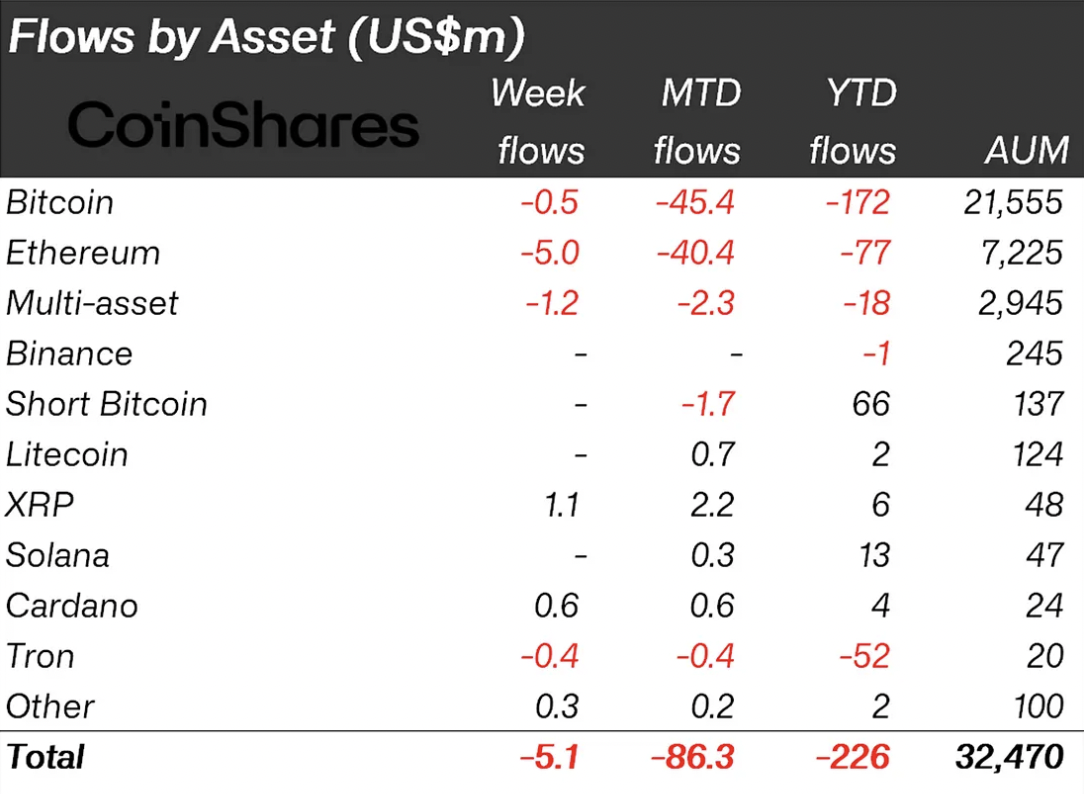

In the latest report released by CoinShares, XRP has once again emerged as the clear frontrunner in cryptocurrency-focused investment products, experiencing a significant surge in inflows. With a value of $1.1 million for the week, XRP has achieved one of its most impressive results this year.

Consequently, XRP-focused investment products have amassed positive year-to-date inflows amounting to $6 million. The significance of this data is further underscored by the overall state of the market, which has witnessed outflows amounting to a staggering $226 million.

These investor behaviors from the more traditional financial sector are largely attributed to the growing anticipation surrounding the imminent ruling in the SEC case against Ripple. Similar trends were observed previously in late April and early March, underscoring the significance of investor sentiment.

This sentiment is further reflected in the rising price of XRP, which has experienced an upward trajectory over the past week. Notably, it is not only investors who are expecting a swift resolution to the case; experts like Mark Fagel, a former lawyer and SEC veteran, also predict a verdict within days, as reported by U.Today.

While XRP shines in terms of fund inflows, digital asset investment products encountered minor outflows totaling $5.1 million. Toward the end of the week, a modest influx was observed following news that BlackRock has applied for a Bitcoin Spot Trust. However, these inflows were insufficient to offset the earlier outflows, resulting in the ninth consecutive week of outflows, which now tally an alarming $423 million.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov