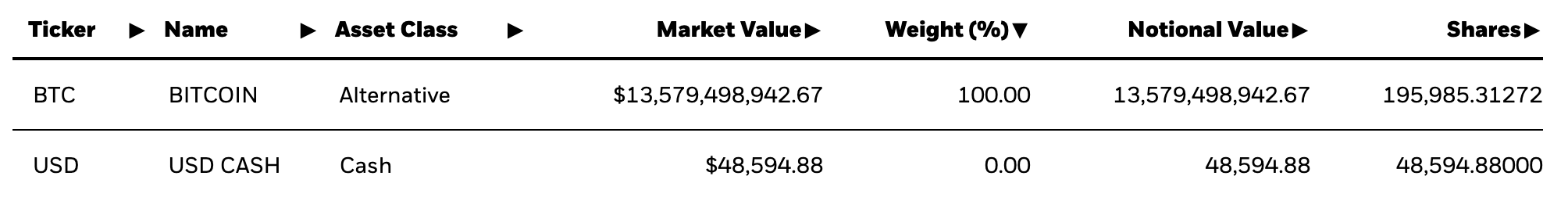

In a significant development within the cryptocurrency space, BlackRock, the world's largest fund manager with assets exceeding $10 trillion, has overtaken MicroStrategy in Bitcoin accumulations. Latest data reveals that BlackRock's iShares Bitcoin Trust (IBIT) now boasts an impressive 195,985.3 BTC, valued at approximately $13.58 billion. This surpasses MicroStrategy's cryptocurrency holdings, which stood at around 193,000 BTC, equivalent to $13.394 billion, as of February 2024.

What makes this achievement particularly noteworthy is the divergent paths taken by the two entities to amass their Bitcoin reserves. While MicroStrategy diligently accumulated BTC since mid-2020, BlackRock entered the cryptocurrency arena only recently, leveraging the approval of spot Bitcoin ETFs to swiftly amass a substantial BTC position.

MicroStrategy, led by CEO Michael Saylor, acquired its BTC at an average price of $31,554, amounting to a $6.1 billion investment, which has now more than doubled in value as Bitcoin continues to reach new all-time highs.

Win-win for Bitcoin

Meanwhile, BlackRock has been making waves with its significant daily Bitcoin purchases, totaling hundreds of millions of dollars. Amid outflows from Grayscale and its GBTC, BlackRock's IBIT has emerged as a formidable player in the Bitcoin ETF market, swiftly reaching $10 billion under management and capturing half of the market share within just two months since its launch.

The race for supremacy in Bitcoin holdings among enterprises raises intriguing questions about the future trajectory of both BlackRock and MicroStrategy. Will Michael Saylor be able to reclaim its title as the largest Bitcoin holder, or will BlackRock continue to dominate the market? Regardless of the outcome, this competition signals a positive trajectory for the broader cryptocurrency ecosystem.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov