Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

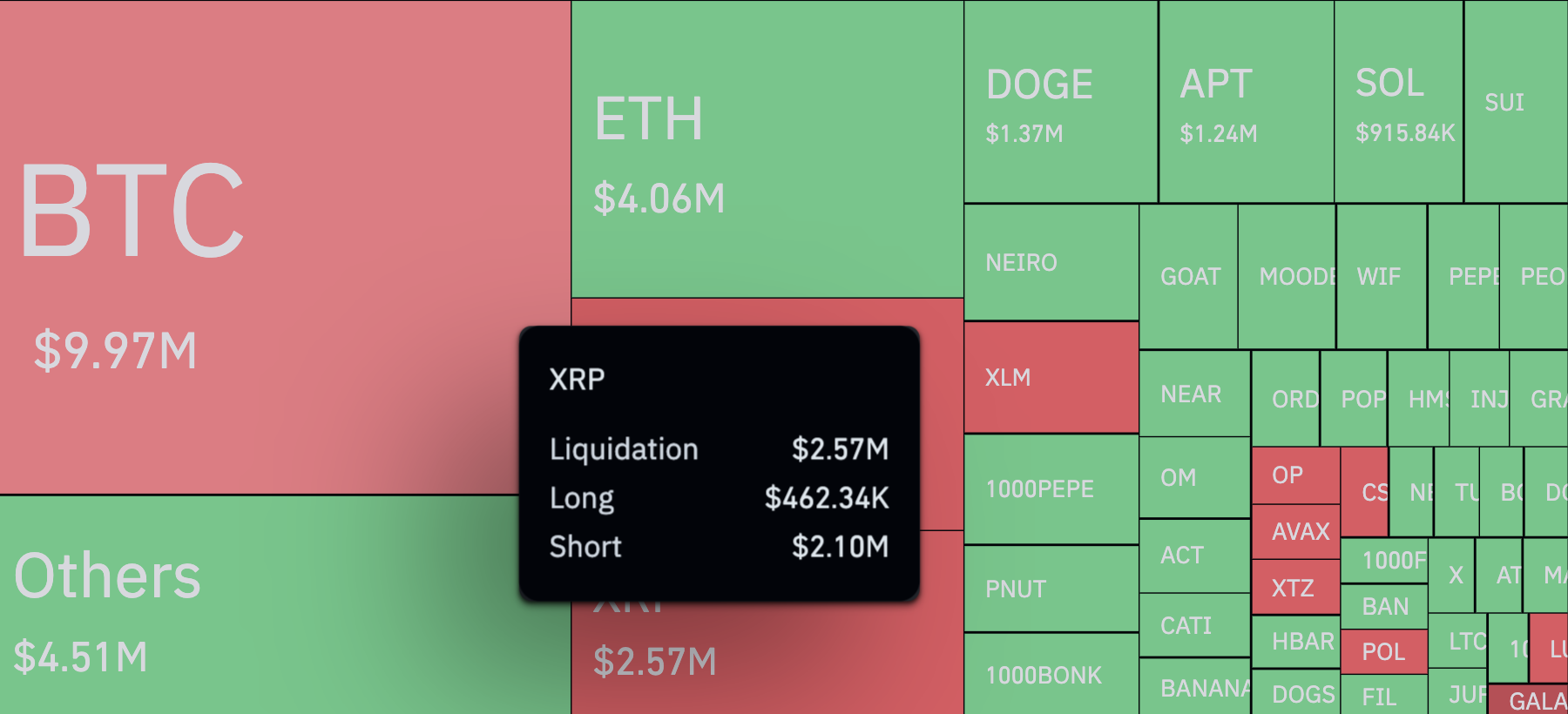

The anomalous dynamics continue with the popular cryptocurrency XRP, especially when it comes to trading on the futures market. Thus, according to data from CoinGlass, the volume of liquidations of perpetual futures on XRP over the past four hours totaled $2.57 million, which is currently the fourth largest volume on the entire crypto asset derivatives market.

What is even more entertaining about this type of liquidation is that only 17.9% of it is long positions, while the entire bulk comes from short position liquidations. As a result, there was an imbalance in XRP during the period under review, with short liquidations exceeding long liquidations by 4.54 times, or 454%.

This difference is explained by the price action of XRP, when the token literally does not stop growing, and partly by the stubbornness of bearish sellers, whose liquidations of short positions stimulate the already vertical growth of the token's price.

Thus, in these four hours, the price of XRP once again printed a green candle of 6.34%, reaching a high of $1.15. As you can now see from the data, this was largely due to the forced closing of bearish positions on futures for more than $2 million.

Clearly, going short on XRP is hardly the best trading strategy right now. Ultimately, the price of the token will continue to rise longer than the sellers have enough money, and it is likely that as long as they keep trying to chase a top in XRP, the price will continue to rise.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov