Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

XRP, the digital asset associated with Ripple Labs, has decoupled from Bitcoin (BTC), showcasing remarkable price growth. While BTC increased slightly by 0.40% in the last 24 hours, XRP is up over 10%, demonstrating its independence from the leading cryptocurrency.

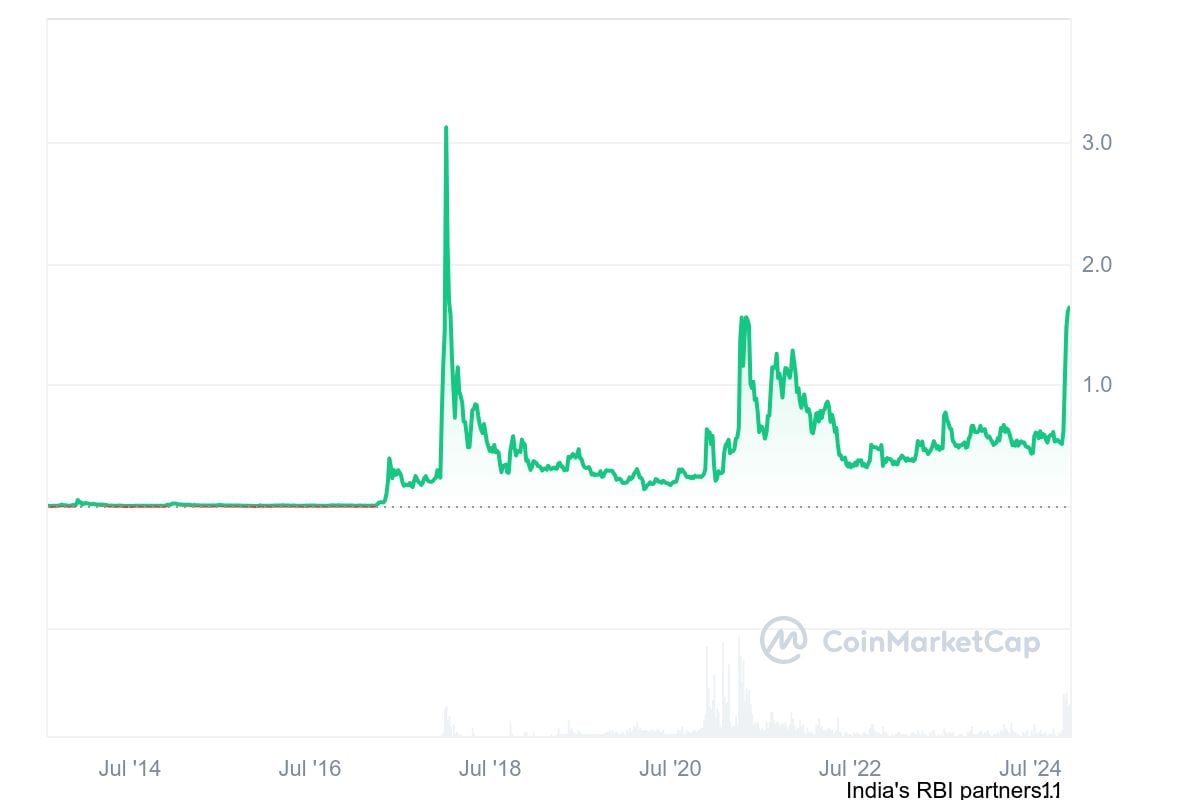

XRP hits six-year high

According to CoinMarketCap data, XRP was up 10.05% in the last 24 hours to $1.62. This price is a huge achievement for XRP, the highest recorded since 2018.

It also shows XRP’s resilience despite a broader market price reversal and Ripple's ongoing legal challenges with the U.S. Securities and Exchange Commission (SEC).

XRP rose from the previous day's low of $1.44 to reach an intraday high of $1.61 before settling at its current price. The daily trading volume is up 10.6% to $8.4 billion, suggesting investors’ willingness to accumulate the coin.

Meanwhile, the entire crypto market is showing mixed sentiment. For instance, Ethereum (ETH) and SUI prices decreased by 1.6% and 7.03% in the last 24 hours. On the other hand, the prices of Solana (SOL), BNB and Avalanche (AVAX) rose by 2.09%, 0.12% and 1.18%, respectively, within the same time frame.

Renewed optimism toward XRP

The renewed optimism around XRP follows the potential overhaul of the U.S. crypto regulatory landscape.

The U.S. SEC chair, Gary Gensler, is set to leave office, boosting the community’s hope of coming reforms. With the U.S. SEC led by a more pro-crypto chairman, the long-standing legal battle between Ripple and the SEC could soon conclude.

Additionally, the market is optimistic about the approvals of XRP Exchange-Traded Funds (ETFs) in the U.S. An ETF is anticipated to drive institutional interest for XRP, leading to more bullish price outcomes.

U.Today reported that Bitwise recently rebranded its XRP Exchange-Traded Product (ETP) to the Bitwise Physical XRP ETP. Other asset managers like Canary Capital and 21Shares have also made moves for the XRP ETF product.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov