Massive liquidations of Bitcoin (BTC) futures positions cause dramatic price moves. Analysts claim that we should keep an eye out for the prices of short-term derivatives contracts as they may indicate future ups and downs.

Mind the gap

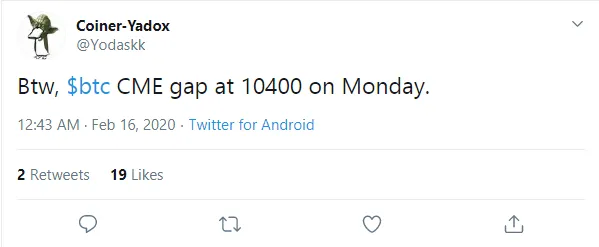

Today, blockchain analyst and trader Coiner Yadox shared his opinion on the situation in the Bitcoin (BTC) futures market. He supposes that a 'CME gap' will be created near the price level of $10,400. According to his estimations, this bubble may be liquidated on Monday, Feb 17.

With that said, there is an opportunity that BTC's spot market prices may also touch this level. If it occurs, the flagship cryptocurrency may return the splendid positions of previous week highs. By the way, shortly after the 'liquidation' of the bubble, the market may see a bloody price drop.

One month ago, a 'CME gap' was disclosed by Dutch trader and analyst Michael van de Poppe only two hours before Bitcoin (BTC) price lost 5,6% in three minutes and dipped below $8,650 level. It occurred when someone shorted an enormous sum of $101 mln in BTC perpetual contracts (BTCUSD) between 11:00 and 11:10.

Within a week

When asked about the potential accuracy of this prediction, the trader responded that it's really high. He revealed that he was analyzing such situations since the launch of first CME contracts in late 2017. Based on his calculations, he figured out that about 75- 80% of gaps got filled within a week.

At press time, Bitcoin (BTC) price is striving to recover from yesterday's drop, fluctuating at the $9,940 level.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov