OKX, one of the largest cryptocurrency exchanges globally, has released its latest monthly proof-of-reserves report. This report provides insights into the state of user funds, exchange reserves and coverage ratio.

According to the most recent data, OKX holds over $19.8 billion in funds and crypto assets, a decrease from $22.4 billion last month. This indicates a reduction in user exposure on the exchange.

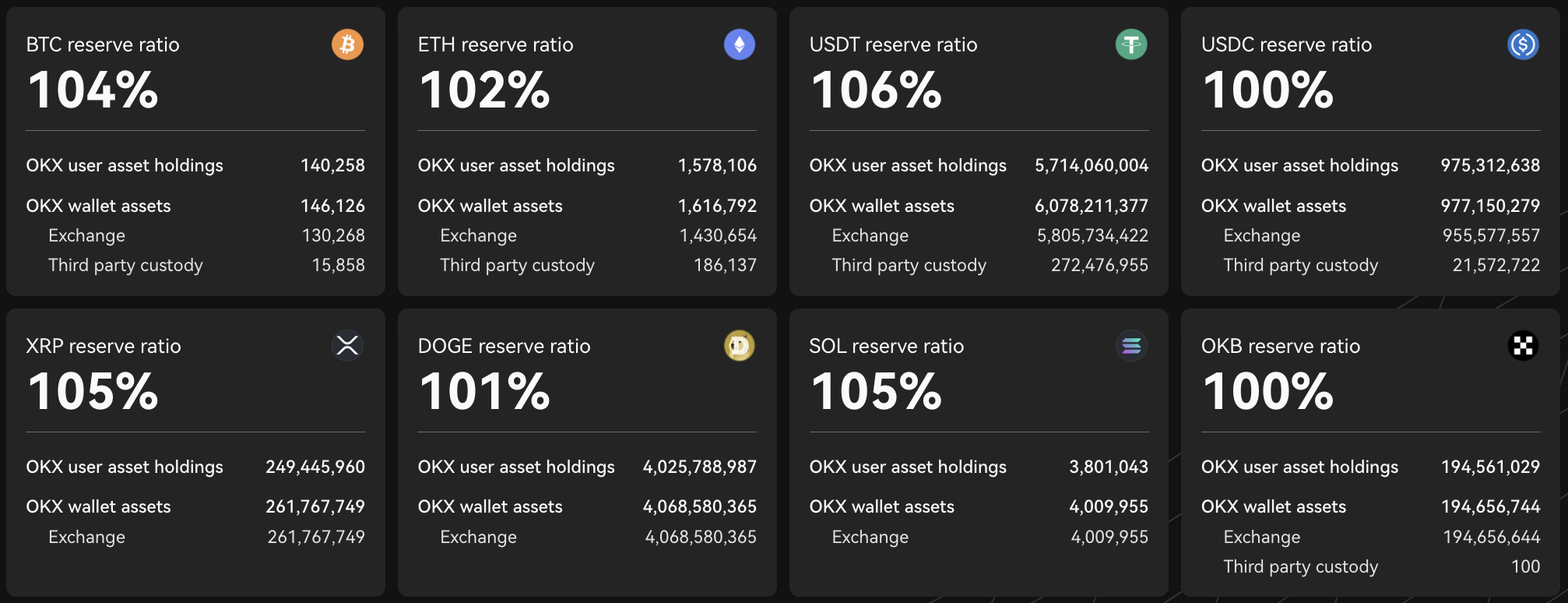

A notable finding from the report is the 10% decline in user assets in one particularly popular cryptocurrency, XRP. User assets dropped from 271.39 million to 249.45 million tokens, a reduction of 21.94 million XRP, valued at $13.16 million at the current price. Despite this decline, the coverage ratio for the token has increased by 3%, now standing at 105%, with reserves of 261.76 million XRP.

This trend marks the third consecutive month of falling user XRP on OKX. However, the data suggests that users’ funds are not necessarily leaving the platform but are being reallocated into other assets.

All money in, no money out

For instance, reserves in USDT have grown by 2.3% since the end of June. Additionally, reserves in Circle's USDC rose from 783.74 million in June to 977.15 million in July, ensuring full coverage of user funds, with surplus.

The decline in XRP is not isolated. Similar patterns are observed with other major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). This trend may indicate that users are either withdrawing assets from the centralized exchange or reallocating funds to other assets, effectively creating a stockpile of "crypto cash."

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov