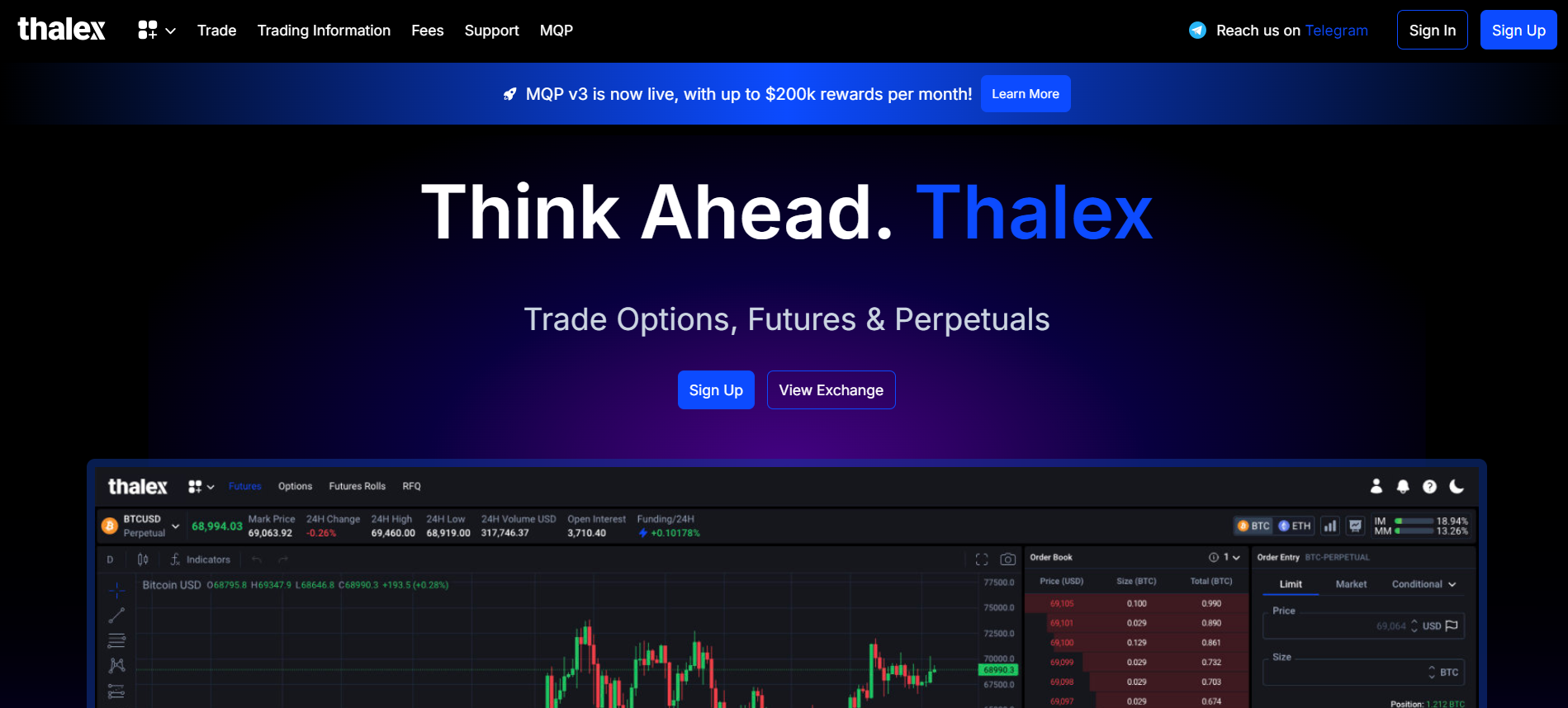

Thalex advances crypto derivatives segment in 2024

To meet this demand, Thalex, a crypto derivatives exchange offering stablecoin-settled options, is ramping up its go-to-market strategy to become a compelling alternative in derivatives trading. Following the announcement of the beta integration with Bitfinex, Thalex continues its scaling, answering the call for a low-friction yet powerful crypto derivatives trading experience.

Hendrik Ghys, co-founder and CEO of Thalex, stresses the importance of such a vision for the next development steps of his protocol:

We built Thalex because we believe that options, futures, and perpetuals are symbiotic and we expect to see significant volume growth across all of these contracts We are close to delivering the customer experience we aimed to realize when we started building Thalex and hope to realize our objective of delivering a frictionless trading experience.

Advertisement

Founded in 2020, the company’s platform enables trading linear, USDT-settled options, futures and perpetuals.

New milestones, new accomplishments: Ecosystem, funding, trading volumes

Since going live in 2023, Thalex’s platform has processed roughly $1.5 billion in trading volume primarily from institutional customers.

Thalex has raised $13 million in funding to date, with investors that include Bitfinex, Bitstamp, Flow Traders, IMC and Wintermute.

Its platform is designed to remove friction in derivatives trading by offering simple specs, fast and reliable tech, and low fees. Its platform lets traders unlock the power of combining futures and options through native multi-leg order support, universal margin accounts and portfolio-based margin requirements.

Thalex utilizes linear, stablecoin-settled contracts and combines unrivaled platform stability with a collaborative and innovative approach to enable traders to capitalize on the enormous opportunities presented by digital assets.

Following a hybrid distribution strategy, Thalex leverages direct onboarding and integrations with exchanges such as Bitfinex to maximize its reach and simplify onboarding for users to trade on Thalex.

Ahead of this, Thalex is bootstrapping liquidity through its Market Quality Program (MQP), designed to directly reward limit orders, regardless of volume, with a $200,000 monthly pool. The program targets both institutional market makers and retail quants. Anyone who posts limit orders automatically participates and competes on a level playing field.

This strategy embodies Thalex’s value of leveling the derivatives trading playing field. The platform subjects all customers to the same standards and provides equal access to incentives, connectivity and risk management tools.

Arman Shirinyan

Arman Shirinyan Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk