Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Toncoin (TON) has rebounded by over 3.5% on the cryptocurrency market in the last 24 hours. Despite this recovery, about 96% of TON addresses are running at a loss, a shocking shift from earlier this year, when it had more addresses in profits. IntoTheBlock data shows that 96% of holders are "out of money."

TON’s price action and investor sentiment

The figures reveal that TON holders recorded $36.77 million in losses from net outflows within the last seven days. Most of the losses came from large holders, who represent 96% of the total addresses.

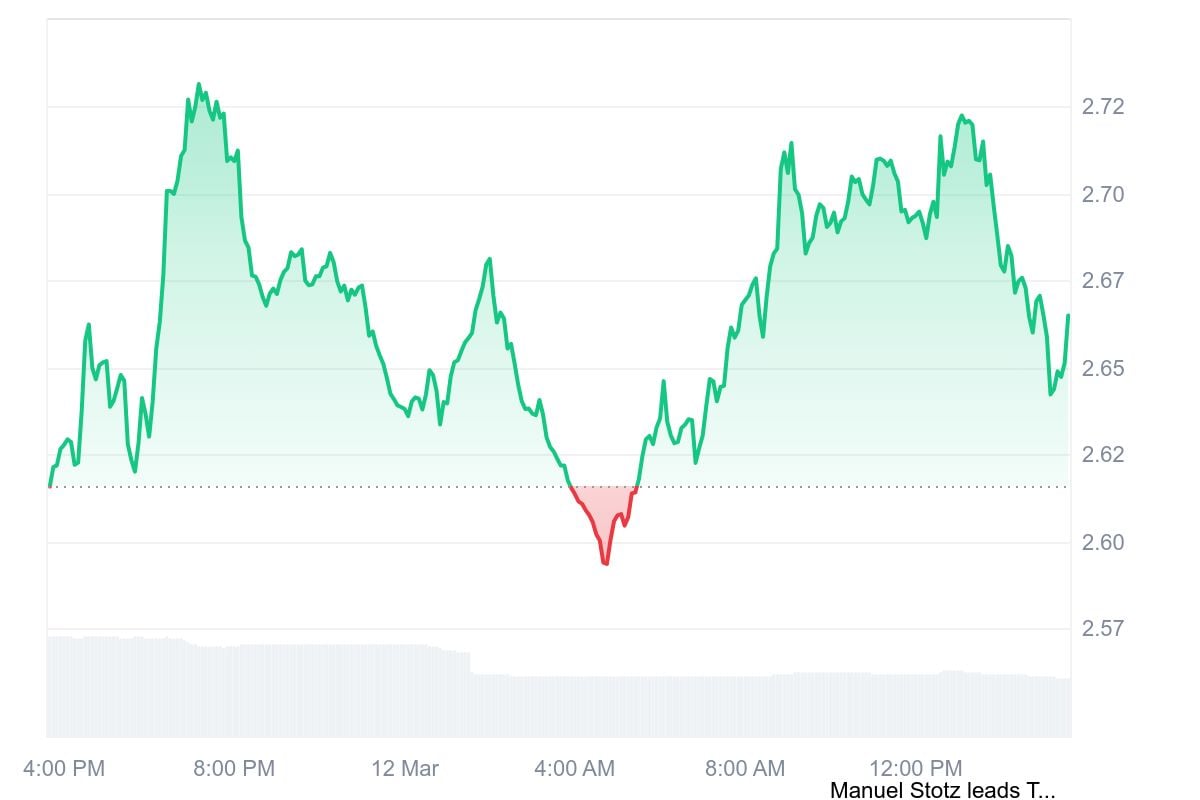

TON has been on a nosedive over the last seven days and briefly breached the $2.40 support level to trade at $2.39.

However, it soon rebounded to its current level some 48 hours ago. Despite experiencing fluctuations, TON has maintained steady upward movement.

As of this writing, TON price was changing hands at $2.66, which represents a 4.77% increase in the last 24 hours, according to CoinMarketCap data. Investors are yet to fully jump on board to purchase the coin as trading volume is down by 36.78% at $187.17 million.

This development raises concerns among community members. Notably, TON has been talked about much in the industry due to its astronomical growth in the past.

What’s next for Toncoin?

Interestingly, TON achieved a significant milestone in May 2024 when it climbed into the world's top 10 digital assets list by market capitalization. It hit a market cap of over $20 billion to occupy ninth place, flipping Cardano (ADA).

Analysts attributed its rapid growth to the mass adoption it experienced in the crypto space. Primarily, Toncoin leveraged Telegram’s massive user base, which has close to a billion active users monthly.

Many had anticipated a comeback in mid-January as the asset entered a low-risk phase with bullish technical indicators. However, TON could not maintain its $5.67 price action nor seek higher levels.

Now, TON is occupying 21st place in the rankings as the hype appears to have faded among users. Toncoin’s volatility since the beginning of 2025 has not helped to rekindle investors’ interest in the asset.

Market watchers are keen to see if the Toncoin ecosystem can halt the losses and initiate a price rediscovery.

Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk Caroline Amosun

Caroline Amosun