Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

As IntoTheBlock revealed, the number of Shiba Inu tokens sold outnumbered purchases by 37.11 billion and brought the total sales value in the last 24 hours to the 1 trillion SHIB mark. Seller pressure continues to be exerted on Shiba Inu from as early as Tuesday, and the delta between sales and purchases of the token is already 229.7 billion SHIB at that time.

However, while the number of bears on Shiba Inu is rising, the number is still inferior to that of bulls during the week. Thus, since the beginning of April, the number of those who believe in an increase in the price of SHIB is 126 addresses, while those who bet on a decrease are 116. Given that IntoTheBlock only counts addresses that trade at least 1% of the total daily token volume, a difference of 10 of them is quite significant.

Shiba Inu (SHIB) price action

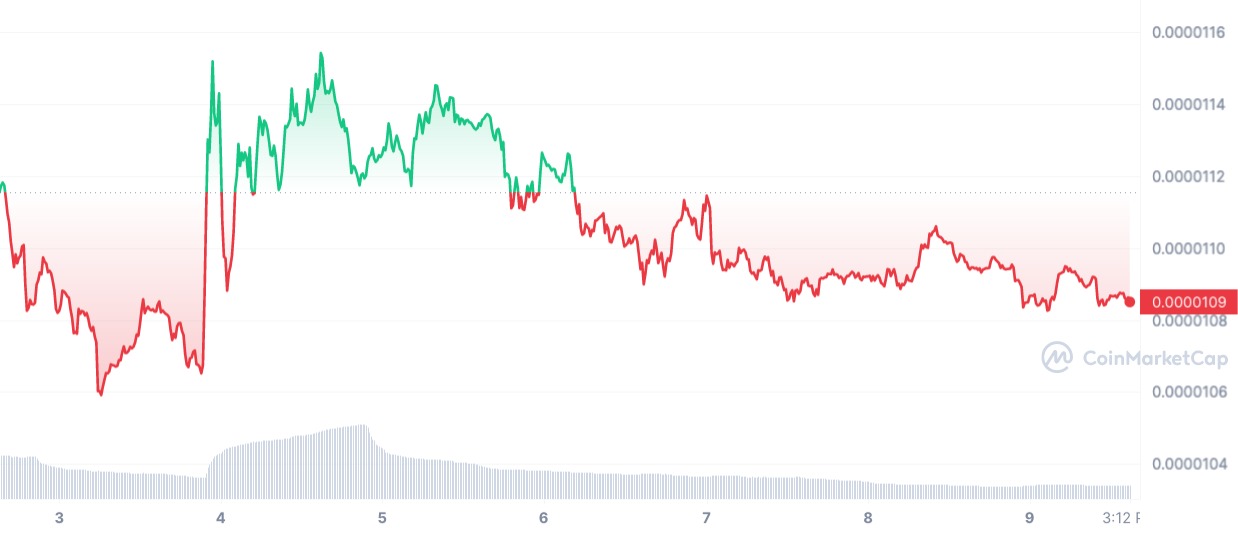

The shift of initiative from bulls to bears on Shiba Inu is also clearly visible on the token's price chart. From peaks set at the beginning of the week, SHIB price fell by 6.5% by the end of the week, dipping below $0.000011 again.

In the broader picture, SHIB continues to flounder in the middle of the price range with no obvious direction, as does the rest of the crypto market. That said, it is likely that this silence in volatility will be broken as early as next week on the back of the Fed's Open Market Committee meeting.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov