Prominent real instate investor, author of ‘Rich Dad, Poor Dad’ and financial educator Robert Kiyosaki is again talking Bitcoin to his army of followers.

Today he explained how Bitcoin, gold and silver are ‘real money’ that can prevent the US Fed Reserve from ‘screwing everyone’.

‘When Fed prints trillions, it screws everyone’

Robert Kiyosaki is a known opponent of the Fed’s QE program that has been running since March, adding trillions of USD to the Fed’s balance sheet, including corporate bailouts and a survival check for average US citizens.

Mr. Kiyosaki has also tweeted many times to share his disapproval of the lockdown caused by the pandemic, which started in China and spread around the world but now seems to be showing signs of slowing down.

Calling the newly printed dollars by the Fed fake USD, Mr. Kiyosaki has been encouraging his followers on social media and on his YouTube channels to protect themselves by buying gold, silver and Bitcoin.

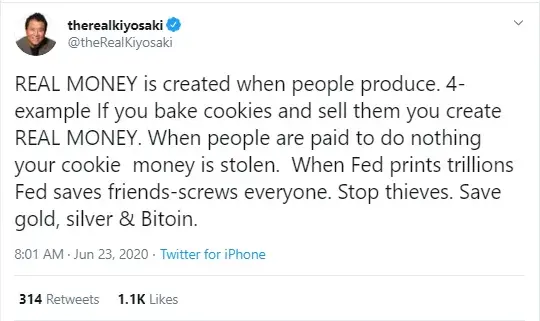

Slightly more than an hour ago, the investment guru took to Twitter again to remind the community that by printing more fiat USD, the Fed saves ‘friends’ and ‘screws everyone’ else.

Mr. Kiyosaki is calling on people to ‘stop thieves’ by saving gold, silver and Bitcoin.

‘Gold is on the verge of a 2009 style break out’: Peter Schiff

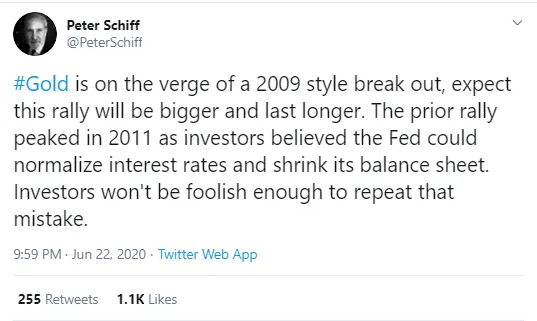

Another gold proponent (but also a well-known Bitcoin critic), Peter Schiff, is pitching gold to his followers again, tweeting that the XAU price is about to break out, similar to 2009.

Back then, after the global mortgage crisis, XAU was trading at $1,087.50 but then surged to $1,420.25 in 2010 and increased to the $1,531.00 level in 2011.

Peter Schiff seems to expect this new gold rally to be of a larger scale and thinks it will last longer than it did in 2009-2012.

The reason for this, as per Mr. Schiff, is that back in 2011 investors trusted that the Fed would be able to shrink its balance sheet and bring interest rates back to normal after the 2009 crisis.

However, it will happen the other way around this time, he tweeted, and gold will keep rising.

Some commenters, however, disagree and say that Bitcoin is much better than gold because the latter is priced in.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov