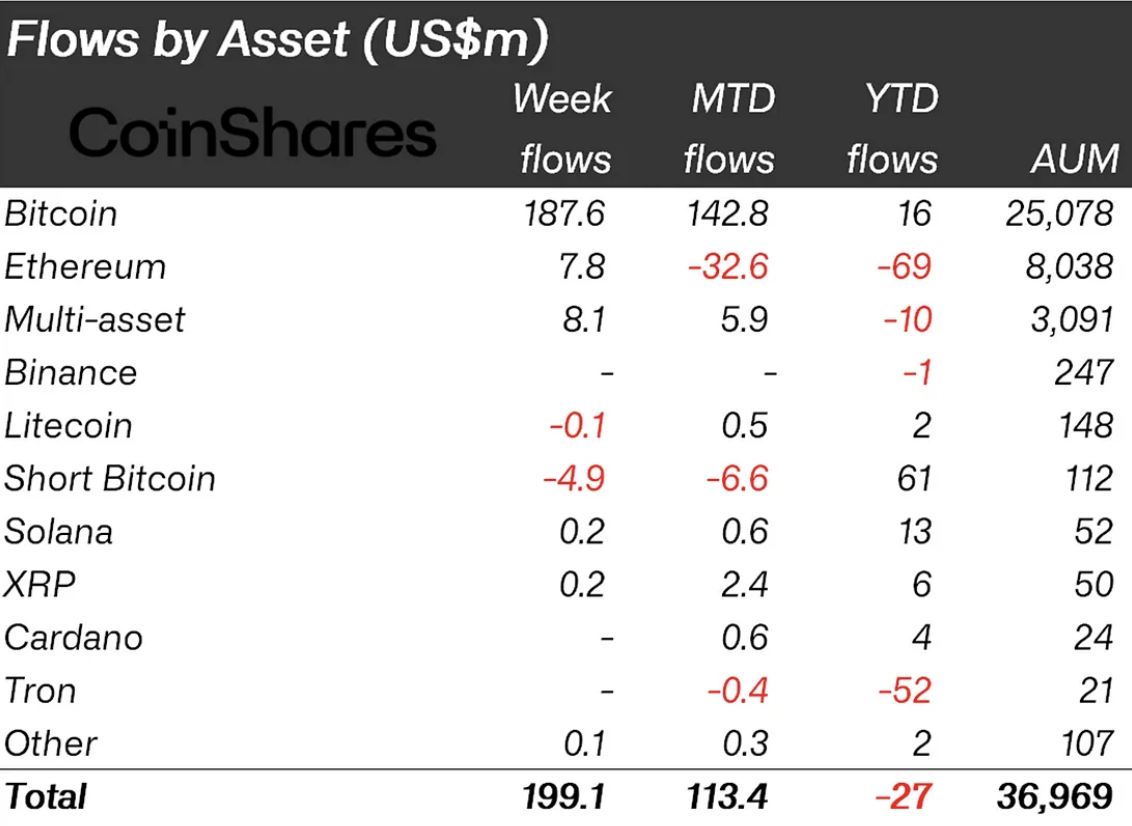

A recent report by CoinShares has revealed impressive gains for XRP, solidifying its position as a frontrunner among crypto investment products. The surge in inflows has propelled XRP to new heights, with a remarkable influx of funds totaling $240,000 in the past week alone. This surge adds to the cumulative value of XRP, which now stands at an impressive $6 million since the start of the year.

However, the positive momentum was not limited to XRP alone, as the entire market experienced a surge of optimism. Digital asset investment products witnessed their largest weekly inflows of the year, with an overwhelming $199 million flooding onto the market. This surge effectively counteracted almost half of the outflows observed over the past two months.

Unquestionably, the primary beneficiary of this resurgent market sentiment has been Bitcoin, as it attracted an impressive $188 million in inflows last week, accounting for a substantial 94% of the total funds received. Conversely, there has been a sustained outflow from Short Bitcoin products, with withdrawals already surpassing a significant 60% of total assets under management in just two months.

Experts at CoinShares attribute this renewed optimism and influx of funds to recent news regarding large funds filing physical collateral exchange-traded funds (ETFs) with the Securities and Exchange Commission (SEC). Notably, among these institutions, BlackRock, managing an estimated $9 trillion in assets, stands out prominently.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov