Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

As the cryptocurrency landscape transitions into a new month, insights into Cardano's (ADA) historical performance offer valuable perspectives for investors. Despite modest 0.3% growth in March, attention now turns to the upcoming month of April, where ADA has displayed a notable pattern over the years.

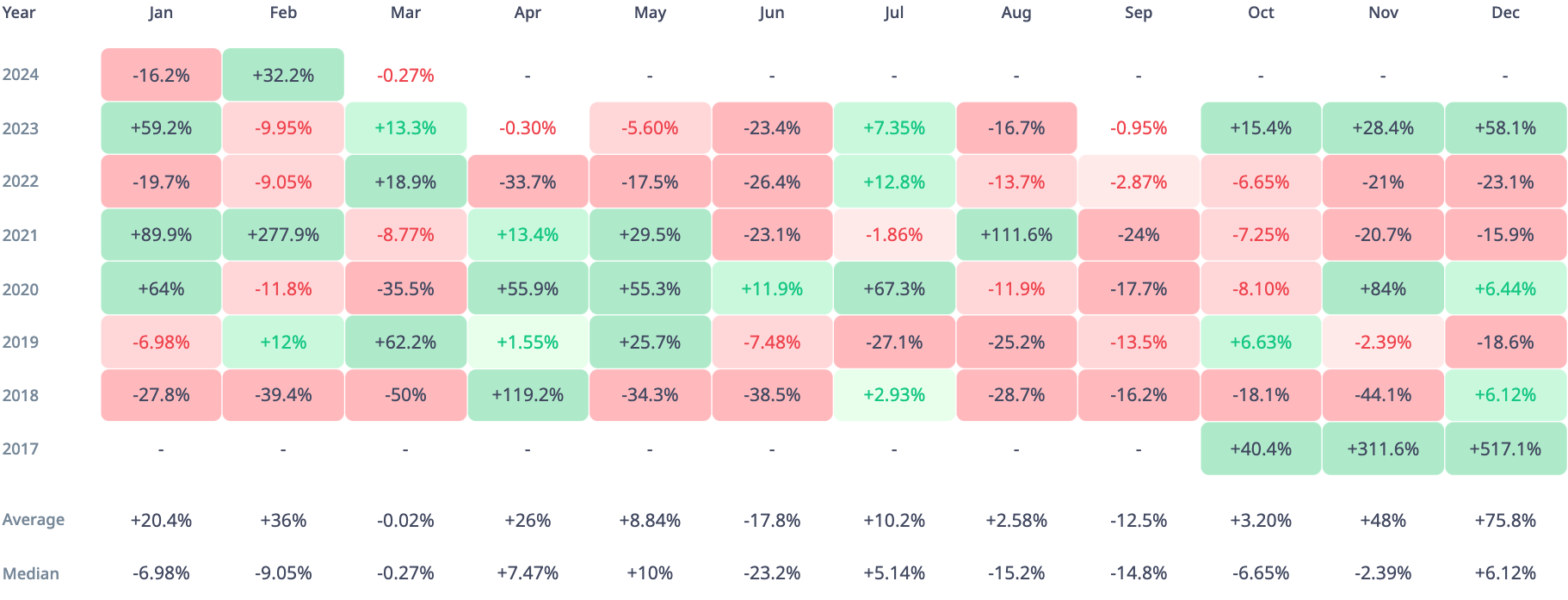

Data analysis from CryptoRank reveals a consistent trend of positive performance for Cardano during April. With an average profitability of 26% and a median value of 7.47%, April has historically been a favorable period for ADA holders. Although past performance does not guarantee future results, Cardano's track record in April provides a positive reference point for investors navigating the crypto market.

Examining the historical data, it is evident that Cardano has predominantly experienced growth during April. While isolated declines occurred in 2022 with -0.3%, and in 2023 with -33.7%, these instances are outweighed by the token's overall positive trajectory during this period. Double-digit percentage gains have been a common occurrence in previous Aprils, underscoring ADA's bullish stance in this particular month.

Despite the inherent unpredictability of the crypto market, the growing dataset surrounding Cardano's price history may be a helpful benchmark for investors. As market dynamics evolve, the historical consistency of ADA's April trend provides a degree of confidence for Cardano enthusiasts seeking to capitalize on potential opportunities in the coming weeks.

Whether this April will uphold the trend remains uncertain, but for now, ADA enthusiasts may remain cautiously optimistic about the potential performance of their favorite asset in the month ahead.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov