Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

It is not every day that you hear someone call Bitcoin (BTC) not just a bad investment but outright harmful to the economy. But then again, Peter Schiff is not just anyone.

The economist, known as the biggest skeptic of cryptocurrencies and an equally popular gold proponent, has once again taken aim at Bitcoin, this time framing it as a destructive force for the United States of America.

While his views might not sit well with crypto enthusiasts, Schiff’s arguments are hard to ignore, especially when you look at what is happening on the markets.

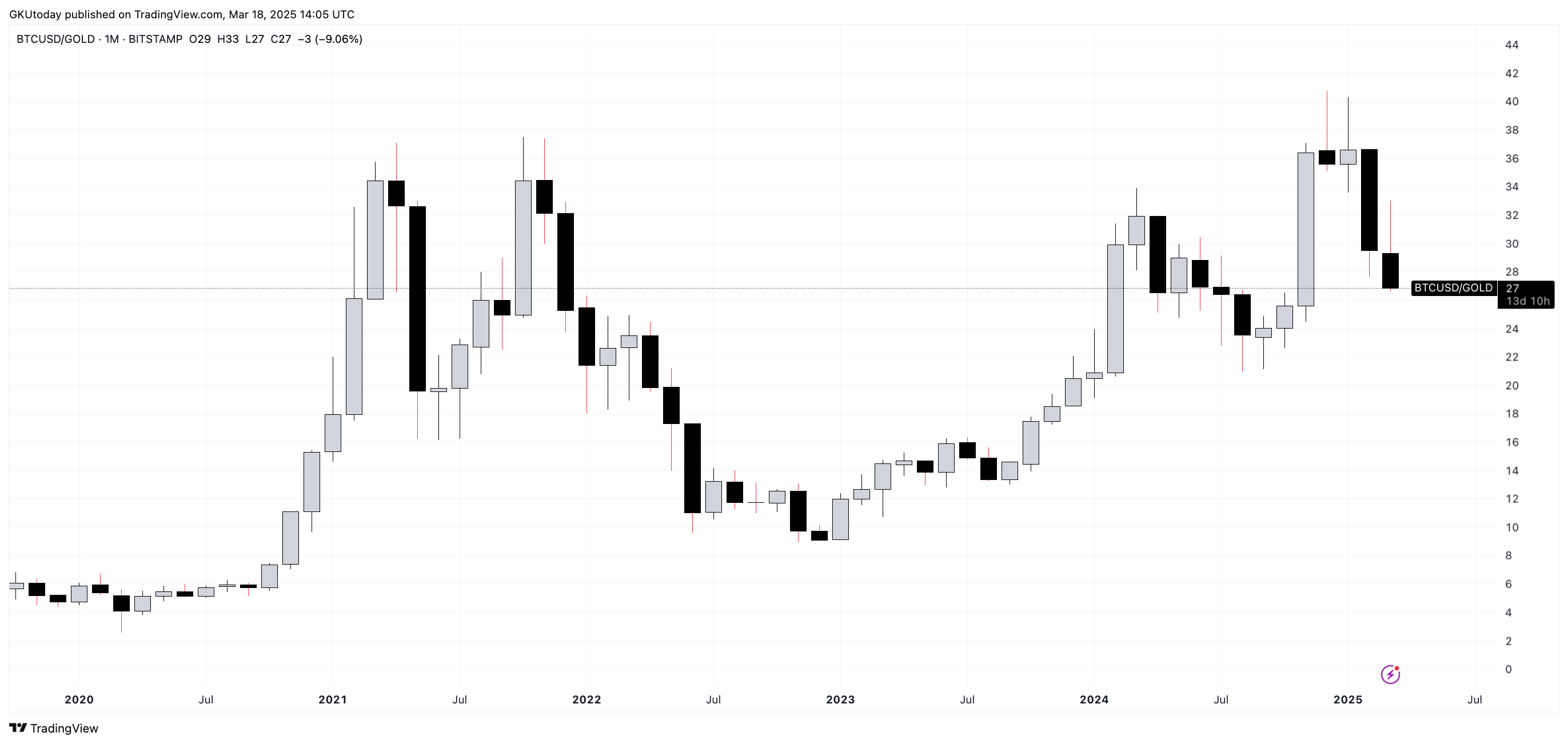

Bitcoin vs. gold

The precious metal has been on a tear recently, closing above $3,000 for the first time ever, a milestone that Schiff believes is just the beginning. Silver, too, is flexing its muscles, trading at $34.10, while U.S. stocks are lagging behind their foreign counterparts.

The expert points out the irony in the new U.S. administration’s reported moves: selling domestic stocks to buy foreign ones and, as he alleges, dumping Bitcoin to invest into gold. It is an occurrence that, in his view, shows where smart money is at.

But let’s talk about Bitcoin for a moment. Schiff is not buying the hype, and he is not alone. Since its peak in November 2021, the cryptocurrency has lost 26% of its value against gold, a trend that Schiff says underscores the growing outflow of investors from crypto to the precious metal.

“What do you think they’re buying with the money?” he asks, pointing to the downtrend in Bitcoin’s price as evidence that gold is leaving "crypto in the dust."

Then there's inflation

He argues that while the "tariff war" is often blamed for rising prices, the real issue is inflation - something the Federal Reserve has failed to take under control.

As the cost of goods climbs higher, Schiff believes gold will continue to shine, while Bitcoin’s so-called resilience will be put to the test as ETF investors start cashing out.

For now, Bitcoin is indeed struggling, losing the $82,000 price point today. But whether Schiff’s predictions come true remains to be seen.

One thing is for sure, though: his warnings about Bitcoin’s impact on the economy are as bold as ever.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov