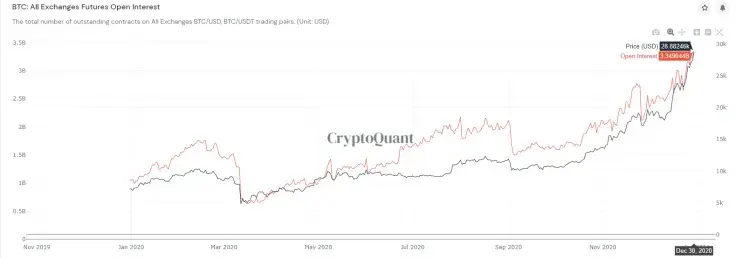

Open interest for Bitcoin futures across major exchanges has hit a new all-time high of $3.34 billion, according to data provided by CryptoQuant.

This might signal that the derivatives market is getting a bit too overheated.

Many previous open interest peaks were preceded by a market correction; this was the case in early September and late November.

Funding rates remain in negative territory

Bitcoin has been slaying shorters all the way up to its new all-time high of $29,300.

As of now, funding rates across all major exchanges are still in the red, meaning that market sentiment is leaning bearish. On the bright side, the chances of a long squeeze are far smaller.

As reported by U.Today, the cryptocurrency is under some pressure on New Year's Eve, dipping below $28,000 earlier today.

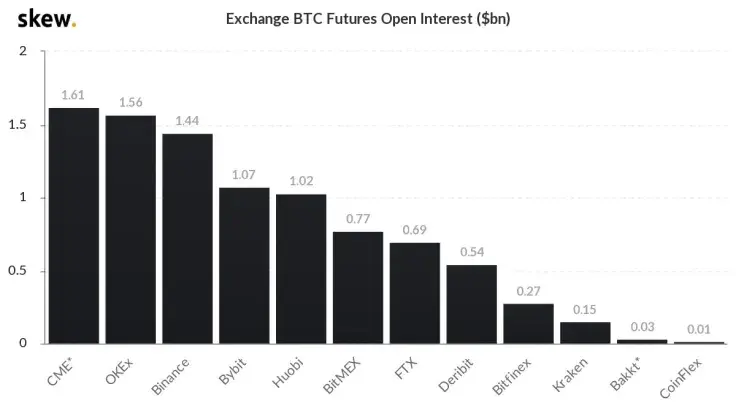

CME surpasses OKEx

It is worth noting that CryptoQuant's data does not include the Chicago Mercantile Exchange (CME).

This week, it became the largest exchange for trading Bitcoin futures by OI, surpassing both OKEx and Binance.

The uptick in activity is mainly attributed to a growing number of institutions entering the industry.

CME also thrived off BitMEX's collapse since more market participants now prefer to trade on a regulated platform.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin