Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

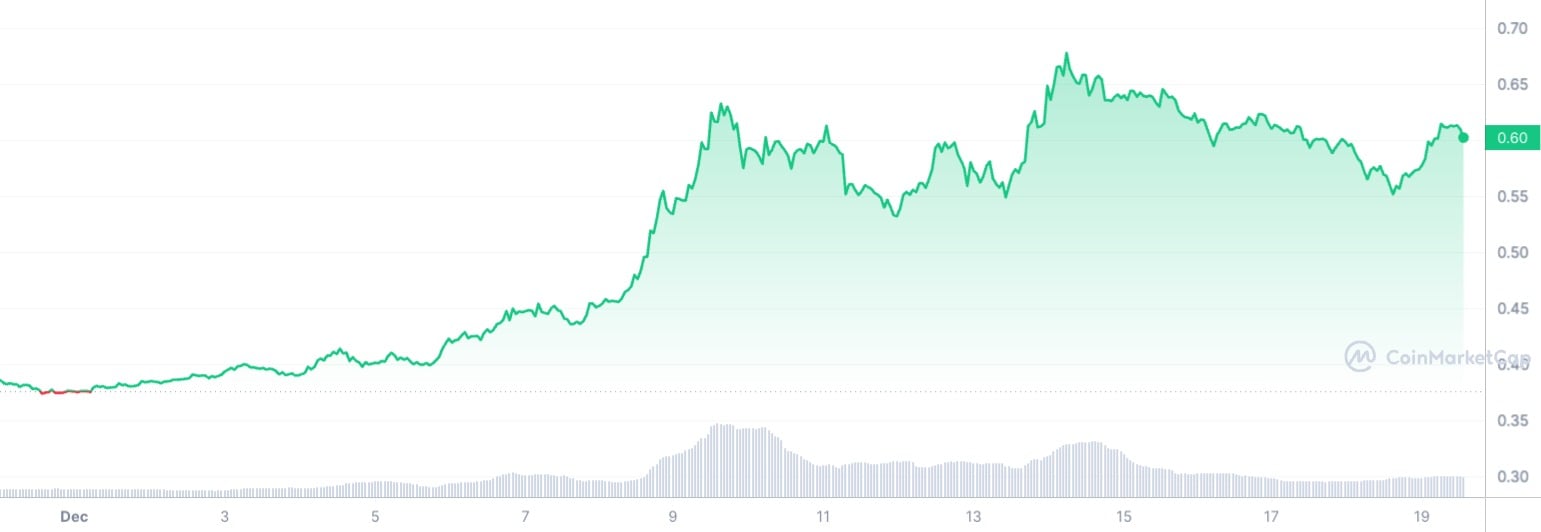

In a promising turn of events, Cardano's ADA has ignited a bullish trend at the onset of the new week, shaking off last week's brief respite after a formidable 50.62% surge. ADA enthusiasts have reason to celebrate once more as the token flaunts a 3.8% gain, currently valued at $0.6.

Despite the recent bullish momentum, skeptics who have criticized Cardano over the past two years are left questioning the sustainability of this resurgence. However, diving into on-chain data reveals a compelling narrative that could propel ADA to new heights.

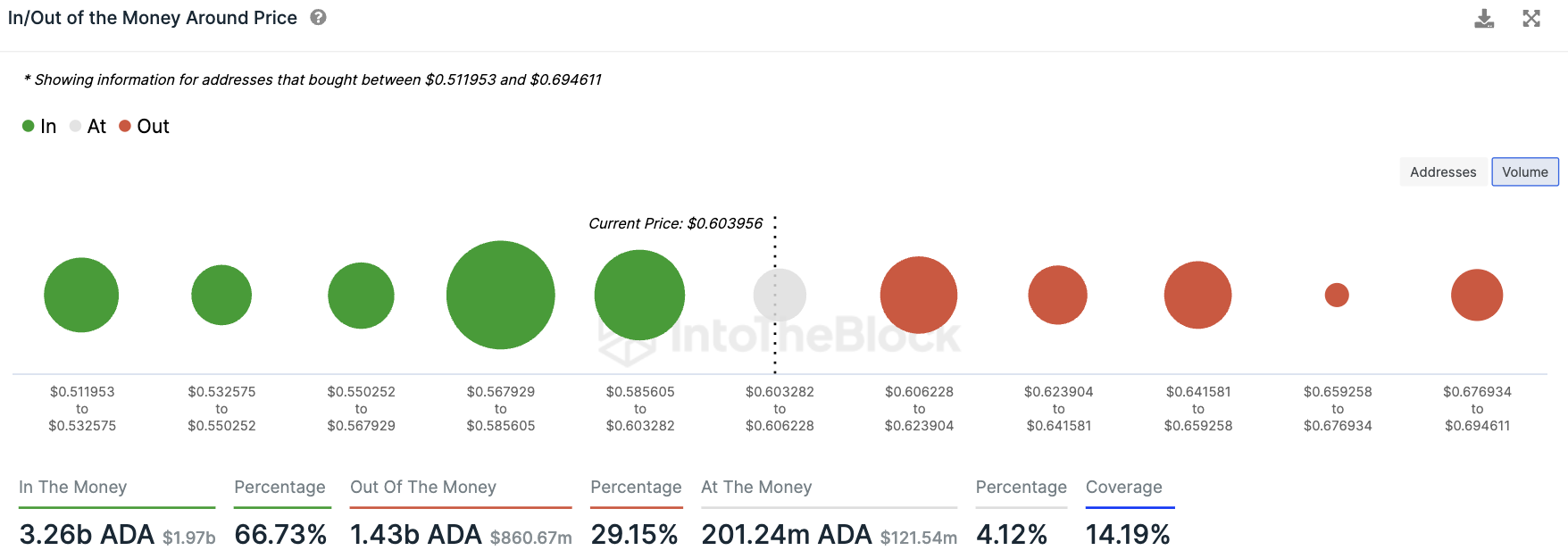

Analyzing liquidity accumulations, a crucial factor in determining price movements, data from IntoTheBlock underscores that major liquidity accumulations for ADA remain positioned below the current market levels.

Should Cardano aspire to breach its near-term target of $0.7 per ADA, it would only need to absorb 1.42 billion ADA—tokens purchased between $0.6 and $0.7, currently causing losses to holders.

The key lies in understanding the dynamics of token growth and the potential impact of loss-making tokens at specific price levels. Cardano faces a critical juncture, with $855 million worth of ADA on the path to $0.7, constituting a formidable 4% of the token's market capitalization.

On the other hand, this volume is dispersed between $0.6 and $0.7, mitigating the risk of concentration at a single critical point.

If Cardano successfully absorbs this volume amid favorable market conditions supporting growth, a tantalizing 15% increase above current values becomes a plausible scenario. However, a cautionary note emerges on the downside, as profit-seeking investors may decide to capitalize on gains, exerting downward pressure on the ADA price.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov