Bank of America, one of the largest banking institutions in the U.S., has demonstrated that Bitcoin cannot serve as an inflation hedge in its most recent research paper.

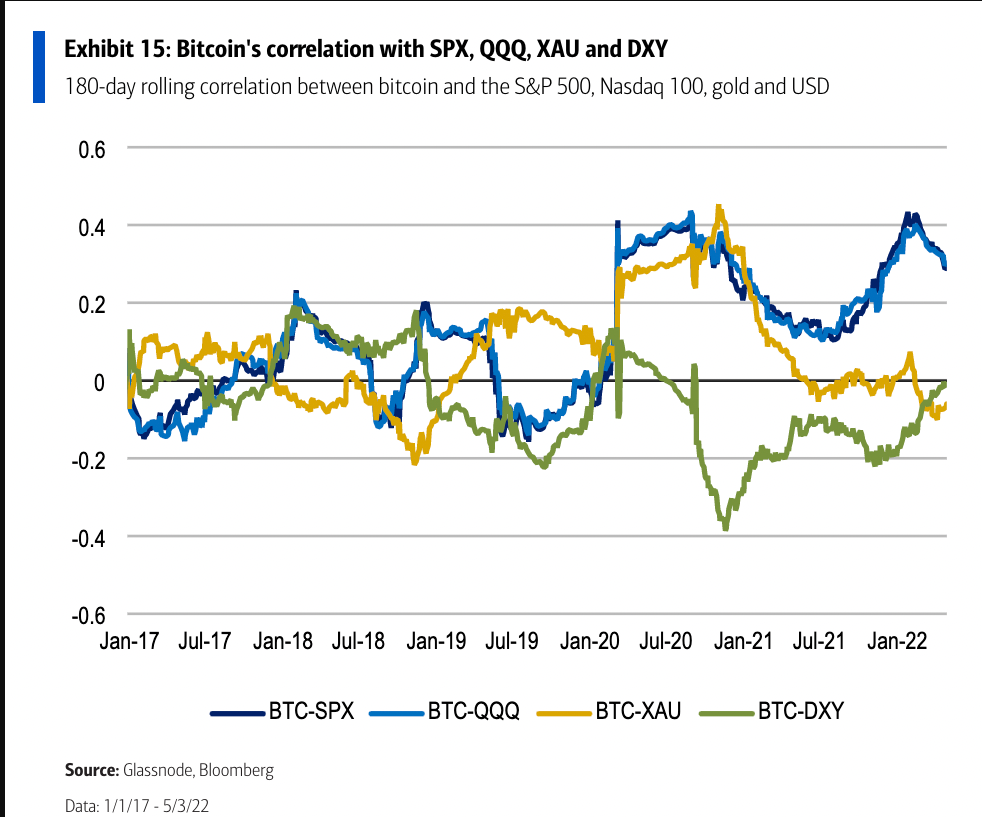

The cryptocurrency keeps trading in tandem with the U.S. stocks despite being promoted as a safe haven asset by its ardent supporters. In fact, the correlation between Bitcoin and the tech-focused Nasdaq 100 stock market index recently reached yet another all-time high.

Bitcoin’s recent price action has been primarily driven by macroeconomic conditions. As reported by U.Today, the U.S. Federal Reserve decided to hike the benchmark interest rate by 50 basis points for the first time in 22 years on Wednesday, reaffirming its bullish stance.

Earlier today, the world’s largest cryptocurrency dipped to $35,268, the lowest level since Feb. 24.

Bitcoin is down almost 48% from its all-time high of $69,044, severely underperforming in 2022 after recording substantial returns last year.

The top cryptocurrency is down 21.4% since the start of this year. For comparison, gold, which remains the top safe-haven asset for investors, is actually up 2.88% year-to-date.

The U.S. dollar has so far been the biggest winner in 2022. The DXY index, which measures the strength of the greenback against other top fiat currencies, soared to yet another multi-decade high earlier today.

Earlier today, Galaxy Digital CEO Mike Novogratz opined that tech stocks were yet to bottom out, meaning that there’s likely more pain in store for crypto as well.

While those who joined the Bitcoin party in 2021 might be underwater, the majority of wallets remain in profit, Glassnode data shows. In 2019, Bank of America named Bitcoin the best-performing asset of the decade.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov