Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Even though bulls are still controlling the situation on the market, some coins have already entered a correction phase.

BTC/USD

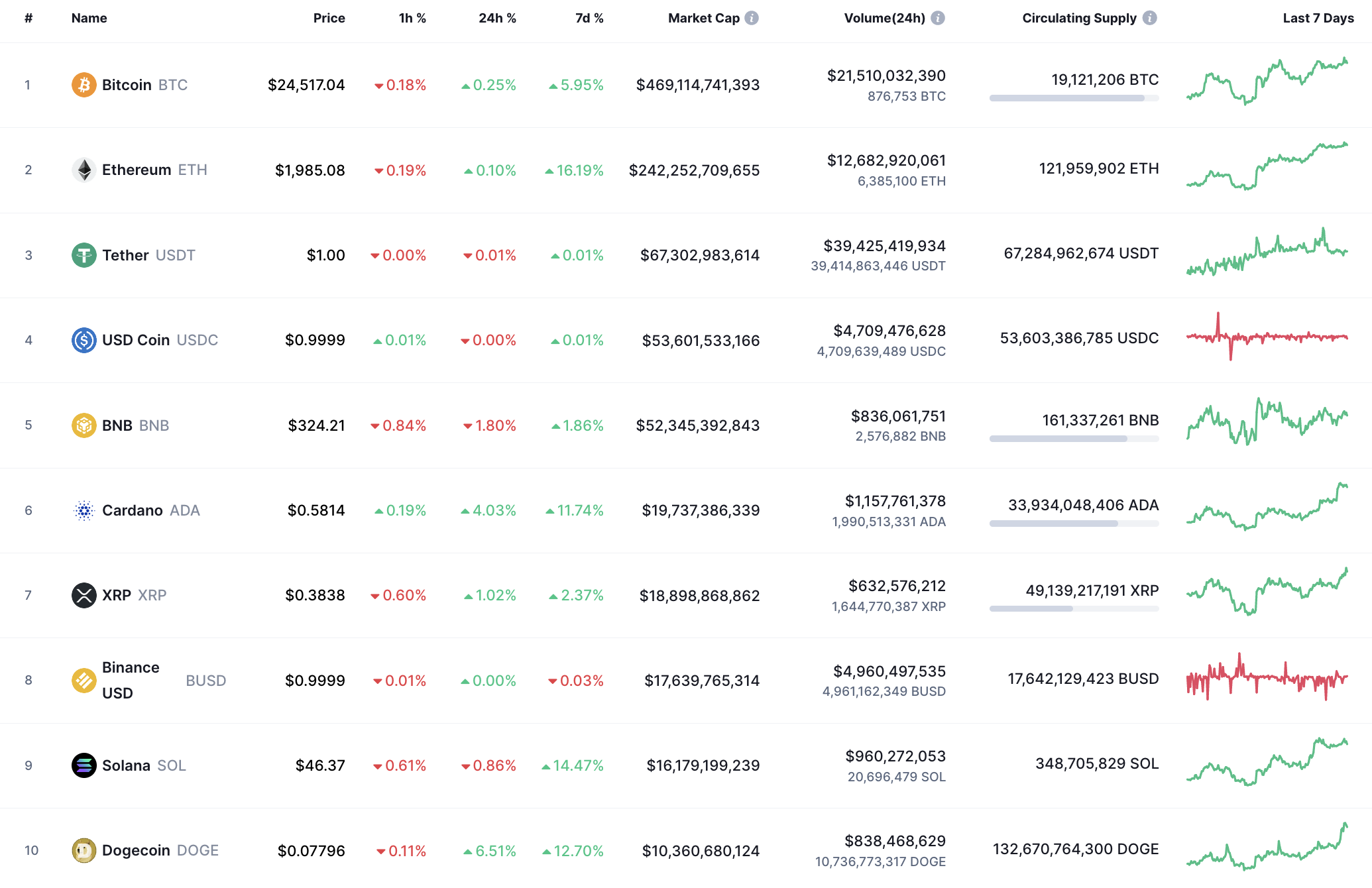

The rate of Bitcoin has seen almost no change since yesterday, while the price has risen by 5.85% over the last week.

On the hourly chart, Bitcoin (BTC) has broken the local support level at $24,516. If buyers cannot restore the initiative, one can expect a sharp fall to $24,200-$24,400 by the end of the day.

On the larger time frame, Bitcoin (BTC) has made a false breakout of the nearly formed resistance level at $24,921, meaning that bulls are not yet ready to conquer the crucial $25,000 zone.

However, if the rate remains above the support at $24,190, growth may possibly occur soon.

From the midterm point of view, the main cryptocurrency is about to close the weekly candle bullish, confirming buyers' presence. In this case, the more likely scenario is a test of the mirror level at $25,400 by the end of the current month.

Bitcoin is trading at $24,448 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov