Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

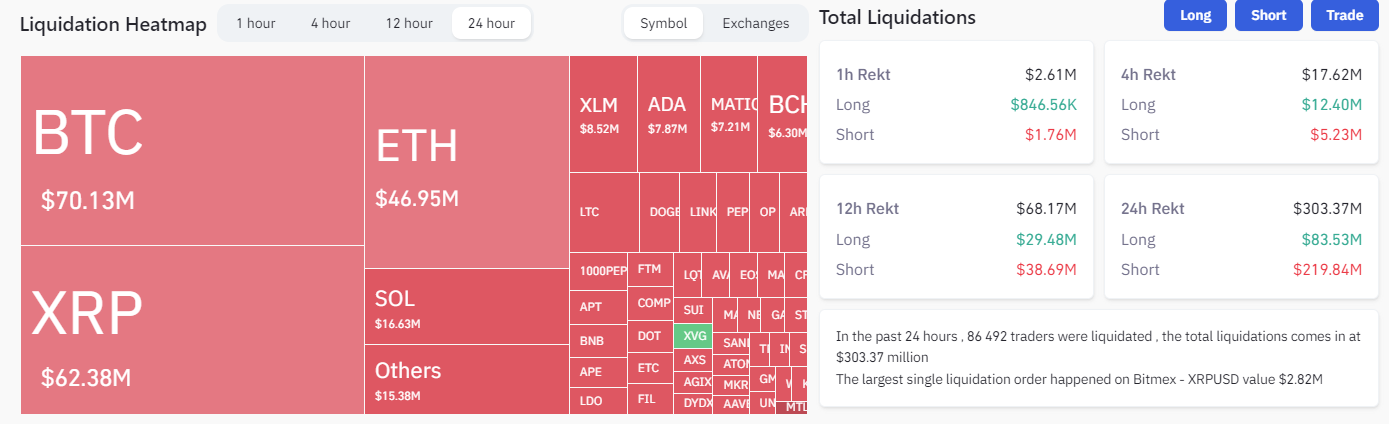

The recent surge in the XRP market, fuelled by Ripple's legal victory against the Securities and Exchange Commission (SEC), has resulted in a wave of short liquidations. Approximately $300 million worth of short positions were obliterated as XRP's price skyrocketed, leaving bears reeling in the wake of a monumental 100% rally.

The positive ruling for Ripple sent shockwaves through the crypto industry. The court's declaration that XRP is not a security removed a significant legal hurdle for Ripple, enabling it to continue operating without the threat of stringent regulations.

The consequent surge in XRP's price caught many bears off guard. Many had taken short positions on the token, betting on a negative outcome in the lawsuit, and were left stunned as XRP's value doubled almost overnight. The abrupt shift resulted in the obliteration of nearly $300 million in short positions on the market in general, making it one of the most significant liquidations on the crypto market this year.

This rally was not confined to XRP alone; other altcoins also experienced surges of 10% to 20%, further adding to bears' woes. This wave of bullish sentiment across the broader crypto market exacerbated the short squeeze, amplifying the impact on those who had been betting against these assets.

The situation serves as a reminder of the volatile nature of the crypto market, where the tables can turn in an instant, especially for assets like XRP. As it stands, the market appears to be firmly in favor of the bulls, with the bears licking their wounds and reevaluating their strategies.

However, the overall open interest on the market has not yet reached the level we witnessed during the bull run.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov