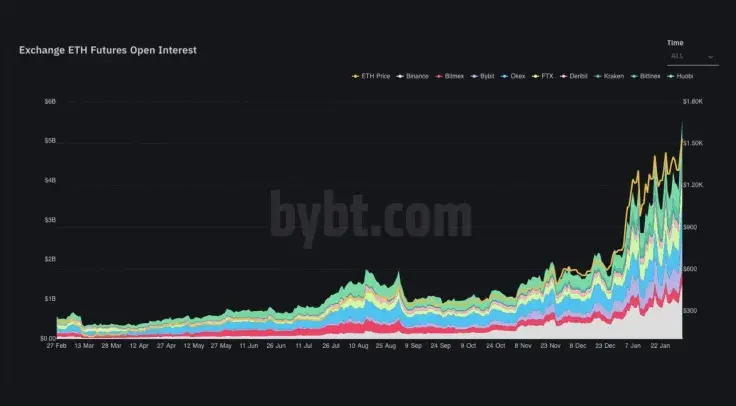

Open interest on Ethereum futures has hit a new all-time high, soaring above $5.6 billion, according to data provided by Bybt.

This came after the cryptocurrency surpassed the $1,600 level for the first time in its history amid a double-digit rally earlier today.

Binance is the number one destination for trading Ether futures with nearly $1.5 billion worth of open interest (OI).

Bybit and Huobi come in second and third places, respectively. They are followed by OKEx and FTX.

Notably, the BitMEX exchange, whose launch of the ETHUSD perpetual swap in August 2018 marked the start of a brutal bear market for the second-largest cryptocurrency, didn’t make it to the top 5.

Brace for CME’s foray

While Ethereum is red-hot right now, things could get shaky with the nearing launch of CME Group’s Ether futures.

JPMorgan’s Nikolaos Panigirtzoglou recently mentioned that the launch of the new product on Feb. 8 could lead to “negative price dynamics.”

The launch of CME’s Bitcoin futures coincided with the top of the previous market that was followed by long-lasting crypto winter.

Caroline Amosun

Caroline Amosun Tomiwabold Olajide

Tomiwabold Olajide Dan Burgin

Dan Burgin