Data provided by CryptoQuant and Whale Alert shows that over the past thirteen hours, an institutional whale bought 11,827 Bitcoins in the major US-based crypto exchange Coinbase and withdrew it into a cold storage vault.

$670.9 million in BTC withdrawn from Coinbase

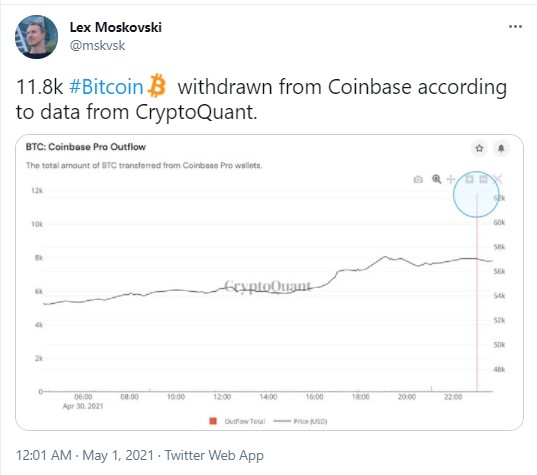

CIO of Moskovski Capital has shared a CryptoQuant chart, showing that institutional investors keep stocking up on Bitcoin and are determined to hold it long-term.

The 11,827 Bitcoins withdrawn from Coinbase Pro are an equivalent of $670,995,053. The transaction has been confirmed by Whale Alert service that tracks large crypto transfers.

Recently, two major banking giants – Goldman Sachs and JP Morgan – have announced their plans to offer exposure to the flagship cryptocurrency to their high net worth customers.

Goldman Sachs will allow 2.5 percent of client’s net worth to be invested in Bitcoin. However, JP Morgan analysts have also predicted that Ethereum will likely outperform Bitcoin.

Bitcoin touches $58,400 line

On April 30, Bitcoin printed two green hourly candles that took it from the $53,000 level to the $57,000 zone and then closed the month in the green.

Earlier today, the king crypto went a little higher to touch the $58,400 level, however, it rolled back immediately.

At the time of writing, BTC is changing hands at $57,659 on the Kraken exchange.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin