Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bitcoin (BTC), the leading cryptocurrency, which hit its latest all-time high of $108,824 just last month in January, might be gearing up to smash that record sooner than anyone expected. And no, this isn’t just another wild guess or hype-driven prediction. It’s rooted in Bitcoin’s own price history, which has a funny way of repeating itself when you least expect it.

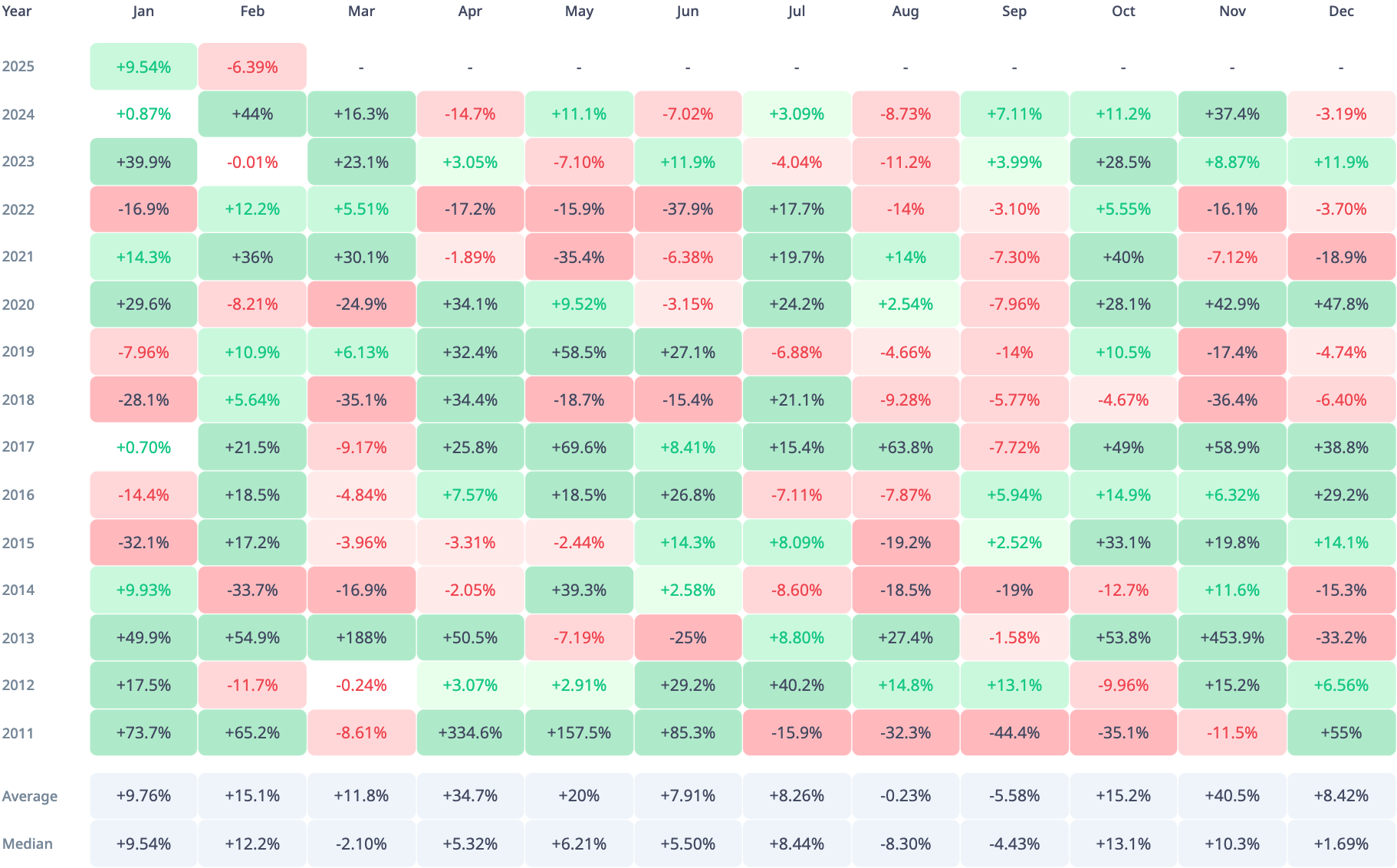

Here’s the thing: If you look at the numbers, Bitcoin has a habit of going on a tear during the spring and early summer months. Data from CryptoRank shows that, on average, BTC has delivered returns of +11.8% in March, +34.7% in April and +20% in May.

Even June and July, often seen as slower months, have historically added +7.91% and +8.26%, respectively. Sure, median returns are a bit more modest, averaging around 4.674% over the next five months, but even that implements ball on the bull side of the court.

Right now, Bitcoin is trading at around $96,000, which means it’s got some ground to cover before it can set a new all-time high. But if history is any guide — and let’s be honest, in crypto, it’s one of the few guides we have — there’s a real chance it could happen.

Think back to March 2024, April 2020, or May 2019. Those were months when Bitcoin didn’t just inch forward, it leaped. And if the stars align again, we could be looking at a similar scenario playing out in the coming months.

Of course, predicting anything in crypto is like trying to catch lightning in a bottle. The market is too wild, too unpredictable. But with 14 years of price history, Bitcoin has given us enough data to at least make educated guesses.

It’s not a crystal ball, but it’s something.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov