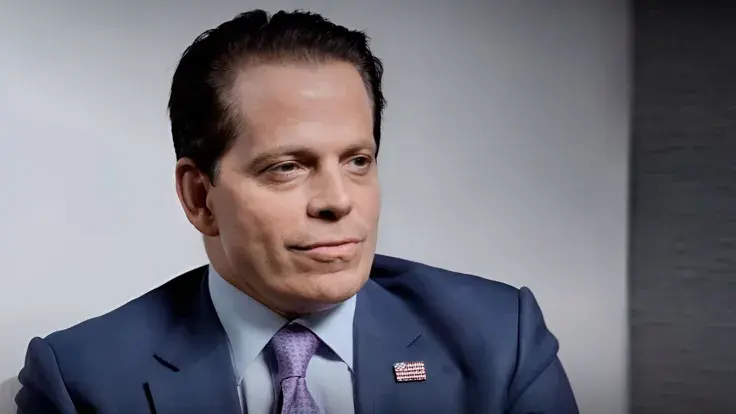

Skybridge Capital, a cryptocurrency-focused hedge fund operated by American financier Anothony Scaramucci, has blocked clients from leaving, according to a Thursday report by Bloomberg.

Investors who control a total of 70% of the fund’s shares have requested redemptions after big gains, but Scaramucci is only willing to return 7% of the shares. However, Scaramucci claims that his actions are in line with the prospectus.

This is not the first time that the American financier has attracted criticism for failing to redeem shares.

In March 2022, SkyBridge has refused to satisfy all the redemption requests of its clients for the first time.

In 2023, a lot of his clients were trying to exit the fund after Scaramucci took a significant reporaional hit following his partnership with FTX CEO Sam Bankman-Fried.

The company’s initial cryptocurrency bets in 2021 were considered to be successful. However, the company got hit by its bet against the failed FTX exchange. In September, Scaramucci even announced a deal to sell 30% of the fund to FTX.

In March 2023, it would only let clients withdraw 7.5% of the shares.

Optimistic Bitcoin predictions

As reported by U.Today, Scaramucci predicted that Bitcoin would be able to hit $750,000 by the end of the decade back in 2023.

However, some of his previous predictions ended up being terribly wrong. For instance, he forecasted that the Bitcoin price would be able to reach $100,000 by the end of 2021.

Back in 2018, the Wall Street financier predicted that SkyBridge would have $20 billion under management after five years. At the end of 2023, it had only $2 billion in assets under management.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov